Bitcoin Price Prediction 2026, 2027 – 2030: How High Will BTC Price Go?

The post Bitcoin Price Prediction 2026, 2027 – 2030: How High Will BTC Price Go? appeared first on Coinpedia Fintech News

Story Highlights

- Bitcoin is currently trading at: $ 86,946.96859254

- Predictions suggest BTC to hit $150K to $250K before 2026 ends.

- Long-term forecasts estimate BTC prices could hit $900K by 2030.

The Bitcoin price prediction 2026 is becoming increasingly bullish as the 2025’s second half comes to a close soon, with all-time highs of $125K reached this year as the highest point.

As a wave of bullish momentum sweeps into the market, investors and traders are intrigued by its next stop.

The year was marked by optimism, driven by massive inflows into spot Bitcoin ETFs, skyrocketing institutional adoption, clearer regulations, and unwavering political support. There were several macro downturns, too, that capped BTC’s uptrend, like trade tariffs and wars.

Despite that, BTC holds its level, making it now seen as “a hedge against inflation” more than ever. Major players, including MicroStrategy, Metaplanet, and several other entities, are boldly adding BTC to their balance sheets, signaling unshakable adoption and confidence in its future.

The market enthusiasm is at a fever pitch, investors are buzzing with questions: “Can Bitcoin sustain its meteoric rise?” and “Will it redefine the financial landscape in the next five years?” This Bitcoin price prediction 2026 – 2030 dives deep into the trends driving this historic rally. Read on for the full scoop.

The BTC price may range between $86,606.9 and $88,320.55 today.

Table of Contents

- Story Highlights

- CoinPedia’s Bitcoin (BTC) Price Prediction

- Bitcoin Price Analysis 2025

- Bitcoin Price Prediction December 2025

- Bitcoin AI Price Prediction For December 2025

- Bitcoin Price Onchain Outlook

- Bitcoin Crypto Price Prediction 2026 – 2030

- BTC Price Forecast 2026

- BTC Price Prediction 2027

- Bitcoin Predictions 2028

- BTC Price 2029

- Bitcoin Price Prediction 2030

- Bitcoin Price Prediction 2031, 2032, 2033, 2040, 2050

- Bitcoin Prediction: Analysts and Influencers’ BTC Price Target

- FAQs

Bitcoin Price Today

| Cryptocurrency | Bitcoin |

| Token | BTC |

| Price | $86,946.9686 |

| Market Cap | $ 1,736,008,911,221.26 |

| 24h Volume | $ 42,845,868,504.1791 |

| Circulating Supply | 19,966,296.00 |

| Total Supply | 19,966,296.00 |

| All-Time High | $ 126,198.0696 on 06 October 2025 |

| All-Time Low | $ 0.0486 on 14 July 2010 |

CoinPedia’s Bitcoin (BTC) Price Prediction

Firstly, at CoinPedia, we feel optimistic about Bitcoin’s price increase. Hence, we expect the BTC price to create a 2025 high of ~$168,000.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $71,827.81 | $119,713.02 | $167,598.22 |

Bitcoin Price Analysis 2025

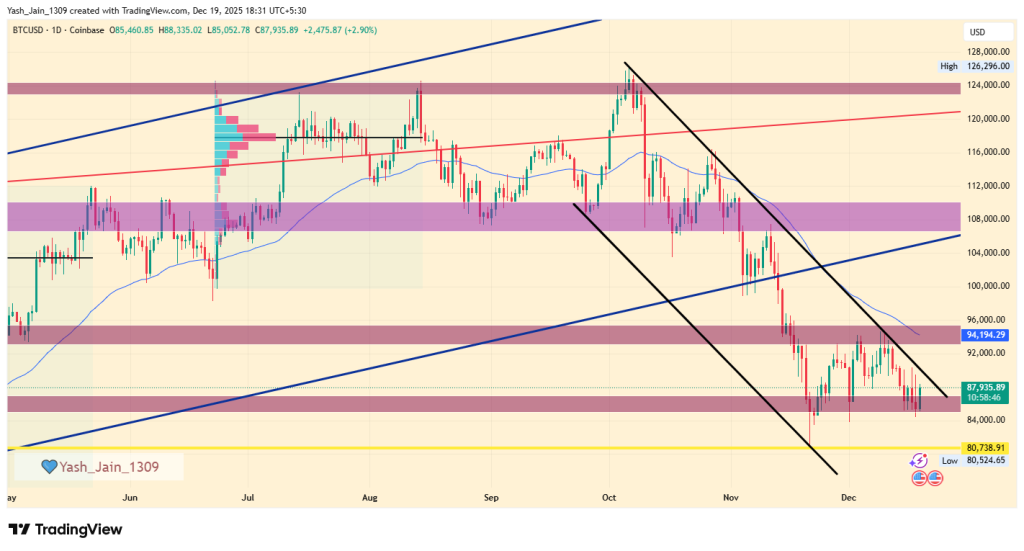

The Bitcoin price performance observed since 2024 has demonstrated an upward trend within a defined upward channel. However, the initial swing low was reached in 2023 at around the $16,000 area.

Since then, a bull market began that reached 2021’s high around $70,000 by early 2024, with a decent pullback rally that continued flipping this high and reached $108,000 in early 2025, and Q3 of 2025 marked an ATH of $126,296.

This advancement marked a huge 675% surge in 1008 days when it reached ATH, but this price action of multi-year was happening inside a broadening ascending wedge. And Q4 2025 is seeing a decline from the upper border of this reliable old pattern.

Even the two-year parallel ascending channel has also confirmed a breakdown from the lower border, suggesting a significant decline is forthcoming.

Since the price action doesn’t fall straight, the year is also about to conclude next month. So, bulls are trying to show a little fight, even FOMC news didn’t generate any momentum. It appears that bears are still influencing BTC’s price action. The current zone of $90K is key; losing it here will let BTC slide back to $80K, and if this fails too. Then the $70K to $75K range would be retested next, where a demand could arise that might trigger a rebound, and the rally could extend to new highs as well.

However, if bulls fail to present a proper fight around the $70,000 to $75,000 support area, then the BTC will fall further, as it could trigger a price action that traps long buyers, potentially leading to a decline towards $53,489 in the first half of next year.

Bitcoin Price Prediction December 2025

The Bitcoin price forecast for December 2025 indicated potential for bullish movements that did not materialize. Even the FOMC meeting on the 10th failed to generate any substantial volatility. A noteworthy observation is that the BOJ’s rate hike did not negatively impact Bitcoin’s price, which continues to hold above the $85K mark. Currently, Bitcoin is trading near the upper boundary of a steeply declining channel, yet it remains constrained below the critical $85K horizontal resistance level.

The ongoing lack of new demand is evident in the subdued price action, suggesting that investor sentiment remains cautious, possibly in anticipation of further corrections. There is a distinct possibility that prices could dip lower, creating opportunities for strategic accumulation at more attractive entry points.

| Month | Potential Low | Potential Average | Potential High |

| December 2025 | $80,000-$95,000 | $100,000 – $108,000 | $115,000 – $118,000 |

Bitcoin AI Price Prediction For December 2025

| Source / Platform | Low Price (USD) | Average Price (USD) | High Price (USD) |

| Gemini (AI-assisted) | $110,000 – $125,000 | $130,000 – $150,000 | $160,000 – $180,000+ |

| ChatGPT (OpenAI) | $92,000 | $117,000 | $138,000 |

| BlackBox AI | $100,000 | $125,000 | $150,000 |

Bitcoin Price Onchain Outlook

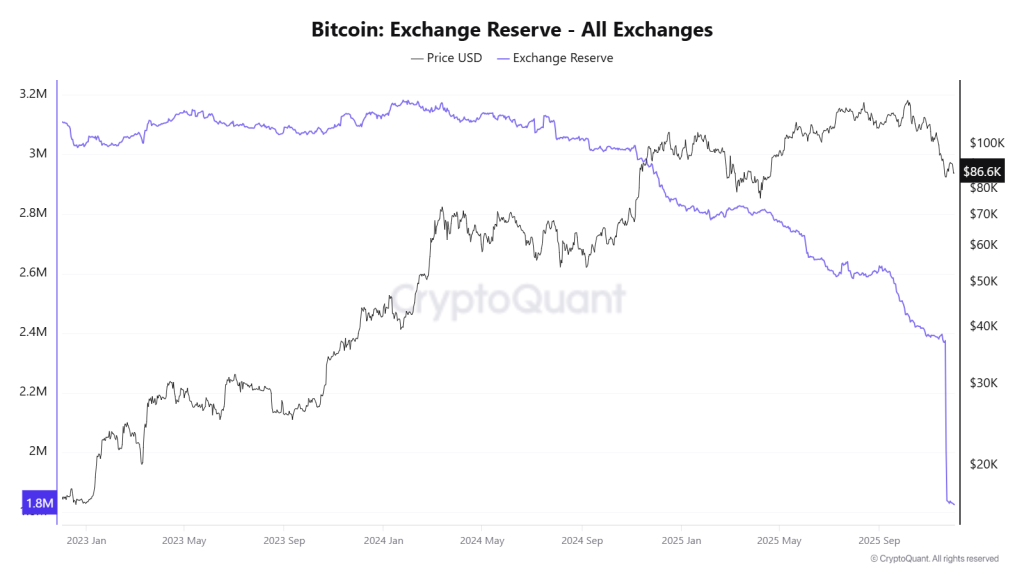

The on-chain data has showed strong accumulation in 2025 and sustained declines in exchange reserves. Crucially, this confirms the elevated institutional commitment, which is evident even in the US Spot ETFs data figures and the corporate adoption also reinforces this trend, with public company holdings nearly doubling since the start of the year.

Ultimately, a Bitcoin price prediction 2025 suggests that the future potential depends strictly on how sustained buying demand remains, as well as geopolitical stability and regulatory clarity.

If the current bullish sentiment persists, the BTC price is expected to reach a cycle high target of $150,000. Conversely, should global uncertainty intensify and sentiment turn negative, the downside risk is projected to find strong support around the $70,000 mark.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $70K | $120K | $175K |

Also Read: What is Bitcoin? An In-Depth Guide To The King Of Digital Currencies

Bitcoin Crypto Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| BTC Price Forecast 2026 | 150K | 200K | 230K |

| BTC Price Prediction 2027 | 170K | 250K | 330K |

| Bitcoin Predictions 2028 | 200K | 350K | 450K |

| BTC Price 2029 | 275K | 500K | 640K |

| Bitcoin Price Prediction 2030 | 380K | 750K | 900K |

BTC Price Forecast 2026

The BTC price range in 2026 is expected to be between $150K and $230K.

BTC Price Prediction 2027

Subsequently, the Bitcoin price range can be between $170K to $330K during the year 2027.

Bitcoin Predictions 2028

With the next Bitcoin halving, the price will see another bullish spark in 2028. Specifically, as per our Bitcoin Price Prediction, the potential BTC price range in 2028 is $200K to $450K.

BTC Price 2029

Thereafter, the BTC price for the year 2029 could range between $275K and $640K.

Bitcoin Price Prediction 2030

Finally, in 2030, the price of Bitcoin is predicted to maintain a positive trend. Indeed, the BTC price is expected to reach a new all-time high, ranging between $380K and $900K.

Bitcoin Price Prediction 2031, 2032, 2033, 2040, 2050

Based on the historic market sentiments and trend analysis of the largest cryptocurrency by market capitalization, here are the possible Bitcoin price targets for the longer time frames.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | $540,830.43 | $901,383.47 | $1,261,936.86 |

| 2032 | $757,162.60 | $1,261,936.86 | $1,766,711.60 |

| 2033 | $1,059,945.80 | $1,766,711.60 | $2,473,477.75 |

| 2040 | $5,799,454.28 | $9,665,757.13 | $13,532,059.98 |

| 2050 | $161,978,188.65 | $269,963,647.74 | $377,949,106.84 |

Bitcoin Prediction: Analysts and Influencers’ BTC Price Target

| Firm Name | 2025 |

| Standard Chartered | $200K |

| VanECk | $180K |

| 10x Reserach | $122K |

| Fundstrat | $250K |

| Blackrock | $700K |

- As per the Bitcoin price forecast by Blockware Solutions, the price of 1 BTC could hit $400,000

- Cathie Wood predicts the price of BTC to achieve the $3.8 million mark by 2030.

- Michael Saylor-led MicroStrategy expects Bitcoin to soar beyond $13 million by 2045.

- ARK Invest has increased its bullish BTC price target to $2.4 million by 2030.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Major risks include global recessions, tighter crypto regulations, declining liquidity, or a sustained breakdown below key support levels.

Bitcoin price forecasts for 2030 range from $380K to $900K, driven by scarcity, long-term adoption, and expanding institutional participation.

While uncertain, many long-term projections suggest Bitcoin could exceed $1 million by 2050 if it becomes a global store of value.

Bitcoin’s fixed supply makes it attractive as an inflation hedge, especially during currency debasement and long-term economic uncertainty.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Fed rate decision September 2025