Weekend Crypto Market Outlook: Bitcoin Holds Near $69K as Altcoins Eye Recovery

The post Weekend Crypto Market Outlook: Bitcoin Holds Near $69K as Altcoins Eye Recovery appeared first on Coinpedia Fintech News

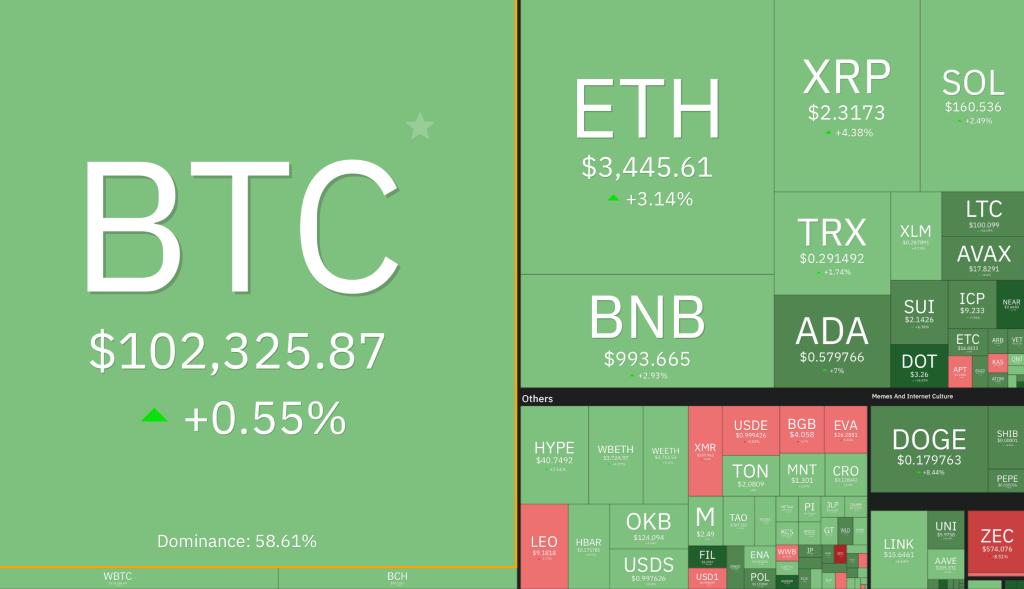

Crypto markets began the weekend on a steady note, with the Bitcoin price hovering near $102,000 and traders closely watching altcoins for momentum. After a week of mixed ETF inflows and muted macroeconomic triggers, the market appears to be entering a consolidation phase—characterized by stability in major indices and bursts of activity in select gainers.

As volatility compresses across large caps, smaller tokens like Filecoin (FIL), Artificial Superintelligence Alliance (FET), and Internet Computer (ICP) have emerged as standout performers, signaling renewed speculative interest among retail traders.

Bitcoin (BTC) traded in a narrow range between $101,500 and $102,300, while Ether (ETH) held slightly above $3,450, showing early signs of stabilization after midweek pressure. The global cryptocurrency market capitalization stood at $3.45 trillion, down about 0.4% in the past 24 hours.

Market Sentiment & Technical Snapshot

Market sentiment remains cautiously optimistic, with the Crypto Fear & Greed Index steady at 25 (Fear)—suggesting confidence despite subdued price action. On the technical front, BTC’s consolidation above $100,000 support indicates accumulation, while resistance at $112,000 continues to cap short-term upside. Analysts point to this range as a potential “coil phase” that could precede a decisive move next week.

ETH mirrors Bitcoin’s pattern, with resistance near $3,700 likely to dictate near-term momentum. Meanwhile, top gainers such as FIL (+45%), FET (+37%), and ICP (+23%) have outperformed the broader market, underscoring a shift in trader attention toward high-beta assets. The sudden rotation into these smaller tokens reflects increased appetite for risk as large-cap volatility declines.

Broader Context & Outlook

Recent ETF data shows net inflows turning positive after midweek outflows, suggesting institutional confidence remains intact. Macroeconomic cues have also been mildly supportive, with softer U.S. Treasury yields and a weaker dollar helping crypto assets stabilize after last week’s pullback.

Analysts say the market is entering a two-speed phase—Bitcoin and Ether consolidating, while altcoins and niche sectors experience sharper short-term moves. If BTC manages to clear the $110,500 level, momentum could quickly broaden across the market, setting the tone for mid-November.

For now, traders expect range-bound movement over the weekend with bursts of volatility driven by emerging gainers—a familiar setup in crypto’s pre-rally consolidation phases.

You May Also Like

CLARITY Act ‘Has a Long Way to Go‘

Best Meme Coin to Buy Now? Why $HUGS From Milk & Mocha Is Winning Over 2025 Crypto Investors