Cipher Mining lands full-site Fluidstack lease, moves to raise $333 million for Texas expansion

Cipher Mining is further scaling its AI-hosting business, securing a deal that will see Fluidstack lease the entire 300-megawatt campus the miner is building in West Texas, while also seeking $333 million in new financing to expand that site.

The company (ticker CIFR) said Thursday that Fluidstack, an AI cloud platform backed by Google, has expanded its existing arrangement to take all remaining capacity at Cipher’s Barber Lake development.

The new 10-year contract adds 39 megawatts of critical IT load and represents about $830 million in additional revenue over the initial term. If two optional five-year extensions are exercised, the agreement would total roughly $2 billion, and about $9 billion across all Fluidstack-Cipher contracts.

The expansion comes with more financial backing from Google, which agreed to increase its guarantee of Fluidstack’s lease obligations by $333 million. Google already guaranteed $1.4 billion under earlier phases of the partnership.

To keep pace with the buildout, Cipher’s subsidiary is proposing a $333 million offering of additional 7.125% senior secured notes due 2030. The notes would be issued through a private placement and remain subject to market conditions.

If completed, the raise would lift the series’ total outstanding to about $1.73 billion. Cipher said proceeds would help finance continued construction at Barber Lake.

AI fold-in

The moves extend a pivot toward high-performance computing that has reshaped Cipher, as well as many of its peers and rivals, over the past year.

Earlier this month, the company signed a 15-year, $5.5 billion AI-hosting agreement with Amazon Web Services and announced plans for a new 1-gigawatt site in West Texas.

Analysts say miners have become increasingly valuable to AI and cloud providers because of their power access and existing data-center footprints.

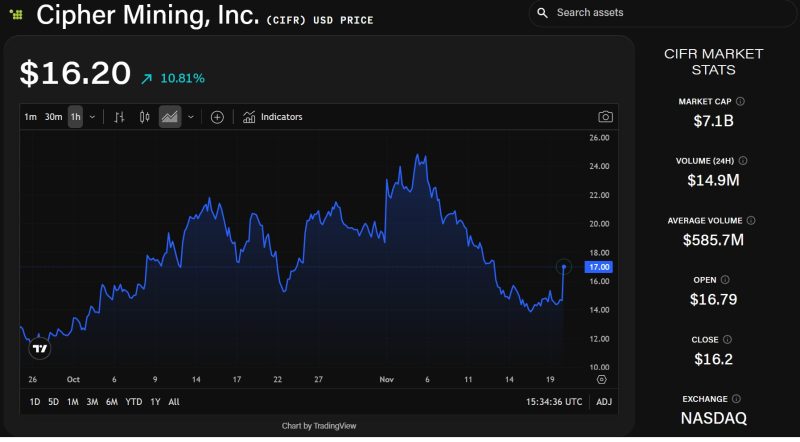

Cipher shares traded around $16.20 on Thursday, up more than 10% on the day and more than 230% year-to-date, according to The Block's price page. The stock also received a boost from Nvidia's blowout earnings print.

Cipher Mining (CIFR) Stock Price. Source: The Block/TradingView

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim