Meet Catchpoint: HackerNoon Company of the Week

We are back with another Company of the Week feature! Every week, we share an awesome tech brand from our tech company database, making their evergreen mark on the internet. This unique HackerNoon database ranks S&P 500 companies and top startups of the year alike.

This week, we are proud to present Catchpoint, the internet performance monitoring platform used by Google, LinkedIn, Tencent, and many, many more! Top online retailers, Global2000, CDNs, cloud service providers, and xSPs in the world rely on Catchpoint to increase their resilience by catching any issues in the internet stack before they impact their business.

Based in New York, Catchpoint provides unparalleled observability into anything that impacts customers, workforce, networks, website performance, applications, and APIs.

\

:::tip Want to be featured on HackerNoon’s Company of the Week? Request Your Tech Company Page on HackerNoon!

:::

\

\

Meet Catchpoint: Fun Facts

Catchpoint has a dedicated section designed to help users learn!

The company’s blog has a very timely post on how businesses can prepare their websites for relentless peak demand ahead of Black Friday, including tips on seeing and fixing blind spots that only emerge under peak conditions, especially those invisible to traditional cloud-based monitoring.

Catchpoint CEO Mehdi Daoudi also frequently speaks to media outlets, more recently on the AWS outage that he estimates could have cost billions of dollars due to loss in productivity for millions of workers.

Meanwhile, Catchpoint recently released a report that showed that some of the world’s biggest retailers are leaving billions on the table because their websites are too slow or unstable.

Businesses, take note! :sunglasses:

Catchpoint🤝HackerNoon Business Blogging

Catchpoint has partnered with HackerNoon on the business blogging program, designed to drive technologists to content and optimize brand recall.

HackerNoon's Business Blogging program gives the business the screen space of the author bio, links to business social media accounts, and a prominent call to action linking to anywhere on the interwebs of the sponsor's choosing.

For Catchpoint, the business blogging program offered an opportunity to bring their best foot forward, and truly demonstrate their technical prowess to a relevant audience.

Discover Catchpoint’s Latest Insights on HackerNoon

- Google’s Agent-to-Agent (A2A) Protocol is here—Now Let’s Make it Observable

\

Catchpoint🤝 HackerNoon Targeted Ads

Catchpoint also recently partnered with HackerNoon on its “Spend less time in war rooms” campaign to reach out to audiences without having to rely on intrusive, cookie-based marketing campaigns.

Through the targeted ad campaign, Catchpoint was able to drive readers to its suite of tools that help find issues across their internet stack before they impact their users or bottom line.

Ad Placement by Content Relevancy, Explained in 7 Seconds

\

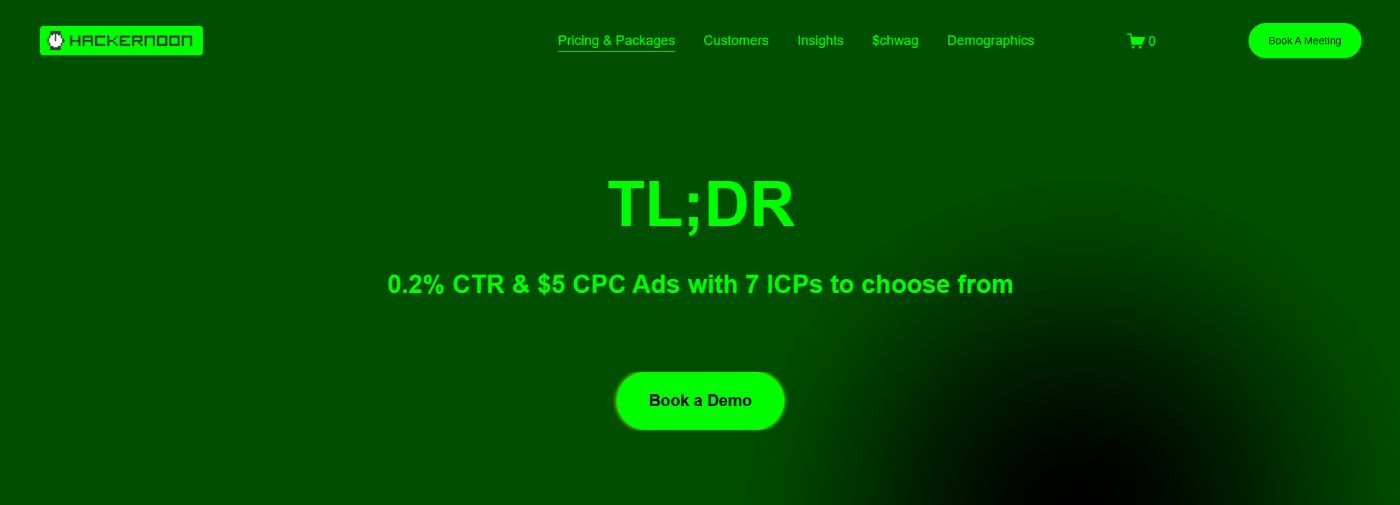

▪️50,000+ tech tags across AI, Web3, Programming, Startups, Cybersecurity, Finance& more. \n ▪️Smart targeting: every story gets 8 tags + a parent category. \n ▪️Multi-format ads: banners, logos, newsletter, and audio. \n ▪️3x more clicks than elsewhere. \n ▪️Leads at unbeatable prices: CPM ~$7, CPC ~$5.

\

\

That's all this week, folks!

Stay Creative, Stay Iconic.

The HackerNoon Team

You May Also Like

WOW Summit Partners with Hong Kong Sevens: Five Memorable Days of Web3, Sports, and Excitement!

First Multi-Asset Crypto ETP Opens Door to Institutional Adoption