Securitize Leverages Plume to Expand Global Real-World Asset Reach

Securitize Leverages Plume to Expand Global Real-World Asset Reach

Securitize partners with Plume to launch institutional-grade assets on Plume's Nest staking protocol, expanding its DeFi footprint.

What to know:

- Securitize partners with Plume to launch institutional-grade assets on Plume's Nest staking protocol, expanding its DeFi footprint.

- The collaboration connects Securitize's tokenized funds to Plume's network of over 280,000 real-world asset holders.

- As part of the collab, Bitcoin finance platform Solv plans to pour millions into Plume's RWA vaults.

Modular RWA-focused layer 2 blockchain Plume announced Wednesday that tokenization giant Securitize is set to expand its footprint in DeFi by rolling out institutional-grade assets on Plume's Nest staking protocol.

The partnership, underscoring the growing convergence of traditional finance and DeFi infrastructures, will connect BlackRock and Morgan Stanley-backed Securitize's tokenized funds to Plume's network of over 280,000 real-world asset (RWA) holders – supposedly the largest RWA investor community globally.

In essence, Securitize's institutional-grade assets gain another robust onchain venue to move, trade and earn yield at scale. All underlying assets are issued and managed under Securitize’s rigorous regulatory framework, ensuring transparency, full auditability, and compliance.

Plume's Nest staking protocol lets investors move, trade, and earn yield on tokenized assets within a regulated and composable DeFi ecosystem, supported by Bluprynt's Know-Your-Issuer verification system for enhanced transparency and trust.

"Through Plume, we’re connecting institutional-grade assets to one of the largest communities of onchain RWA holders anywhere in the world. This collaboration represents a major step toward realizing truly global, transparent, and accessible digital capital markets," Carlos Domingo, Co-Founder and CEO of Securitize, said in a press release shared with CoinDesk.

Teddy Pornprinya, co-founder and CBO of Plume, emphasized that the on-chain world operates under the same principle as traditional markets: distribution determines scale. He explained that tokenized assets require liquidity, reach, and composability to realize their potential, capabilities Plume is uniquely positioned to provide.

“Securitize sets the gold standard in compliant issuance. Plume delivers the global distribution, composability, and liquidity layer that makes these assets come alive in DeFi," Pornprinya said.

The rollout starts with Hamilton Lane funds and will expand through 2026, targeting $100 million in capital, according to the press release. As a part of the deal, Bitcoin finance platform Solv plans to invest up to $10 million in Plume's RWA vaults, broadening BTC-based yield offerings with regulated, real-world asset exposures.

Speaking on the matter, Ryan Chow, co-founder and CEO of Solv Protocol, stressed BTC's role in yield-bearing markets.

“As regulated on-chain markets emerge, bitcoin will underpin a new generation of yield, credit, and liquidity infrastructure, where demand for yield-bearing bitcoin with RWA-backed yields replaces passive treasuries as the next phase of institutional adoption," Chow said.

More For You

Protocol Research: GoPlus Security

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

Solana ETFs Post Second-Biggest November Inflows as Demand Grows During Downturn

Spot SOL exchange-traded funds extended an inflow streak since they began trading on Oct. 28 while bitcoin and ether ETFs bled hundreds of millions of dollars.

What to know:

- U.S. spot solana ETFs have experienced inflows for the 17 consecutive days since their debut last month.

- The ETFs have amassed a total net inflow of $476 million, with a notable single-day inflow of $48.5 million on Wednesday.

- Unlike solana, spot bitcoin and ether ETFs have faced significant outflows, highlighting a shift in investor interest.

Solana ETFs Post Second-Biggest November Inflows as Demand Grows During Downturn

Tether Invests in LatAm Crypto Infrastructure Firm Parfin to Boost USDT Among Institutions

Ether Treasury Firm FG Nexus Unloads Nearly 11K ETH to Fund Share Buyback

Cipher Mining Inks New 10-Year HPC Deal With Fluidstack; Shares Rise 13%

CoinDesk 20 Performance Update: Aptos (APT) Gains 10% as All Index Constituents Rise

World App Starts Virtual Bank Accounts Pilot for USDC Payroll Deposits

Cipher Mining Inks New 10-Year HPC Deal With Fluidstack; Shares Rise 13%

Ether Treasury Firm FG Nexus Unloads Nearly 11K ETH to Fund Share Buyback

U.S. Added Stronger Than Forecast 119K Jobs in September, but Unemployment Rate Rose to 4.4%

Crypto Markets Today: Bitcoin Holds Steady Amid Wave of Sell Pressure as Altcoins Slide

India's Debt-Backed ARC Token Eyes Tentative Q1 2026 Debut, Sources Say

BlackRock Takes First Step Toward a Staked Ether ETF

You May Also Like

Sei Foundation's DeSci Fund appoints UN blockchain expert as venture partner

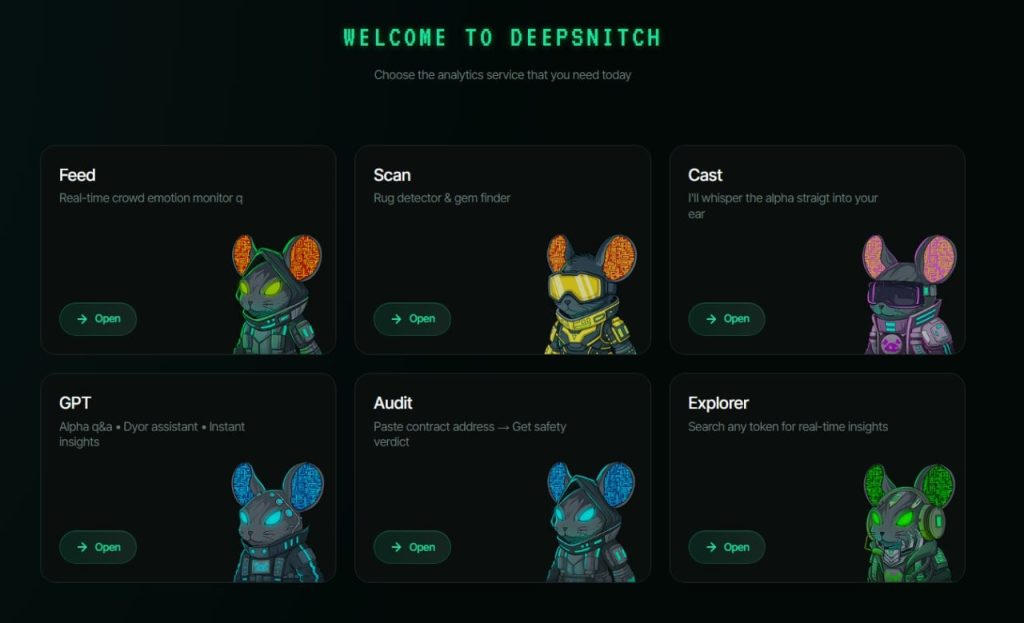

XRP Price Prediction March Update: Ripple and Aave Consolidate While DeepSnitch AI Surges 170%+ and Raises $1.8M