Zcash Price Prediction 2025: Can Rising Network Strength Push ZEC Toward a New Cycle?

The post Zcash Price Prediction 2025: Can Rising Network Strength Push ZEC Toward a New Cycle? appeared first on Coinpedia Fintech News

Zcash price prediction 2025 is drawing renewed attention as ZEC posts a strong on-chain and market performance despite broader volatility. Rising network hashrate, higher mining difficulty, increased node count, and expanding Zcash privacy transactions all point toward growing adoption, which also aligns with the upward momentum visible in the Zcash price chart.

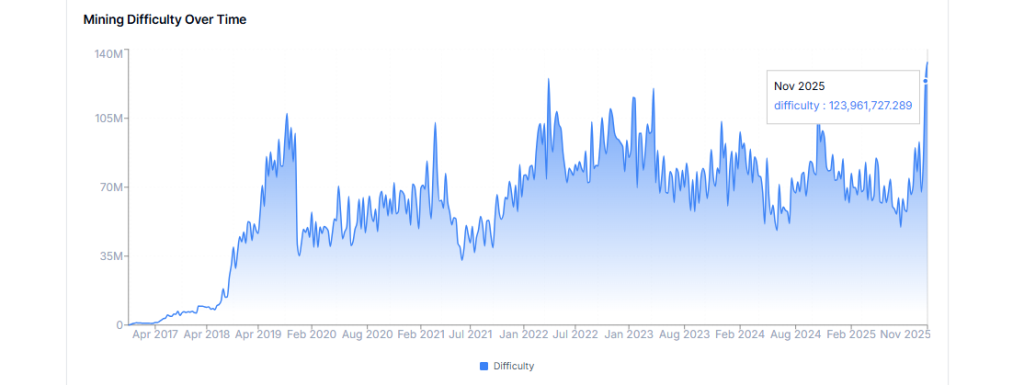

Mining Difficulty and Nodes Hit ATH as Network Strengthens

A major development supporting the current Zcash price forecast is the “impenetrable fortress” it is becoming for a network. Why such an extreme term because surge in mining difficulty is equivalent to network’s elevating security, which recently reached an all-time high of 123.9 million.

This rise is directly tied to the expanding hashrate, signaling that more computational power is actively securing Zcash crypto.

As difficulty increases, it becomes significantly harder and more expensive for any single party to dominate the network, thereby improving security and decentralization.

Similarly, the Zcash node count has also reached a new peak. More nodes mean more participants validating transactions and holding complete copies of the blockchain.

This minimizes the risk of outages or attacks. For a privacy-focused network like ZEC, both rising difficulty and node expansion reflect strong infrastructure maturity.

Growth in Shielded Transactions Reflects Expanding Utility

Beyond mining resilience, adoption metrics for Zcash are increasing too. Its privacy transactions continue rising across both major pools.

Since 2019, Sapling shielded outputs have grown from 154,000 to over 2 million in 2025. While, the Orchard transactions, introduced later, have expanded from 302,300 in 2022 to nearly 914,000 in 2025. This consistent rise demonstrates that users are increasingly turning to Zcash crypto for its privacy features.

The growing reliance on shielded transfers indicates that ZEC crypto’s core value proposition is gaining traction. As more privacy transactions appear on-chain, it reinforces the idea that demand is not speculative alone but tied to real usage, a factor that naturally supports long-term Zcash price prediction outlooks and broader adoption narratives.

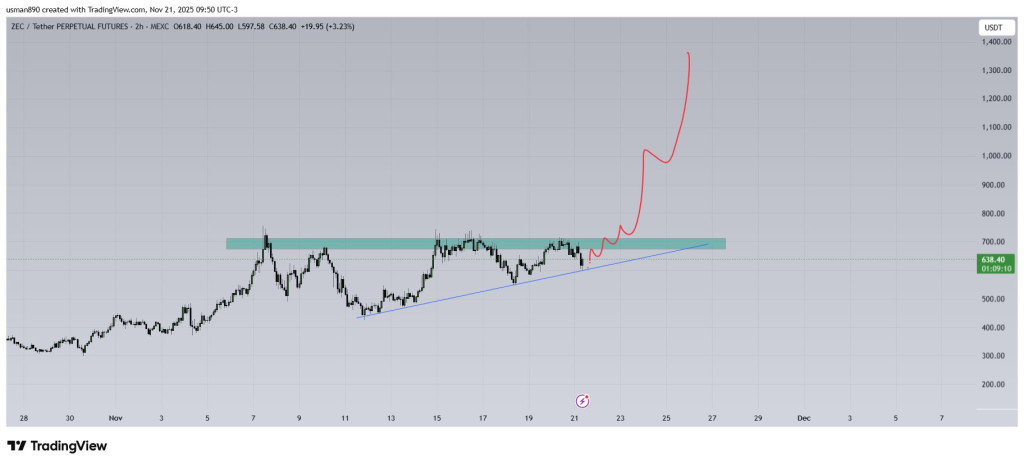

Technical Structure Points Toward Key Levels on the Zcash Price Chart

Technically, ZEC price today trades near the $637 region, when writing. It is maintaining a strong uptrend despite indicators flashing sell signals for hitting overbought conditions.

However, the market momentum has remained firm, so buyers are so committed that they could even continue absorbing selling pressure. Analyst suggests, the key resistance to watch right now this month is $744. A clear flip above this level could open the path toward $1,000, and potentially $1,400, provided market momentum and network strength continue aligning.

As the year progresses, the Zcash price prediction 2025 outlook will largely depend on whether these accelerating fundamentals and growing privacy adoption can sustain the current trend and support higher valuations.

However, this doesn’t slide the odds of a bearish move to come, in fact, it may come if it loses the short-term 20-day EMA bands support, which is at $560 for now, around 12% lower from CMP.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Top 6 Crypto Coins: Why Analysts Call BullZilla the Best Crypto to Buy Right Now?