Bitcoin Price Slumps 10% In 7 Days As Michael Saylor Teases Another BTC Buy In ”Big Week”

The Bitcoin price slumped 10% over the last week and a fraction of a percent in the past 24 hours to trade at $94,986 as of 2:37 a.m. EST on trading volume that soared 59% to $78.2 billion.

This comes as Michael Saylor hinted at another Bitcoin purchase from Strategy (MSTR) this week. Saylor posted on X with the words “Big Week” and a portfolio chart, which usually indicates a plan to buy more BTC.

In the post, Saylor included a chart showing that Strategy now has around 641,692 BTC in its hoard valued at $61 billion.

The new purchase would arrive at a time when the market is going through a volatile period after falling below the psychologically important $100k level.

Spot Bitcoin ETFs (exchange-traded funds) recorded a net outflow of $1.11 billion last week, marking the third consecutive week of outflows, according to SoSoValue data.

Peter Schiff Predicts Strategy’s Bankruptcy

In another development, Bitcoin permabear Peter Schiff said Strategy is a ”fraud” that will eventually go bankrupt.

Schiff’s stand comes from concerns regarding the company’s financial stability amid ongoing volatility.

Schiff also continues to warn people from buying BTC. ”I warn people who don’t own Bitcoin not to buy, and advise those who do own it to get out before the final crash,” he said.

Bitcoin Price Consolidating Around The $95,000 Zone – Breakout Incoming?

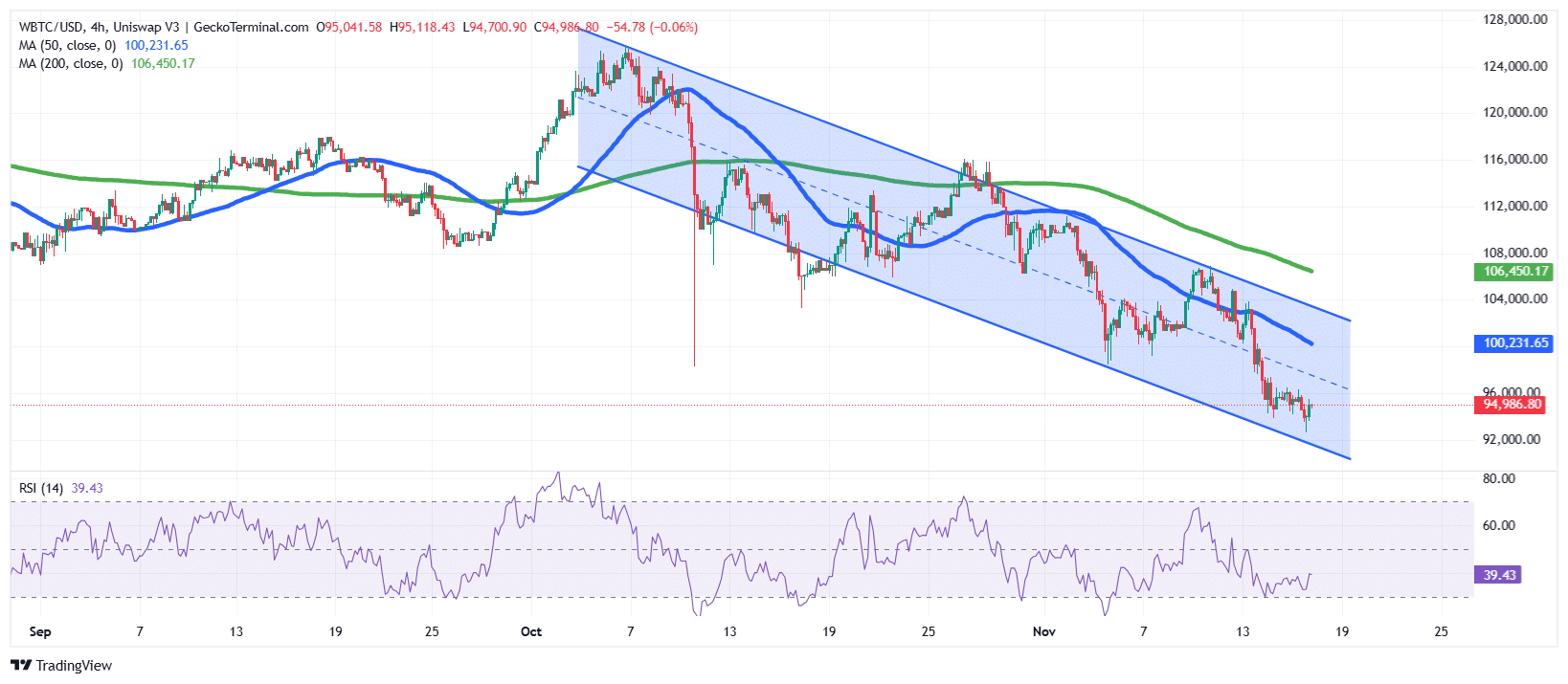

On the 4-hour timeframe, the BTC/USD chart analysis shows that the BTC price went through a sustained surge in October to touch the $126,080 all-time high (ATH).

However, bulls could not hold this level, as the bears took charge, driving the price through a falling channel pattern. The sustained drop saw the Bitcoin price fall below the $100,000 level, reaching around $93,000.

Currently, the bulls are aiming for a breakout, with the price of Bitcoin now consolidating between $94,000 and $95,000, as they eye a recovery.

As a result of the bearish trend over recent weeks, BTC is now trading below both the 50-day ($100,231) and 200-day ($106,450) Simple Moving Averages (SMAs), supporting the overall bearish stance.

Meanwhile, the Relative Strength Index (RSI) after Bitcoin surged from below the $94,000 zone appears to be recovering from the 30-oversold level to the current 39. This level still shows that BTC bulls need sustained buying pressure to regain control and push the price back above $100,000.

BTC/USD Chart Analysis Source: GeckoTerminal

BTC/USD Chart Analysis Source: GeckoTerminal

According to the analysis, BTC seems to be consolidating within the $95,000 level. The surging RSI could signal renewed interest and bulls buying the bottom.

If the price of Bitcoin recovers and breaks out of the $95,500 zone, the next key resistance levels and targets could be the 50-day and 200-day SMAs, $100,231 and $106,450, respectively.

Conversely, if bearish pressure persists within the falling channel, Bitcoin could drop back to the channel’s lower boundary, around $91,700, in the coming days.

This outlook is supported by analyst Scott Melker, with over 1 million followers, who notes that Bitcoin closed below the 50 MA on the weekly chart, which acts as a top bearish indicator.

Related News:

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim