Bitcoin Falls as Investors Question If AI Bubble Has Burst

Certainly! Here’s the rewritten version of the article with an engaging introduction, SEO optimization, and preserved HTML structure:

—

The recent turbulence in the financial markets highlights the intricate relationship between traditional equities and the evolving cryptocurrency landscape. While tech stocks stumble amid economic uncertainties, Bitcoin’s price movements continue to reflect broader risk sentiment, raising questions about its role as a hedge in volatile times. With the Fed’s monetary policy outlook and US fiscal policy debates intensifying, traders are closely watching how these macro factors could influence the future of crypto markets and blockchain investments.

-

Bitcoin’s recent decline below $86,000 signals increased correlation with the tech-heavy Nasdaq amid macroeconomic uncertainty.

-

US job data and Federal Reserve minutes influence expectations for future interest rate adjustments, impacting both crypto and traditional markets.

-

Despite strong earnings reports from companies like Walmart, concerns over AI expansion costs and data center investments weigh on investor sentiment.

-

Crypto traders anticipate improved liquidity prospects as US fiscal pressures and political developments unfold, potentially offering new opportunities in the crypto markets.

The tech-heavy Nasdaq experienced a sharp 4% intraday decline on Thursday, despite Nvidia’s robust earnings and optimistic forecasts for its artificial intelligence division. Investors fretted over surging AI development spending, which spurred fears of excessive valuations and potentially overheating tech investments. Simultaneously, Bitcoin traded below the $86,000 mark—a level not seen since April—highlighting its increased association with risk assets during turbulent periods.

Market commentators remain divided. Billionaire investor Ray Dalio suggested that although markets are in a bubble, there’s no imminent trigger for a crash. He advised investors to diversify into scarce assets like gold, reflecting concern over potential wealth taxes rather than monetary policy shifts. However, recent positive U.S. employment data diminished these hedging strategies’ appeal, as traders wager that the Federal Reserve might halt rate cuts amidst resilient job growth.

According to the latest minutes from the Federal Open Market Committee (FOMC), most policymakers expressed caution about easing policies further, citing risks of entrenched inflation. Bond markets now assign just a 20% probability of interest rates reaching 3.50% by January 2026—a notable decline from a month prior—indicating a cautiously optimistic outlook among investors.

Fed target rate probabilities for Jan. 2026 FOMC. Source: CME FedWatch ToolMeanwhile, the broader outlook remains cautious. Strong U.S. employment figures have prompted traders to reduce expectations for rate cuts, reflecting ongoing concerns about inflation and economic stability. As the debate over monetary policy continues, traders are weighing the potential for liquidity improvements and how political developments, such as US President Donald Trump’s tariff-focused stimulus proposals, might influence risk appetite in both traditional and crypto markets.

AI Spending and Market Guidance overshadow robust earnings

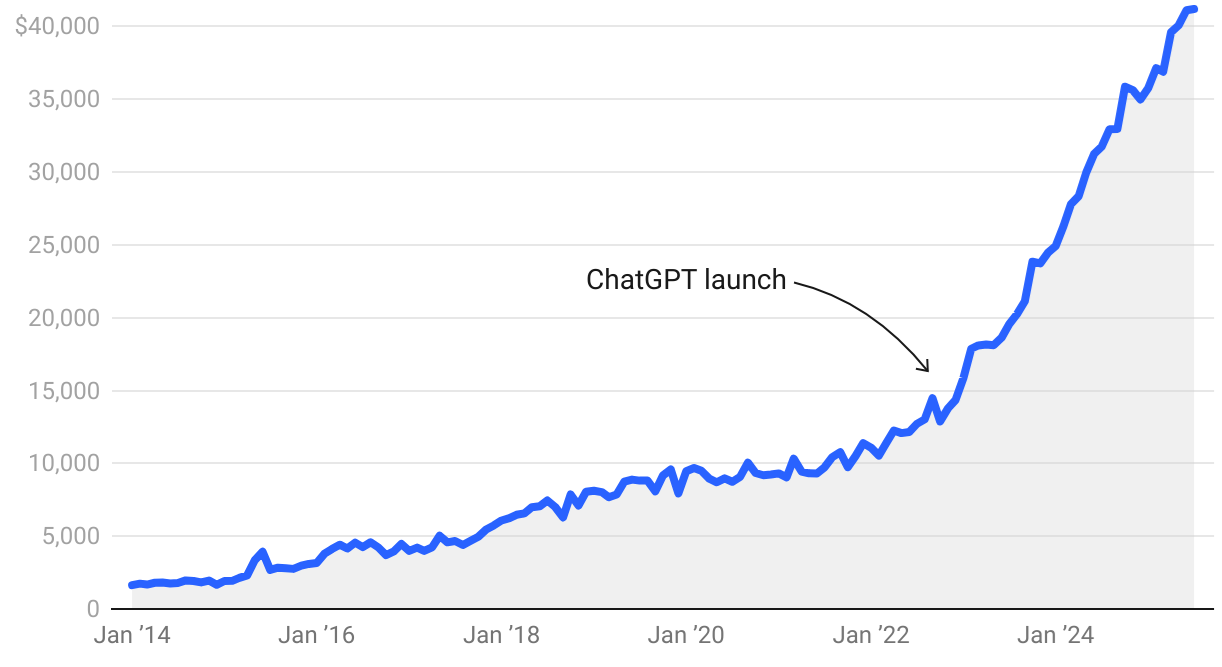

Despite beating earnings expectations, including a notable surprise from retail giant Walmart, traders are worried about the heavy costs associated with AI development—particularly data center investments. Gil Luria, head of technology research at D.A. Davidson, warned that the surge in data center construction might be a speculative bubble that could face a correction in the coming years.

Data center construction spending, seasonally adjusted (millions). Source: Distilled

Data center construction spending, seasonally adjusted (millions). Source: Distilled

Luria stressed that data centers are “inherently speculative investments that might face a reckoning in the near future,” and cautioned that Nvidia’s earnings alone don’t necessarily confirm the maturity of AI economics. Since reaching an all-time high on October 29, the Nasdaq has declined 7.8%, reflecting growing investor risk aversion in the face of high valuation concerns.

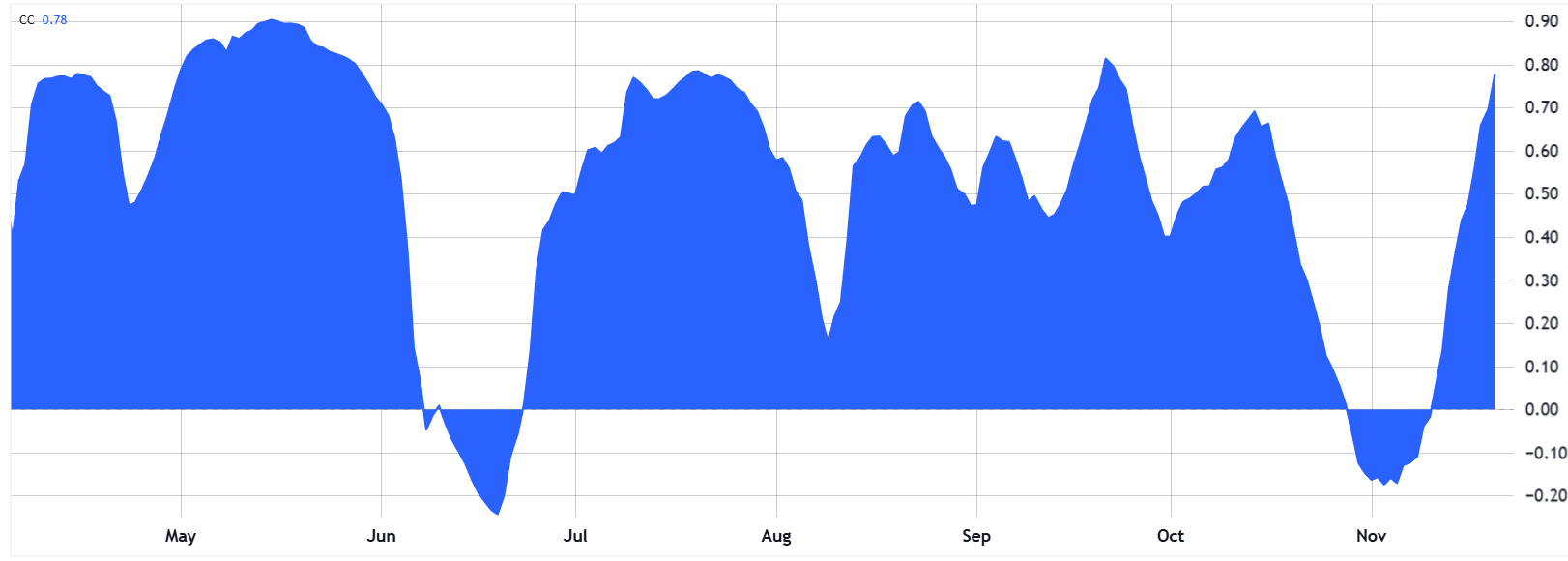

30-day correlation: Bitcoin/USD vs. Nasdaq CFD. Source: TradingView / Cointelegraph

30-day correlation: Bitcoin/USD vs. Nasdaq CFD. Source: TradingView / Cointelegraph

Bitcoin’s price movements continue to mirror stock market trends, with its correlation to the Nasdaq rising to a six-month high of 80%. This suggests that during periods of macroeconomic uncertainty, traders prioritize risk management strategies over Bitcoin’s traditional role as a decentralized store of value. Nonetheless, many investors remain cautious, waiting for clearer entry points as broader macroeconomic conditions remain unpredictable.

As liquidity conditions potentially improve amid ongoing geopolitical and fiscal uncertainties, some analysts believe panic sellers might regret their exits. The US fiscal debt situation lingers, while political initiatives like Trump’s “tariff dividend” proposal could stimulate the economy and renew the appeal of risk assets, including cryptocurrencies.

This article provides an overview of current market conditions in the cryptocurrency and traditional finance sectors and does not constitute investment advice. The opinions expressed are solely those of the author and should not be taken as financial guidance.

This article was originally published as Bitcoin Falls as Investors Question If AI Bubble Has Burst on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim