Trading time: Gold hits record high, sucking blood from BTC, tariffs and non-agricultural data become the focus of the market this week

1. Market observation

Keywords: BNB, ETH, BTC

Bitcoin seems to have been sucked by gold. Spot gold broke through $3,100/ounce this morning, setting a new record high again. Goldman Sachs predicts that it will reach $3,300 by the end of the year. In contrast, Bitcoin closed down last week and is currently fluctuating around $82,000. Economist Peter Schiff warned that if gold rises to $5,000, Bitcoin may fall 95% from its 2021 high to $10,000. In addition, the on-chain market was also relatively cold over the weekend, and the heat of the BNB chain gradually subsided. Although SOL has pulled back nearly 60% from its historical high, trader Eugen still established a long order at $125, believing that the sharp fluctuations from $88,000 to $82,000 provide a good risk-reward ratio.

Market data shows that the total market value of the cryptocurrency sector has shrunk by $610 billion since 2025. About 8,000 bitcoins that have been silent for many years have been transferred recently, worth $674 million, exacerbating market concerns. Bloomberg strategist Mike McGlone said that if Bitcoin cannot resume stable growth, altcoins may be sold off more, and ETH may even fall to $1,000 later this year. However, not everyone is pessimistic. Elliot Chun, partner of Architect Partners, predicts that by 2030, 25% of S&P 500 companies will include Bitcoin on their balance sheets. Currently, listed companies hold a total of 665,618 bitcoins, accounting for 3.17% of the total supply, of which MicroStrategy dominates with 506,137 bitcoins. At the same time, Zhu Su observed in Hong Kong that some family offices are paying close attention to Michael Saylor's strategy and considering adopting a similar Bitcoin reserve model.

In addition, the regulatory environment continues to improve, and multiple favorable factors are taking shape. Crypto-friendly Paul Atkins is about to take office as SEC chairman, which may promote the unlocking of Ethereum ETF pledges and facilitate the approval of more digital asset ETFs. In addition, the US Strategic Bitcoin Reserve legislation is expected to be introduced in May, which may make Bitcoin and gold a sovereign-level asset. The Hong Kong Monetary Authority is also developing a stablecoin regulatory framework, and the relevant bill has entered the Legislative Council review stage. At the same time, Panama announced a draft cryptocurrency bill, planning to recognize digital assets as legal payment tools. The US FDIC has revoked the policy that banks need to obtain prior approval to provide crypto services, clearing the way for traditional financial institutions to enter the crypto market.

However, the macro environment is still full of uncertainty, and the market is facing multiple challenges. Capital Flows analysis believes that if Bitcoin wants to break through $100,000, macro liquidity needs to change continuously, otherwise if the stock market falls, Bitcoin may fall back to the range of $72,000-75,000. The market generally believes that against the backdrop of intensified global trade frictions and rising uncertainty, the safe-haven appeal of gold continues to increase. Bank of America analysts pointed out that the current market is undergoing five major disruptive changes, including the end of the era of "big government" in the United States, the transformation of technology stocks, the EU fiscal stimulus, the end of deflation in Japan, and the recovery of Chinese consumption, which will profoundly affect the market trend. In addition, the tariff adjustment on April 2 and the non-agricultural data on April 4 are expected to become key variables in the short-term market trend.

2. Key data (as of 13:30 HKT on March 31)

-

Bitcoin: $82,117.28 (-12.33% year-to-date), daily spot volume $17.854 billion

-

Ethereum: $1,806.71 (-46.01% year-to-date), with a daily spot volume of $12.316 billion

-

Fear and corruption index: 34 (fear)

-

Average GAS: BTC 1 sat/vB, ETH 0.35 Gwei

-

Market share: BTC 61.4%, ETH 8.2%

-

Upbit 24-hour trading volume ranking: XRP, LAYER, BTC, ETH, DOGE

-

24-hour BTC long-short ratio: 0.9928

-

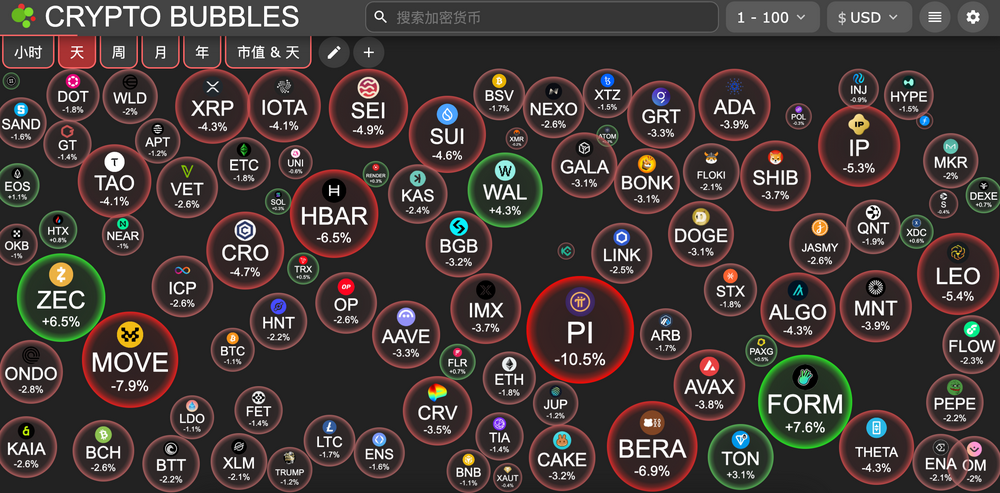

Sector ups and downs: The crypto market fell across the board, with the PayFi sector falling 3.71% and the Meme sector falling 2.88%.

-

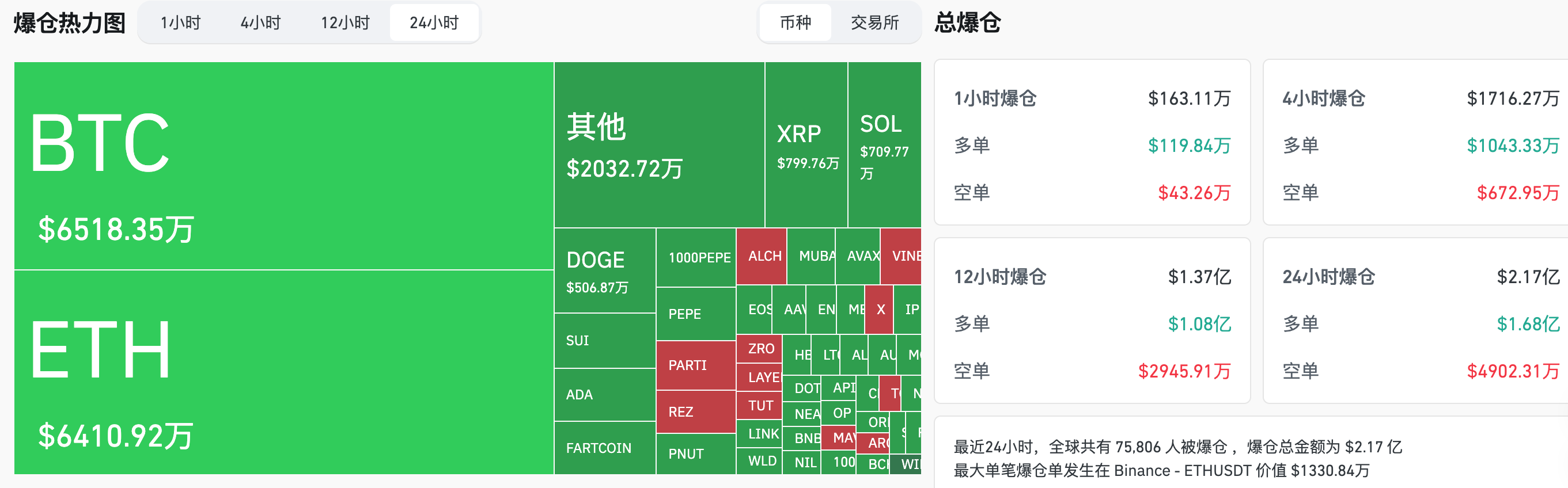

24-hour liquidation data: A total of 75,806 people were liquidated worldwide, with a total liquidation amount of US$217 million, including BTC liquidation of US$65.18 million and ETH liquidation of US$64.10 million

3. ETF flows (as of March 28 EST)

-

Bitcoin ETF: -$93.16 million

-

Ethereum ETF: $4.68 million

4. Today’s Outlook

-

The first quarter of the ZKsync incentive program Ignite ends, and plans to distribute 100 million ZK

-

Four.meme will switch to PancakeSwap V2 liquidity solution and destroy new tokens LP on March 31

-

Terraform Labs will open a portal for crypto asset loss claims on March 31, with a deadline of April 30

-

Binance Launchpool will list GUNZ (GUN) at 21:00 on March 31

-

mtnDAO announces $MTN token uncapped sale on MetaDAO Launchpad

-

Ark Invest's ARKK, ARKW and ARKF ETFs will be listed on Cboe BZX

-

Binance will remove USDT and other non-compliant stablecoins from European users

-

TON Foundation and Jupiter have reached a cooperation to incubate a new DEX on the TON virtual machine. The winner will be announced on March 31, 2025

-

Japanese Bitcoin Company Metaplanet Conducts 10:1 Stock Split

-

Jupiter: Appeals for addresses mislabeled as Sybils or Bots close on April 1

-

Binance will delist GALA/BNB, PERP/BTC, USDT/CZK, USDT/RON trading pairs

-

IOST: Snapshotting has been executed, and the airdrop query portal is planned to be launched on April 1

-

Cayman Islands’ new cryptocurrency regulatory framework introduces new licensing requirements, effective April 1

-

Optimism (OP) will unlock approximately 31.34 million tokens at 8:00 am on March 31, accounting for 1.93% of the current circulation, worth approximately US$23.8 million;

-

Sui (SUI) will unlock approximately 64.19 million tokens at 8 am on April 1, accounting for 2.03% of the current circulation, worth approximately $152 million;

-

ZetaChain (ZETA) will unlock approximately 44.26 million tokens at 8:00 am on April 1, accounting for 6.05% of the current circulation and worth approximately $13.2 million.

-

DYDX (DYDX) will unlock approximately 8.33 million tokens at 8 am on April 1, accounting for 1.09% of the current circulation and worth approximately US$5.4 million.

The biggest gainers in the top 500 by market value today: X Empire (X) up 27.61%, Alchemist AI (ALCH) up 17.08%, Concordium (CCD) up 10.44%, CZ'S Dog (BROCCOLI) up 9.95%, LayerZero (ZRO) up 9.39%.

5. Hot News

-

Weekly preview | Trump’s “reciprocal tariffs” take effect on April 2; Terraform Labs opens a portal for crypto creditors to claim

-

Macro Outlook of the Week: Trump overturns the table, April 2 may become a watershed for global assets

-

Data: SUI, W, ENA and other tokens will usher in large-scale unlocking, among which SUI unlocking value is about 152 million US dollars

-

Metaplanet announces issuance of 2 billion yen zero-interest ordinary bonds, funds raised will be used to purchase Bitcoin

-

Spot gold broke through $3,100 per ounce on Monday, setting a new record high

-

Analysis: Financial giant Vanguard Group may indirectly get involved in cryptocurrencies through GameStop Bitcoin reserves

-

Goldman Sachs raises its forecasts for U.S. recession and tariff rates

-

Movement Labs deposits 17.15 million MOVE tokens with Coinbase, worth $7.74 million

-

Japan's FSA considers classifying crypto assets as financial instruments and regulating internal transactions

-

Vitalik Buterin's robot's "cat-like meowing" behavior has caused dissatisfaction in the Ethereum community. He has not yet responded to the matter

-

A whale who once lost $15.72 million in TRUMP trading bought more than 333,000 TRUMPs again

-

Report: Average stablecoin liquidity per token drops 99% between March 2021 and 2025

-

The total number of users of South Korea’s top five crypto exchanges reached 16.29 million, accounting for 32% of the total population

-

El Salvador has increased its holdings by 8 bitcoins in the past 7 days, bringing its total holdings to 6,131.18 bitcoins

-

NFT transaction volume rebounded 4.5% to US$102.8 million in the past 7 days, and CryptoPunks transaction volume surged 140%

-

Cryptocurrency daily trading volume fell 70% from a peak of $126 billion during the US election to $35 billion

-

MARA plans to launch a $2 billion ATM equity issuance plan, Barclays Bank and other financial institutions will participate

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

The History of Crypto Advertising Sponsorship: A Cycle Experiment with Buying Attention and Legitimacy