Crypto News: Odds Of A December Rate Cut Double As Bitcoiners Become Hopeful

A detailed look at the rising odds of a December Federal Reserve rate cut, how traders reacted and why Bitcoin holders grew more confident.

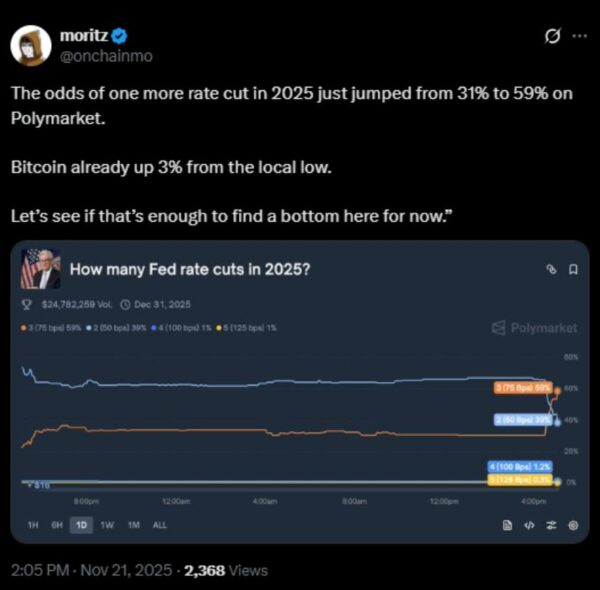

Bitcoin traders saw a rare change in tone this week, after the odds of a December Federal Reserve rate cut climbed almost twice as high as the previous day.

The change brought a wave of new discussion across crypto circles, as many argued that an easier policy stance could help Bitcoin slow its recent slide.

Rising Rate Cut Odds Bring New Attention From Bitcoin Traders

Bitcoin has had a rough week. The price dropped more than 10% over seven days, falling toward $85,000 according to CoinMarketCap. Traders watched the steady decline and waited for something to shift the mood.

Odds of a rate cut have jumped | source- X

Odds of a rate cut have jumped | source- X

That change in trend arrived on Friday. The CME FedWatch Tool showed the odds of a December rate cut rising to 69.40%. This was a huge jump from the 39.10% reading the day before. The change created an immediate response from many traders who follow macro signals.

Crypto analyst Moritz posted that the move might be enough to help Bitcoin find a local bottom. Several others echoed that view and the idea that the Federal Reserve could cut rates in the near term created hope that sellers might ease their pressure.

Fed Remarks Trigger Fast Market Repricing

The surge in expectations came after comments from New York Fed president John Williams.

He stated that the Fed could cut rates soon without harming progress toward its inflation goal. Bloomberg analyst Joe Weisenthal said these remarks were likely the main reason behind the sudden jump in rate cut expectations.

Analysts are warning traders not to move too fast. They say that markets sometimes react strongly to early signals before the full picture becomes clear. Some traders agree, though many still took the change as a promising sign.

Crypto analyst Mister Crypto said rate cuts usually align with stronger price action for risk assets.

Bitcoin often benefits when traditional investments offer lower returns. Bonds and term deposits become less appealing during easing cycles, which can push investors toward alternative assets.

Related Reading: What Are The Odds Of Another Rate Cut In December?

More Fed Voices Add To The Market Conversation

New details from several Federal Reserve officials have added fuel to the market’s trend.

Williams said he sees room for a near-term adjustment that moves policy closer to neutral. His position carries more weight because he serves as vice chairman of the Federal Open Market Committee.

Fed governor Stephen Miran offered another notable signal. He told reporters he would vote for a 25 basis point cut if he were the swing vote, though he prefers a 50 basis point cut. His comments pushed expectations higher because he has been more aggressive than most officials.

Current pricing now shows a more than 75% chance of a cut next month. This is far above readings from earlier in the week.

Fed data from recent months has been mixed. September payrolls rose by 119,000, well above the expected 51,000. The unemployment rate ticked upward to 4.4% Some officials saw this as a sign that past rate hikes have slowed the labor market.

Miran said the jobs report should push uncertain officials toward easing. He pointed to rising permanent layoffs and said restrictive policy may not be needed at the same level anymore.

Not all officials shared that view.

Boston Fed president Susan Collins said she prefers to hold rates steady for now. She sees steady demand in her region and worries about companies passing higher costs to customers.

Dallas Fed president Lorie Logan expressed similar caution. She said she needs to see softer inflation or a weaker job market before supporting another cut.

Philadelphia Fed president Anna Paulson also urged caution. She noted that each previous cut raises the standard for the next one.

Vice chair Philip Jefferson said he sees higher risk in employment than inflation at the moment. He did not rule out a cut but said he favors a slow approach.

In all, the FOMC meets on December 9 and 10 and traders are now tracking each comment from Fed members as they prepare for the final meeting of the year.

The post Crypto News: Odds Of A December Rate Cut Double As Bitcoiners Become Hopeful appeared first on Live Bitcoin News.

You May Also Like

Adam Wainwright Takes The Mound Again Honor Darryl Kile

SUI Price Consolidation Suggests Bullish Breakout Above $1.84