Cardano News: Cardano Trader Loses $6M in ADA in Faulty Stablecoin Swap

A five-year Cardano holder accidentally lost $6.05 million in ADA tokens during a stablecoin swap, highlighting extreme decentralized finance risks.

A long-term investor in the Cardano ecosystem recently suffered a devastating financial setback. The trader accidentally lost over $6 million in ADA tokens. This huge loss came when they were executing a stablecoin swap in an illiquid trading pool.

Illiquidity and Slippage Trigger Multi-Million Dollar Loss

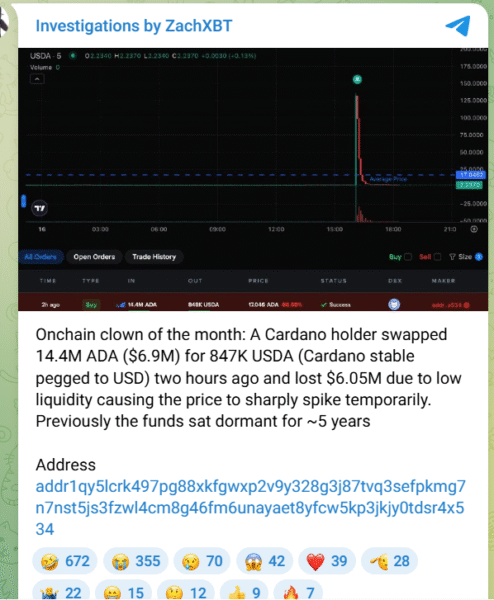

Specifically, the transaction, first flagged by blockchain analyst ZachXBT, saw 14.4 million ADA tokens transferred. This volume of ADA at the time of the swap had a value of about $6.9 million.

As a result, the massive transfer was meant to secure USDA stablecoins. The US dollar Anzens (USDA) is a low-market-cap cryptocurrency. However, the trade only turned 847,695 USDA stablecoins in return.

Related Reading: Cardano News: Cardano Founder Calls for “Gigachad Bullrun” | Live Bitcoin News

In fact, the massive discrepancy in price came to a whopping $6.05 million lost to the user. The main reason lies in the liquidity that is not enough in the trading pool.

This problem caused huge slippage while executing the swap. Slippage is a situation where the price of the asset changes drastically because of the mammoth size of the incoming trade. The pool simply could not take in the volume.

Source: ZachXBT

Source: ZachXBT

Therefore, the poor technical execution even made the swap disastrous for the holder. It highlights the importance of technical awareness in decentralized trading environments. Such errors have huge financial penalties.

Moreover, the account that is linked to the costly transaction has a strange background. The digital wallet was reportedly not active since the year 2020. This extended dormancy confuses the massive activity.

Dormant Wallet Activity and the DeFi Risk Reminder

Furthermore, the trader’s intent in buying the low-market-cap USDA stablecoin is also ambiguous. Moving such a sizeable sum into an illiquid asset raised immediate questions. The motives of the decision are being questioned.

The incident is a harsh, unavoidable reminder to the whole of the cryptocurrency market. In fact, it emphasises the sharp risks associated with trading in illiquid decentralized finance (DeFi) pools.

Hence, traders must always be extremely careful when it comes to trading pool depth and then executing large transactions. Users should be very careful to verify the available liquidity in order to avoid sudden price spikes. This preemptive action helps to avoid major financial erosion.

The sheer size of this one, catastrophic loss, highlights the inherent complexities of DeFi. In addition, the story confirms that technical trade flaws can happen to even the most experienced and long-term holders.

Consequently, experts emphasize that the understanding of transaction basics is a non-negotiable requirement for all parties involved in the transaction. It is important to understand the functioning of slippage protection mechanisms. This basic knowledge is the protection of capital.

Lastly, this $6 million ADA token loss serves as a final warning for the industry. As a consequence of this, all users of DeFi will have to reassess their risk parameters. Transparency and careful pool selection are of paramount importance to safety.

The post Cardano News: Cardano Trader Loses $6M in ADA in Faulty Stablecoin Swap appeared first on Live Bitcoin News.

You May Also Like

Forward Industries Bets Big on Solana With $4B Capital Plan

UK Looks to US to Adopt More Crypto-Friendly Approach