Bitcoin UTXO Age Bands Put Local Bottom At $95K — Here’s Why

After a disappointing performance during the week, the price of Bitcoin has continued its sluggish action over the weekend. According to data from CoinGecko, the premier cryptocurrency has been hovering around the $102,000 level over the past 24 hours.

While this current choppy price action seems like an improvement from the severe downturn witnessed in recent days, it doesn’t particularly bring calm to the world’s largest cryptocurrency. Interestingly, the latest on-chain data suggests that the Bitcoin price might still be at risk of further correction in the coming days.

Why BTC Price Might Find Bottom Around $95,000

In a November 8 post on the social media platform X, on-chain analyst Burak Kesmeci predicted the local bottom for the price of Bitcoin. According to the crypto pundit, the flagship cryptocurrency could fall to as low as $95,000 before seeing relief and perhaps rebounding to new price highs.

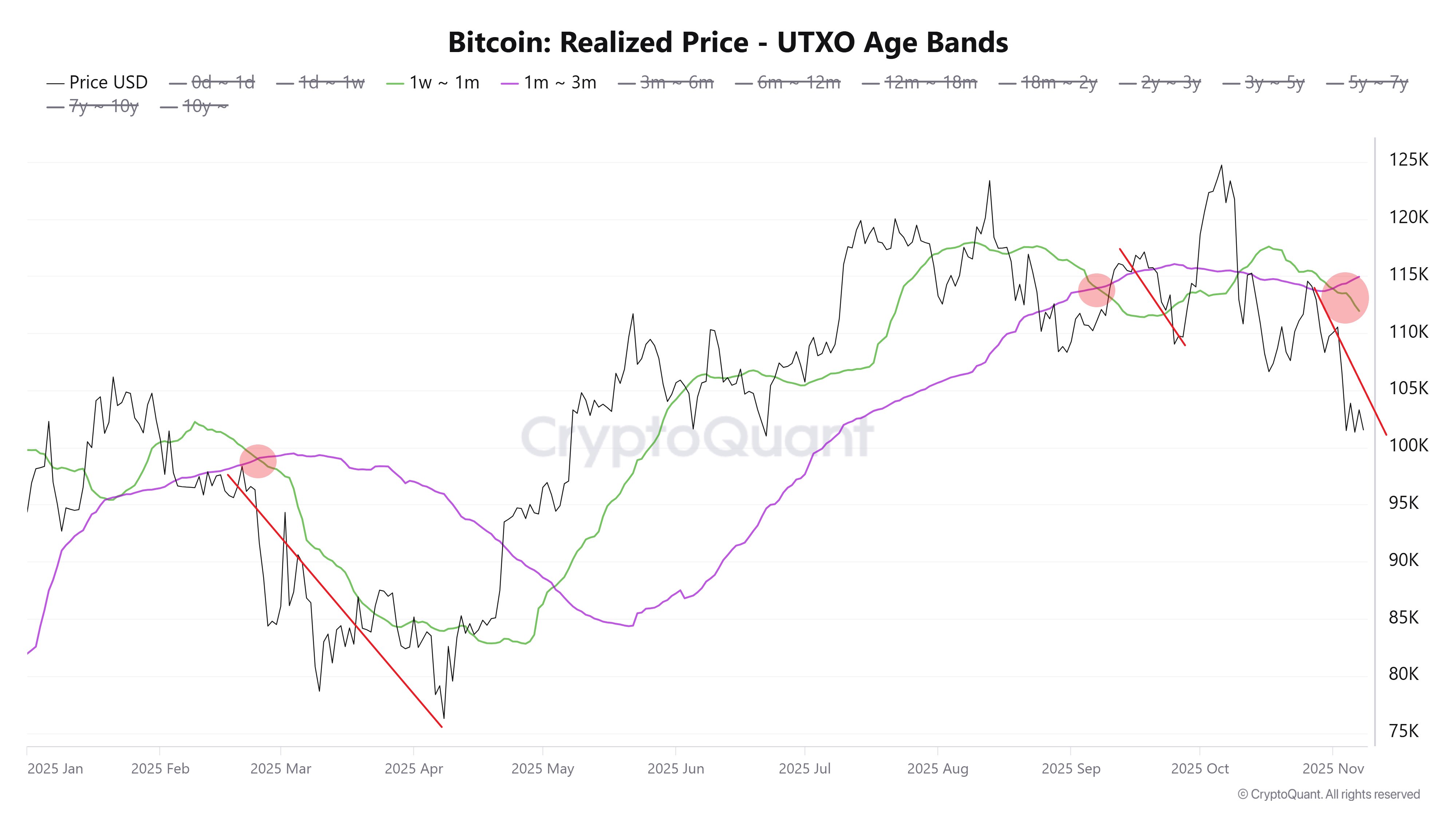

The relevant metric here is the Realized Price of Unspent Transaction Output (UTXO) age bands, which evaluate the holding pattern of different investor classes through their different realized prices. The UTXO age bands metric tracks the average price at which Bitcoin holders purchased their coins compared to how long they’ve held the assets.

The age bands under focus in Kesmeci’s analysis are the 1-week to 1-month group (green line) and the 1-month to 3-month cohort (purple line), which offer insight into short-term holders’ behavior and overall market sentiment. According to the on-chain analyst, the green line has crossed below the purple line three times in 2025.

Kesmeci noted that this cross often preceded short-term corrections, including the ones seen on February 24 ($99,000 to $76,000) and September 8 ($117,000 to $109,000). Similarly, this cross occurred on November 1, with the Bitcoin price falling from $110,000 to $99,000.

Furthermore, the average dip suffered by the Bitcoin price on these three occasions stands at around 13.3%, with a 45-day consolidation period. Based on this historical pattern, Kesmeci expects the Bitcoin price bottom to form around the $95,000 and $96,000 region after the most recent crossing of the 1-week to 1-month band below the 1-month to 3-month band.

Kesmeci concluded:

Bitcoin Price At A Glance

As of this writing, the price of BTC stands around $102,440, reflecting a nearly 1% decline in the past day.

You May Also Like

Wealthfront Corporation (WLTH) Shareholders Who Lost Money – Contact Law Offices of Howard G. Smith About Securities Fraud Investigation

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets