The OCC Clears U.S. Banks to Hold Crypto on Balance Sheets for On-chain Operations

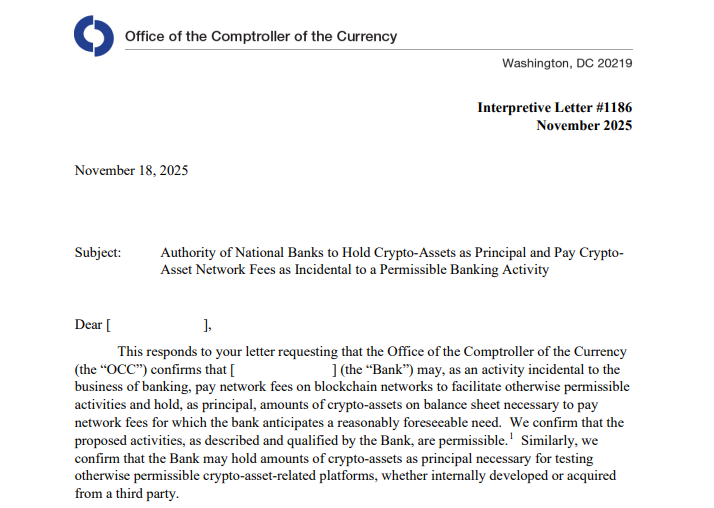

The Office of the Comptroller of the Currency (OCC) has formally cleared national banks in the United States to hold cryptocurrency on their balance sheets and spend it, marking the biggest policy shift for the banking sector’s relationship with digital assets since 2020.

The decision, published in a new interpretive letter, overturns years of restrictive guidance and opens the door for major banks to engage directly with public blockchain networks.

Source: OCC

Source: OCC

The new guidance confirms that national banks can now hold crypto as a principal when needed to pay network fees, commonly known as gas fees, on blockchains used to support “otherwise permissible” banking activities.

This includes everything from settling transactions on distributed networks to operating blockchain-based platforms. Banks may also hold digital assets for testing crypto-related systems, whether developed internally or built by third-party providers.

U.S. Regulators Continue Crypto Pivot With New Guidance on Bank Asset Holdings

In the letter, Adam Cohen, the OCC’s senior deputy comptroller and chief counsel, said the change simply allows banks to perform long-existing activities more efficiently.

He argued that allowing banks to hold the necessary crypto directly prevents them from relying on outside counterparties or exposing themselves to operational risks just to acquire small amounts of digital assets needed to operate on-chain.

The decision marks a clear departure from the cautious posture adopted under the Biden administration, when national banks were required to seek explicit supervisory approval before engaging in anything related to crypto.

Alongside the FDIC and the Federal Reserve, regulators at the time strongly discouraged banks from interacting with public, permissionless networks like Ethereum, warning that such systems posed elevated operational and compliance risks.

That environment has shifted sharply under the current administration. In March, the OCC rescinded the Biden-era supervision requirement through Interpretive Letter 1183, allowing banks to engage in crypto custody, stablecoin activities, and blockchain participation without pre-clearance.

Weeks later, additional clarification was issued, permitting banks to buy and sell cryptocurrency held in custody on behalf of clients.

The move gave banks room to outsource crypto-asset storage and execution to vetted third-party custodians while maintaining safety and soundness standards.

Today’s announcement extends that deregulatory momentum by giving national banks explicit authority to keep digital assets on their own balance sheets when necessary for operations.

The OCC also reaffirmed that all crypto activity remains subject to the same rigorous risk-management expectations as traditional banking functions.

Can the OCC’s Shift Revive the Crypto Banking Ambitions Paused Since 2021?

The reversal builds on the more permissive framework briefly introduced in 2020, when the OCC under the Trump administration approved crypto custody, stablecoin reserve services, and the ability for banks to run blockchain nodes.

That guidance was narrowed in 2021 under Interpretive Letter 1179, which required banks to obtain supervisory “non-objection” before launching crypto operations, a rule now fully undone.

Leadership changes have also played a role. Jonathan Gould, confirmed in July as the OCC’s first permanent chief since 2020, previously worked in both blockchain and regulatory policy, showing a renewed appetite for deeper integration between digital assets and mainstream banking.

The shift comes amid broader activity across the banking and crypto industries.

Earlier in the year, the OCC’s move to relax restrictions coincided with a public pledge from Donald Trump to end what he described as regulatory pressure on crypto firms, a reference to what industry advocates have called “Operation Choke Point 2.0.”

While some bank executives argue that elements of the crackdown persist at the Fed and FDIC, the OCC has taken the lead in rolling back earlier constraints.

The policy change also lands as global companies push deeper into digital finance.

Several crypto and fintech firms, like Coinbase, Circle, Paxos, Stripe, and Ripple, are on a short list of major firms seeking national digital bank status.

Sony Bank’s proposal to launch a national trust issuing a dollar-backed stablecoin has drawn pushback from U.S. banking groups, which argue that supervision of non-traditional entrants needs clearer guardrails.

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip