Best Crypto to Buy Now – Zcash (ZEC) Price Prediction

The broader crypto market continues to struggle as selling pressure intensifies and fear rises across major assets. Most top-ranked cryptocurrencies remain deep in the red on both daily and weekly timeframes, reflecting a sentiment environment dominated by panic and extreme uncertainty.

Despite this sharp pullback, Zcash has emerged as one of the rare standout performers, posting impressive gains while nearly everything else has declined.

The privacy-focused cryptocurrency has surged double-digits in the middle of a heavily bearish cycle, catching the attention of traders who have been monitoring its ecosystem since far lower price ranges.

In this article, we examine a fresh Zcash price prediction based on insights from crypto analyst and trader Jacob Crypto Bury, whose full analysis is available in the video below or on his YouTube channel. We also highlight one of the best crypto to buy now alongside $ZEC.

Zcash Breaks Into the Top 10 After a Wild Multi-Billion Market Cap Jump

Zcash has been on an absolute tear lately, delivering one of the most explosive runs in the entire market. Its market cap recently rocketed from the mid-billion range to nearly $12B before cooling to around $10B, cementing its position among the top non-stablecoin assets.

A 216% surge in just a month is almost unheard of in the current market climate, especially when most major coins have struggled to hold support.

A big part of Zcash’s momentum comes from growing confidence among well-known industry figures who believe it’s positioned strongly for the next wave of privacy-focused adoption.

Arthur Hayes, co-founder of BitMEX, has been especially vocal. He stirred up conversation by claiming “ZEC > XRP,” hinting that Zcash could outperform even some of the biggest established cryptocurrencies.

Not long after, he added fuel to the fire with a mysterious post implying he might have bought $ZEC, but leaving everyone guessing. Critics immediately questioned his motives, with some suggesting he was simply trying to spark hype.

Despite all the chatter around Hayes and other promoters, one thing remains certain. Zcash keeps drawing attention, volume and momentum, and the market continues pushing it forward with or without the rumors.

Zcash Price Prediction

Zcash continues to push upward despite unfavourable market conditions, suggesting that bullish momentum remains intact. The price has traded within a tight channel but strong buying pressure keeps bringing it back toward key resistance levels.

If this momentum persists, $ZEC could attempt another retest of the upper boundary near the $740–$750 range, which has repeatedly acted as a ceiling. A clean breakout above this level may open a path toward the $800 region, representing roughly a 15% move to the upside.

However, Zcash remains overheated on higher timeframes, and any extended rally could still lead to a rapid corrective phase. Traders should therefore expect sharp volatility as the market decides whether Zcash enters a new leg upward or cools off after its recent surge.

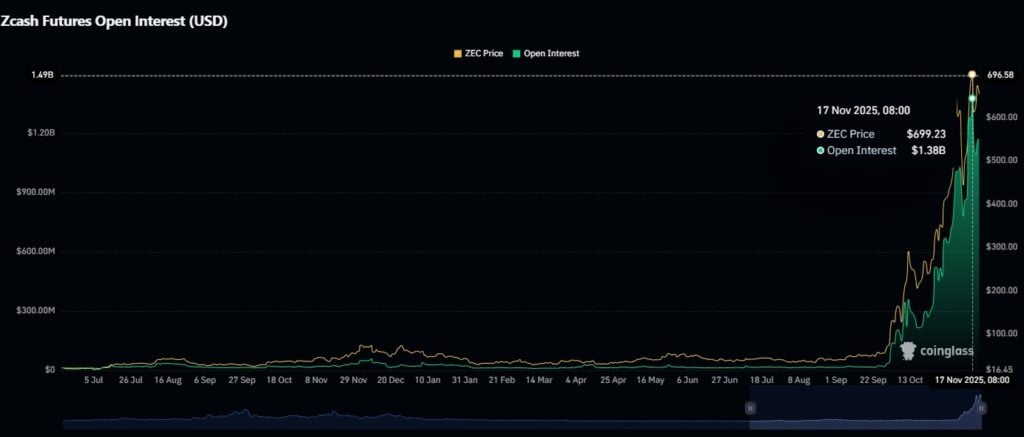

Traders Boost ZEC Exposure as Futures Open Interest Climbs Sharply

Data from CoinGlass indicates that open interest in Zcash futures saw a significant jump throughout November, reaching around $1.38 billion by November 17 as traders expanded their positions. This surge closely aligned with $ZEC’s push toward the $700 mark.

The increase highlights market expectations for continued price action following $ZEC’s rapid gains. At the same time, the sharp rise in both long and short positions suggests heightened sensitivity to potential liquidation events.

Meanwhile, $ZEC’s spot market has experienced increased volatility in inflows and outflows over the past few weeks. For much of the year, activity remained subdued, but late October saw a clear shift.

Large inflows during price retracements indicate that traders were actively adjusting their holdings amid market corrections.

Simultaneously, notable outflows point to ongoing accumulation by market participants. A recent net inflow of $1.16 million on November 20 underscores this dynamic rotation, reflecting active repositioning as investors respond to short-term price swings and broader market trends.

Best Crypto to Buy Now Alongside ZEC

While Zcash dominates the headlines, Bitcoin Hyper (HYPER) is emerging as a strong contender for those looking to capitalize on upside potential in the Bitcoin network. The project is building the first Bitcoin Layer 2 network.

Its platform is designed to enable fast and low-cost BTC transactions while supporting staking, decentralized finance, and on-chain applications. The network uses a high-throughput virtual machine to ensure scalability and near-instant transaction finality.

The native token, $HYPER, will serve multiple purposes within the ecosystem, including payments, governance, and staking rewards. The presale has already raised around $28 million, offering staking APY of up to 40%.

With the market still dominated by fear, disciplined accumulation of Zcash and Bitcoin Hyper, combined with careful risk management, positions investors to benefit when sentiment improves and the next wave of bullish momentum begins.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

MicroStrategy Eyes New Bitcoin Milestone With Another Purchase