Quant Price Rebounds to $79, Is $86 the Next Target?

The post Quant Price Rebounds to $79, Is $86 the Next Target? appeared first on Coinpedia Fintech News

Quant’s price journey has sparked fresh excitement, especially after this week’s visible rebound. The QNT token managed to climb 2.57% to $79.59 in the last 24 hours, drawing eyes to the utility surge and technical bounce. What set this rally apart was a combination of strong token news, a resilient technical setup, and a sector-wide shift favouring real-world blockchain solutions.

With traders jumping in, driven by Quant Network’s new QuantNet and Fusion launches, it looked like the market found a new rhythm. Let’s dig into what’s actually fueling the move and where the QNT price might head next.

Will Bulls Break $82, or Are Bears Coming?

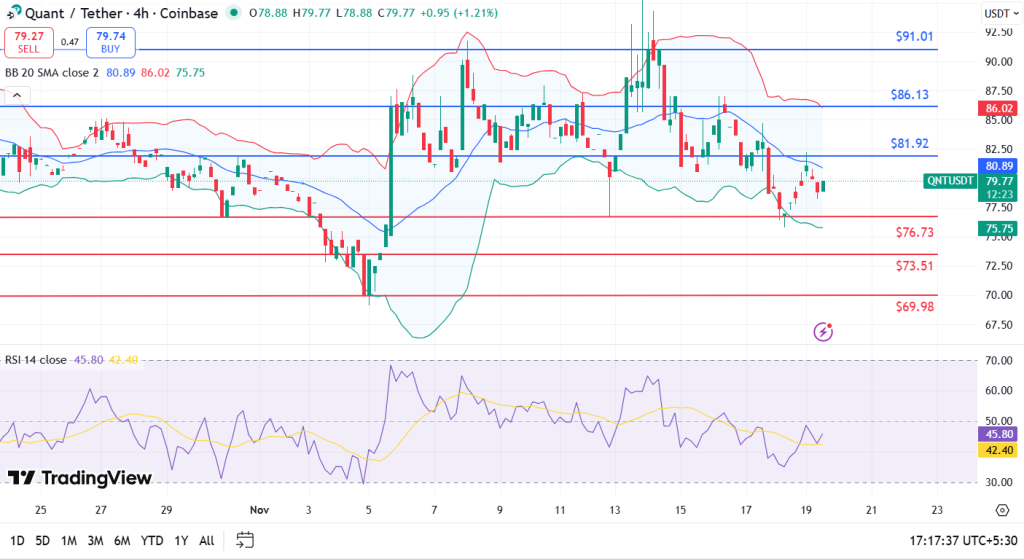

QNT’s rally started after touching an ascending trendline that has supported its price for almost a year. When prices bounced from $77.70 up to $82.10, the move signalled renewed confidence. Holding above the 50-day EMA at $81.92 offered dip-buyers a green light to step in. The price zig-zagged near crucial resistance levels, with targets at $81.92 and $86.13.

If Quant price can clear $82, bulls could aim for $86 or even $91 within the next 5–10 days, depending on how quickly volume picks up and sentiment stays strong. If prices drop below $76.73, sentiment could turn bearish fast, with downside risk down to $73.51 and possibly $69.98.

For now, I see a tug-of-war. Bulls lean on momentum from QuantNet and Fusion’s launch, while the bears point to low volume as a warning. As long as the price holds above the key support trendline, any bearish slide likely remains short-lived.

Conclusion

Looking ahead, I expect the QNT price to test the $81.92 resistance, but it needs higher volume to break above and push toward $86 or $91. If enthusiasm from the QuantNet launch remains, a 5–10 day timeline could see these targets hit.

That being said, the bears only get loud if the price falls under $76.73, as momentum could fade and trigger a short drop closer to $73.51. For now, the overall tone feels cautiously bullish.

FAQs

Quant trades at $79.59, up 2.57% in 24 hours, but down 4.88% for the week, showing mixed momentum.

Short-term targets for Quant are $81.92 and $86, with $91 possible if volume and sentiment improve within 5–10 days.

Quant is cautiously bullish right now, as price holds key support and benefits from positive network news. Hence, you can pick a trade.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Spur Protocol Daily Quiz 21 February 2026: Claim Free Tokens and Boost Your Crypto Wallet