Kenya Alerts: No Licensed VASPs as Bitcoin ATMs Pop Up in Malls

Kenya’s recent implementation of comprehensive crypto legislation marks a pivotal moment for the country’s emerging digital economy. Despite government warnings that no licensed crypto providers are currently operating, several Bitcoin ATMs have surfaced in Nairobi’s bustling shopping malls, signaling a burgeoning interest in cryptocurrency among local consumers. This development highlights the rapid pace of crypto adoption juxtaposed with the regulatory uncertainty that continues to shape Kenya’s crypto landscape.

- Bitcoin ATMs appear in Nairobi malls shortly after Kenya’s new crypto law took effect, despite lack of licensing.

- The Kenyan government’s Virtual Assets Service Providers Act of 2025 aims to regulate the sector, but licensing procedures are pending.

- Authorities warn that currently no VASP (Virtual Asset Service Provider) is authorized to operate legally in Kenya.

- Crypto activity is expanding in informal sectors and lower-income neighborhoods like Kibera, where Bitcoin offers access to financial services.

- Regulatory ambiguity creates a challenging environment for the growth of crypto markets in Kenya.

Bitcoin ATMs have recently appeared across major shopping malls in Nairobi, shortly after Kenya adopted its first comprehensive cryptocurrency law. Local media reported that machines branded “Bankless Bitcoin” were installed next to traditional banking kiosks, providing cash-to-crypto services to Kenyan consumers.

This isn’t Kenya’s first encounter with Bitcoin ATMs. In 2018, the East African news outlet reported that several machines by BitClub had briefly operated in Nairobi, though adoption remained limited and the devices did not become mainstream in retail spaces.

Current data from CoinATMradar reveals only two Bitcoin ATMs in the entire country, underscoring how nascent the infrastructure remains. Nonetheless, the presence of these machines signals a notable shift as Kenya’s government pushes forward with new regulations.

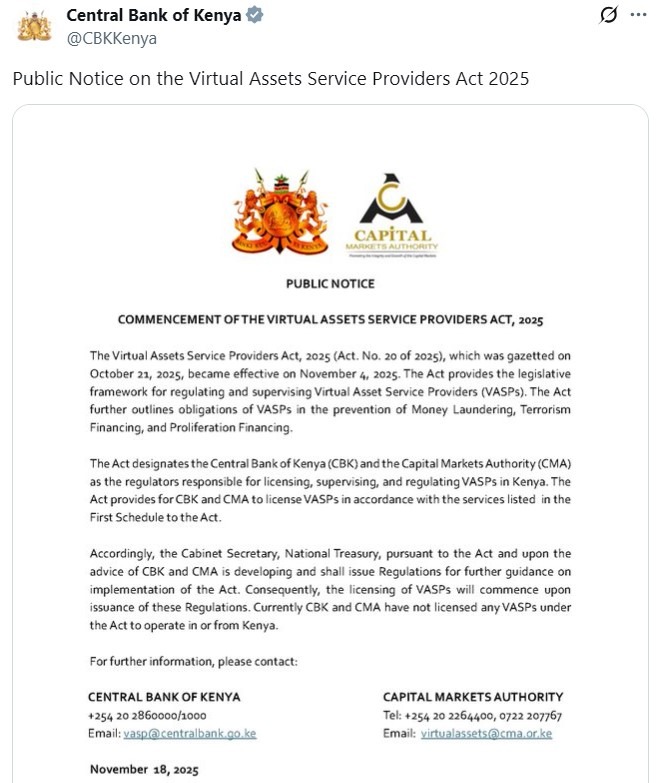

Just weeks after the Virtual Assets Service Providers Act of 2025 came into effect, Kenya introduced its first formal licensing framework for crypto platforms, including wallets, exchanges, and custodians. On Nov. 4, the Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA) jointly announced that no entities have yet received licenses under the new regime. They warned businesses claiming licensing are operating illegally, emphasizing the need for formal approval.

A Bitcoin ATM spotted in Kenya. Source: Capital FMThe Central Bank of Kenya warns that no VASP is licensed yet

The regulators clarified that, although the law is now in force, the licensing process has not yet been initiated, leaving current operations in a legal gray area. The CBK and CMA issued a joint statement, warning the public against engaging with unlicensed VASPs.

“Currently, CBK and CMA have not licensed any VASPs under the Act to operate in or from Kenya,” the statement read. The National Treasury is expected to develop regulations that will guide the licensing process once finalized.

Source: Central Bank of Kenya

Source: Central Bank of Kenya

This regulatory disconnect creates a paradox: physical infrastructures, like Bitcoin ATMs, are appearing in the market while authorities caution the public about the lack of licensing and legal safeguards. Critics argue that this discrepancy raises questions about the enforcement of crypto laws and the compliance of private crypto businesses operating within the country.

Despite the regulatory ambiguity at the formal level, Kenya’s crypto ecosystem is thriving on a grassroots level. Bitcoin’s presence in lower-income districts like Kibera demonstrates its importance as a financial tool for those lacking access to traditional banking. Local entrepreneur Ronnie Mdawida emphasizes that Bitcoin provides “financial freedom” to residents, allowing them to hold value without elaborate paperwork—a crucial advantage for Kenyans living on near-poverty levels.

This juxtaposition of increasing crypto infrastructure and ongoing regulatory uncertainty highlights the dynamic nature of Kenya’s crypto markets, as both regulators and consumers navigate an evolving landscape.

This article was originally published as Kenya Alerts: No Licensed VASPs as Bitcoin ATMs Pop Up in Malls on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

MicroStrategy Eyes New Bitcoin Milestone With Another Purchase