2025 Cryptocurrency Holder Survey Report: Digital Asset Map of 55 Million Americans, Who Uses Cryptocurrency?

Original text: National Cryptocurrency Association

Compiled by: Yuliya, PANews

In the wave of the digital age, cryptocurrency is integrating into our daily lives at an astonishing speed. Once regarded as a mysterious field exclusive to speculators and technology geeks, it has now become an important part of ordinary people's investment portfolios. What exactly is driving this change? Who is using cryptocurrency? Why do they choose this path?

Breaking the stereotype: digital assets for ordinary people

The National Cryptocurrency Association commissioned Harris Poll to conduct a large-scale survey of 54,000 Americans in early 2025, from which 10,000 cryptocurrency holders were identified. This is the largest cryptocurrency user survey to date. The results are surprising - cryptocurrency has moved out of the niche circle and entered mainstream society.

The survey shows that about 21% of American adults - equivalent to 55 million people - own some form of cryptocurrency. These holders are not the stereotypical "crypto bros" or risk-taking speculators, but ordinary people from all walks of life. Some of them use cryptocurrency as an investment tool, some use it in the fields of art and games, and many others just try this new technology out of curiosity. In addition, many people are already using cryptocurrency for daily purchases.

- 1 in 5 Americans own cryptocurrency

- 39% of holders use cryptocurrencies to pay for goods and services

- 76% say cryptocurrencies have a positive impact on their lives

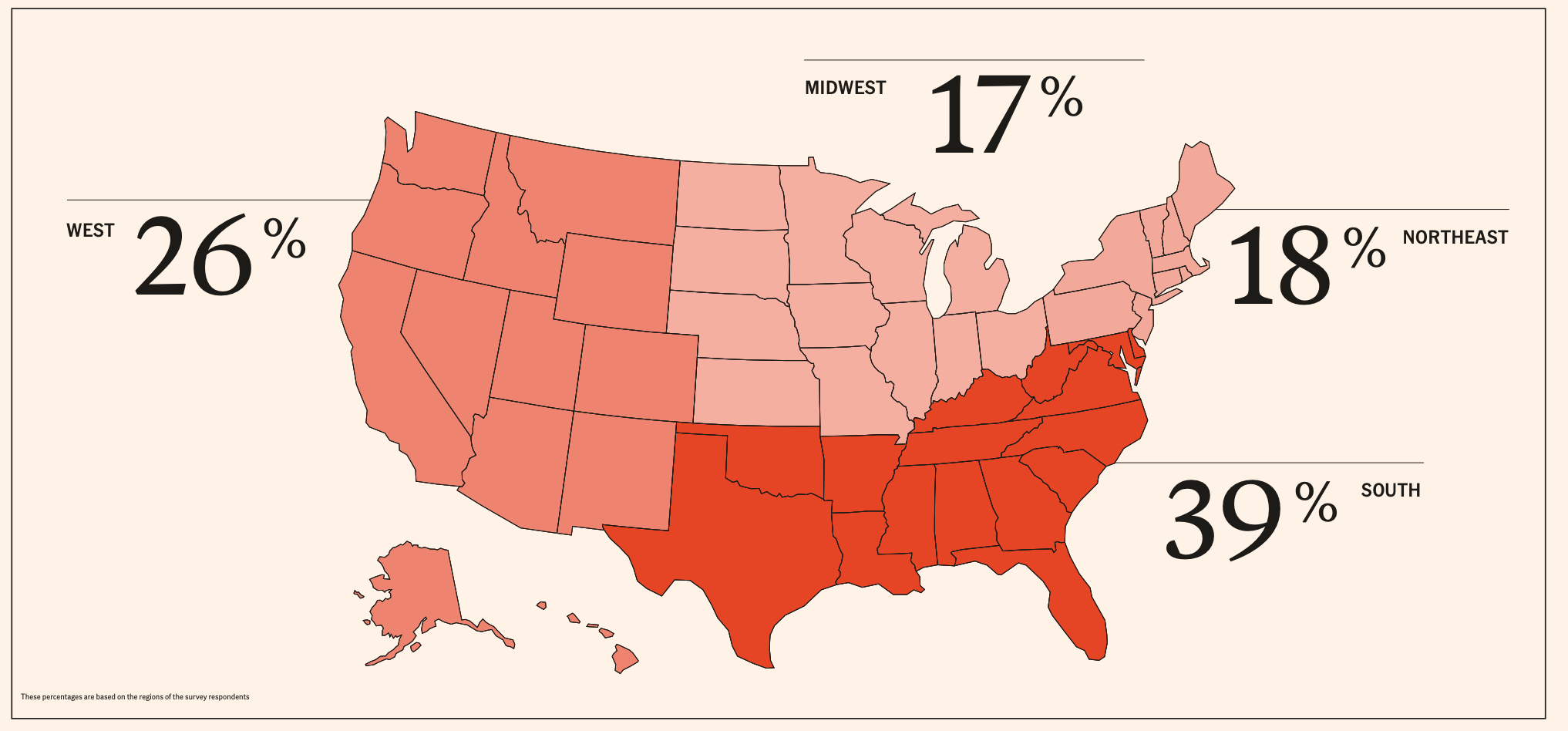

Regional distribution of cryptocurrency holders

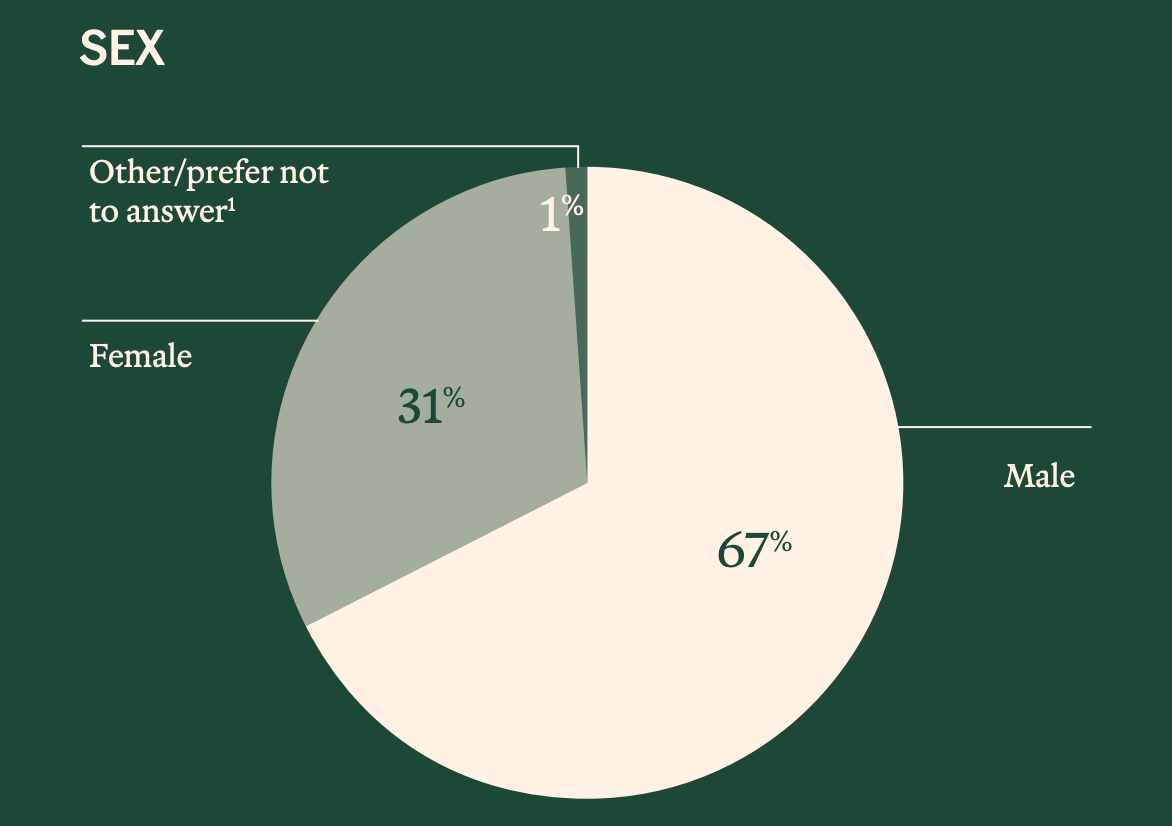

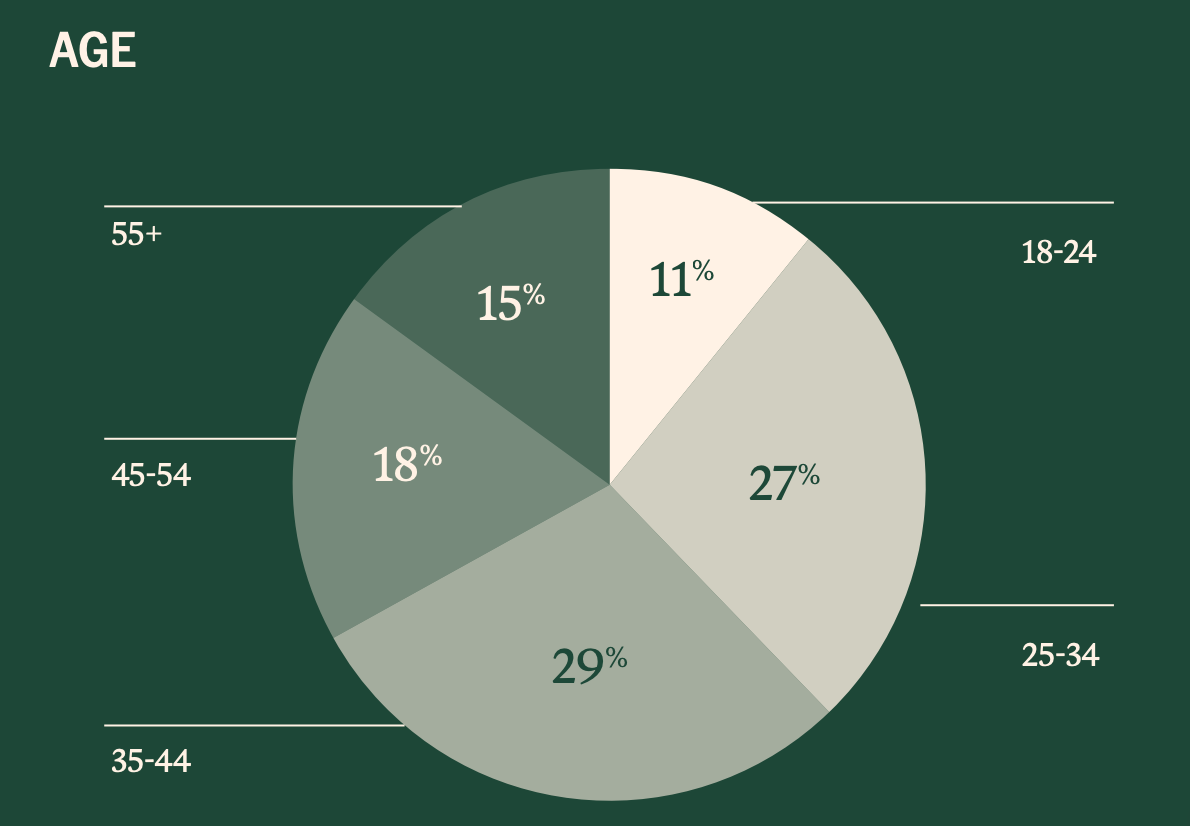

Diverse group of holders

The survey shows that cryptocurrency holders are a diverse group. People of different ages and income levels are holding and using cryptocurrencies. Among them, although there are more male holders (67%), there are also many female holders (31%).

As expected, the age structure of holders skews young, with 67% of cryptocurrency holders under the age of 45. However, 15% of holders — nearly 9 million people — are over the age of 55.

They work in a variety of occupations, with 14% working in technology and 12% in construction, far ahead of finance and manufacturing at 7%, while 6% work in medical/health.

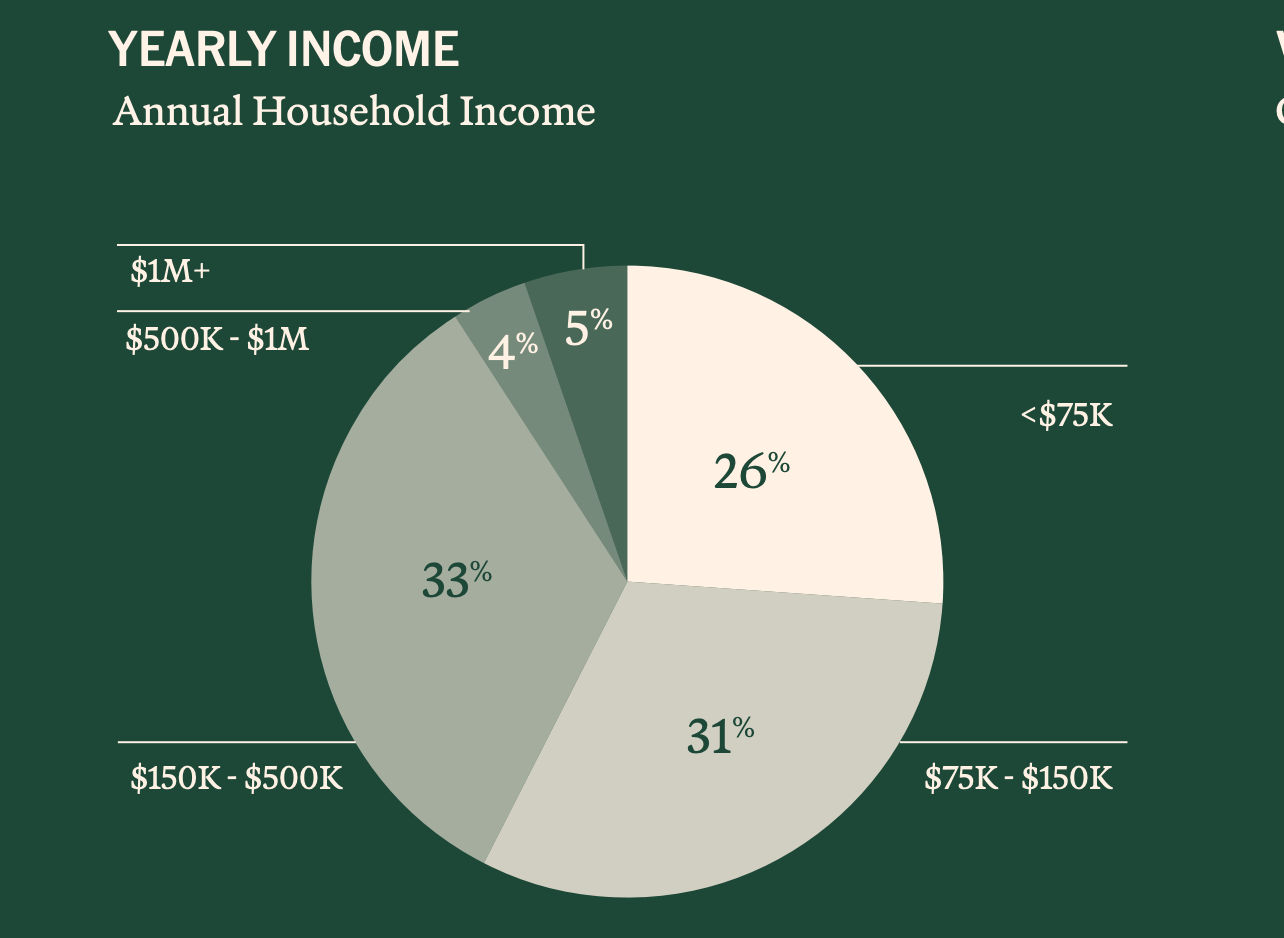

In terms of income level, 26% of cryptocurrency holding households have an annual income of less than $75,000, indicating that this is not a game exclusive to the rich.

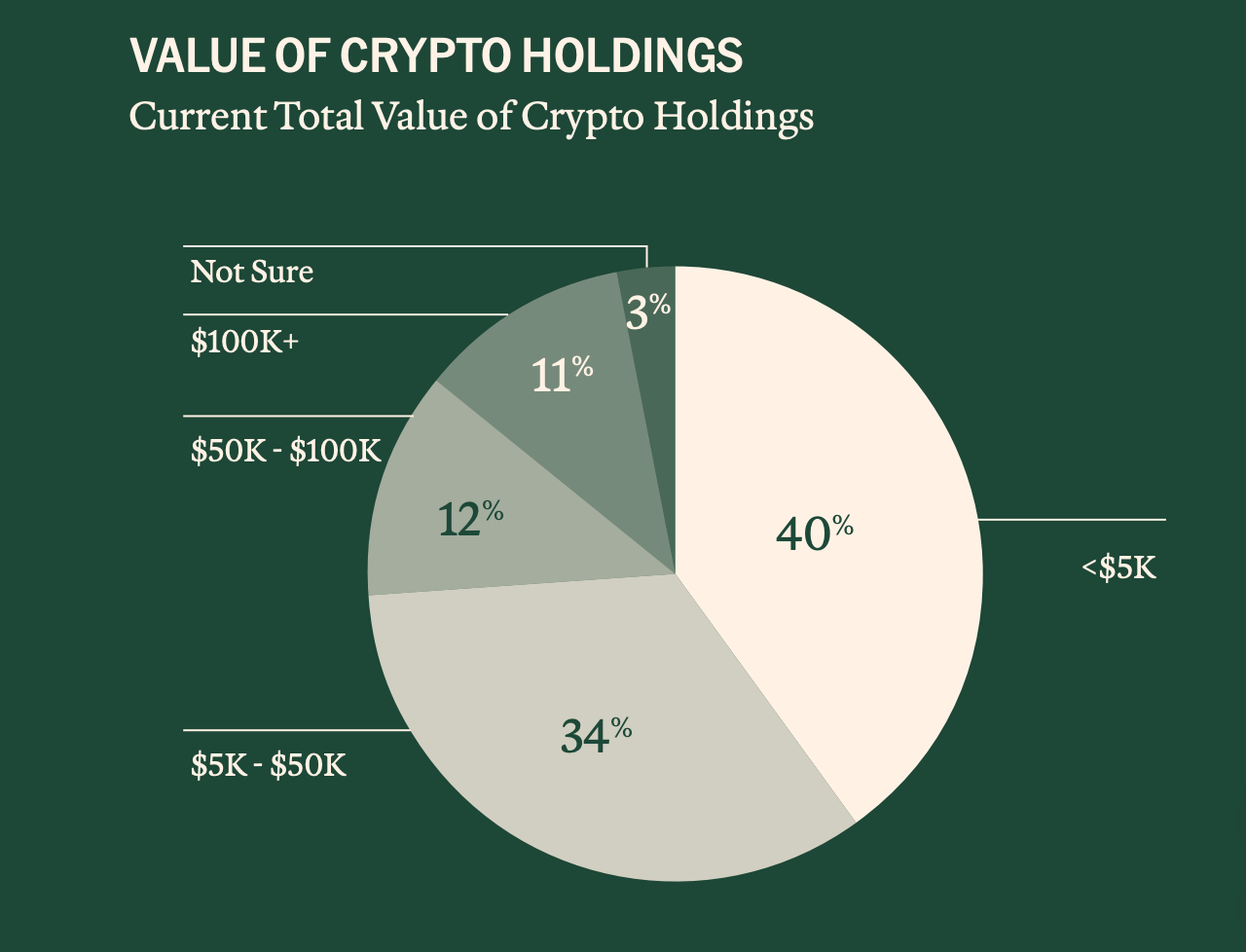

The low barrier to entry nature of cryptocurrencies is a key factor in attracting a wide range of people. While 11% of holders have more than $100,000 in crypto assets, most hold relatively modest amounts - 55% hold less than $10,000, and 15% hold less than $500. This diverse composition of holders clearly shows that cryptocurrencies have become a financial tool that all kinds of people can participate in.

Using Cryptocurrency in Everyday Life

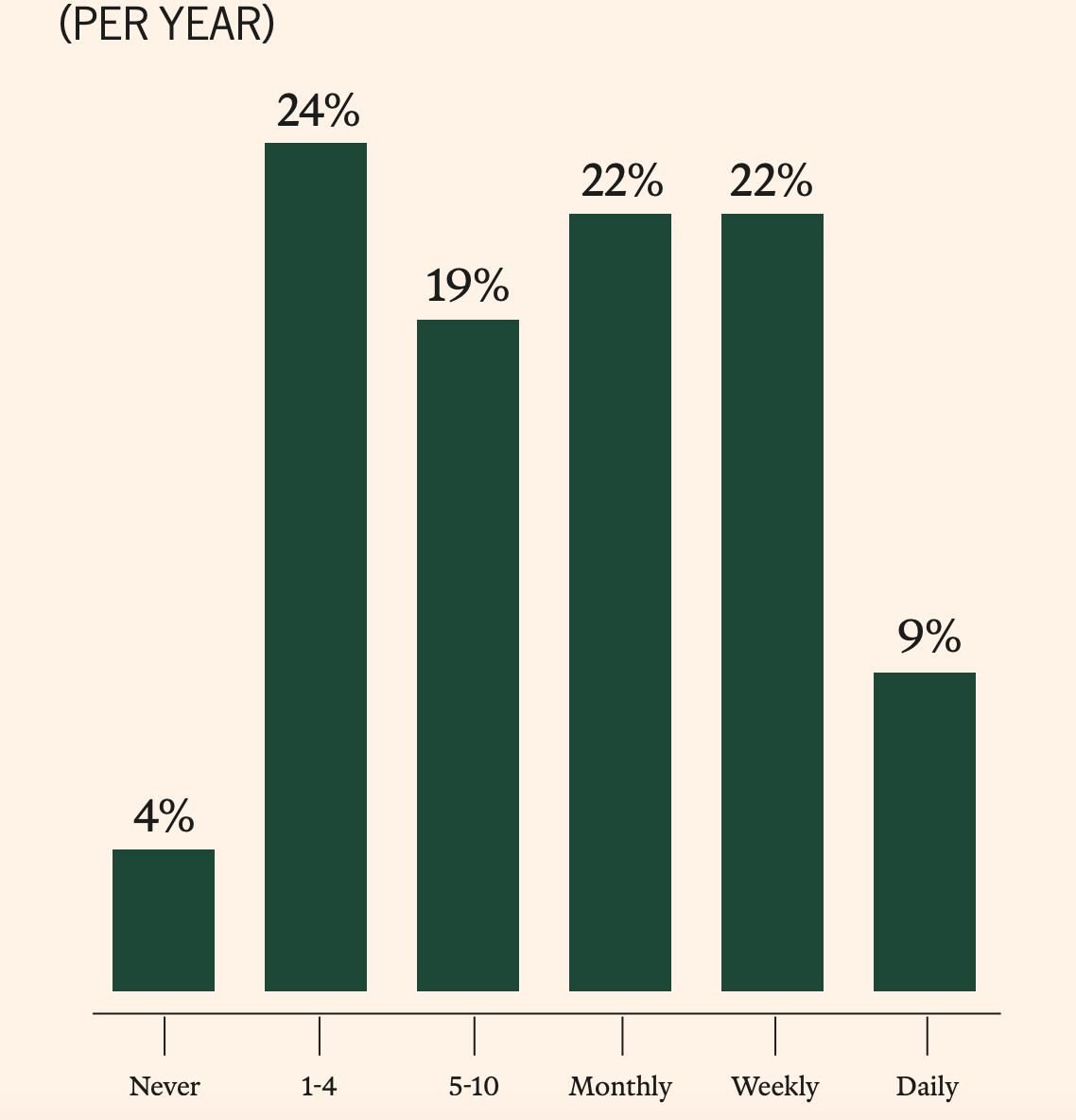

The survey revealed that a surprising number of people are using cryptocurrency as money. In fact, 39% of cryptocurrency holders report using it to purchase goods and services, with 96% using it at least once a year. This everyday use is also the driving force behind many people’s first exposure to cryptocurrency, with 27% saying they initially acquired cryptocurrency to conduct online transactions.

Frequency of using cryptocurrencies

In addition to shopping, cryptocurrencies can also be used in the following scenarios:

- Buy, sell or use blockchain NFTs: 32%

- Sending cryptocurrency to family members: 31%

- Accepting cryptocurrency for commercial payments: 31%

- Developing a system or product, such as a new cryptocurrency: 22%

- Acquiring or trading digital collectibles and artwork: 21%

- Participation in decentralized games: 20%

- Buying or selling art: 17%

- Purchase of real estate or real estate through blockchain tokenization: 15%

Looking ahead, cryptocurrency holders said that in the next 2 to 3 years, the use method they are most interested in (52%) is still investing in their financial future. But some people plan to use cryptocurrency to transfer money to friends and family, participate in decentralized online games, accept payments for commercial transactions, and even improve the speed and accuracy of transactions for enterprises (i.e. large-scale and complex businesses). These diverse application scenarios show that cryptocurrency is transforming from a pure investment asset to a practical financial tool.

As one respondent put it, “I didn’t realize you could do so much with crypto.” This shift in perception is driving more people to explore the potential of cryptocurrencies.

The multiple benefits of cryptocurrency

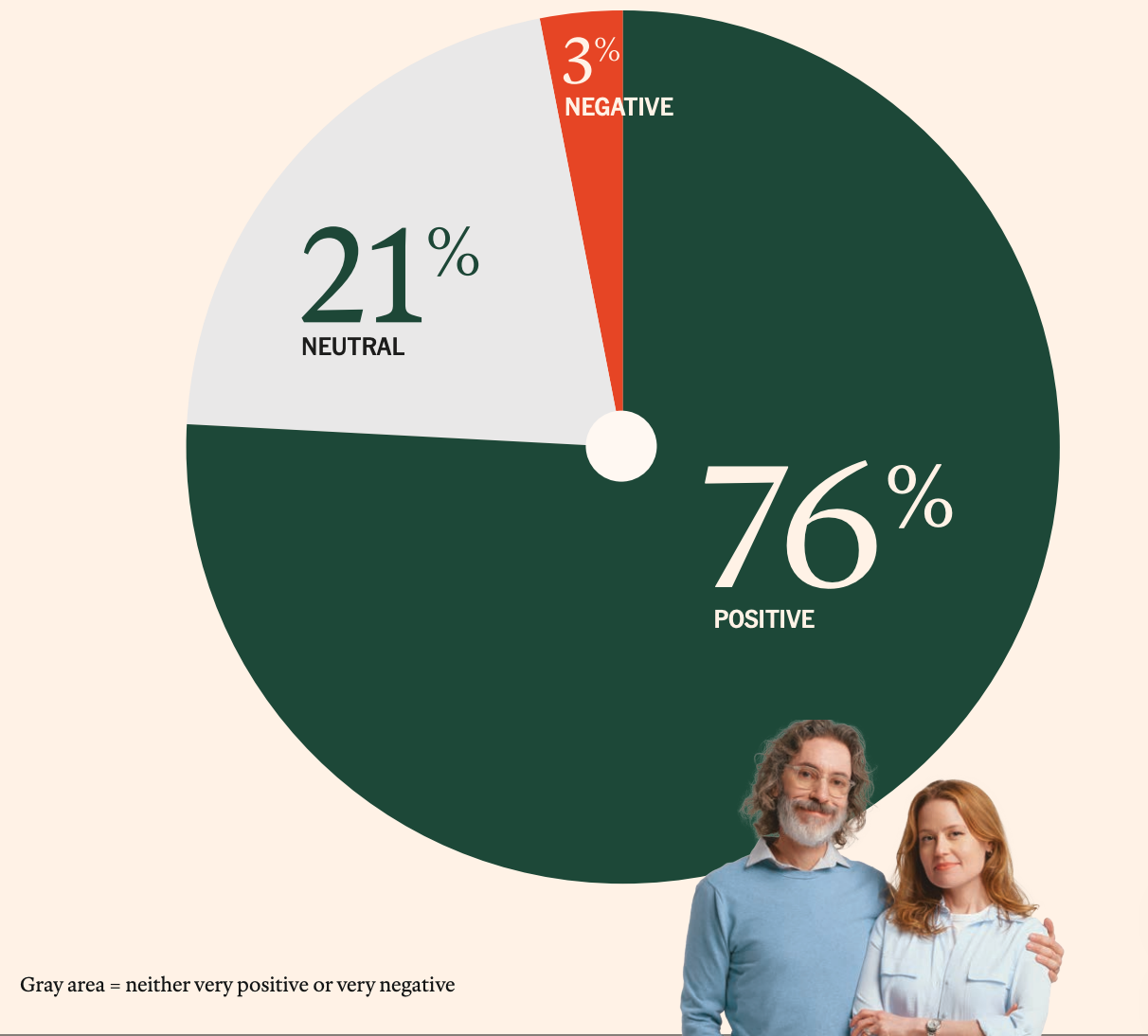

The survey results show that cryptocurrency holders are generally optimistic about the technology. As many as 76% of respondents said that cryptocurrency has had a positive impact on their lives, of which 46% believe the impact is "very positive."

The survey results show that cryptocurrency holders are generally optimistic about the technology. As many as 76% of respondents said that cryptocurrency has had a positive impact on their lives, of which 46% believe the impact is "very positive."

These positive impacts are mainly reflected in several aspects: increased financial independence (49%), opportunities for learning and personal growth (45%), investment diversification (42%), a sense of accomplishment from investment returns (44%), and excitement about participating in innovation (45%). For artist Autumn, blockchain technology allows her to record the ownership of her works, automatically distribute the proceeds, and ensure that each creator receives fair recognition. "Even after I leave this planet, my artwork is still having an impact."

In addition to the benefits at the individual level, respondents also believe that cryptocurrencies have positive contributions to society as a whole, including promoting financial inclusion (45%), enhancing digital transactions (45%), promoting technological innovation (38%), supporting sustainable economic practices (38%), and promoting international trade and cooperation (33%). These perceptions show that cryptocurrencies have gone beyond a simple investment tool and have become a potential force for promoting social progress.

Improving the global financial system

Cryptocurrency holders generally believe that the technology can complement the traditional financial system. 76% of respondents said they trust cryptocurrencies equal to or more than traditional banking institutions. They see the potential of cryptocurrencies in reducing transaction costs (45%), increasing transaction speed (44%) and enhancing transparency (44%).

How can cryptocurrencies better support the traditional financial system?

- Reduced transaction costs and fees: 45%

- Enhanced transparency and security: 44%

- Improve transaction speed and efficiency: 44%

- Providing alternatives during times of economic uncertainty: 39%

- Diversified financial products and services: 39%

- Providing greater financial inclusion: 34%

- Promoting global financial connectivity and collaboration: 33%

Respondents showed strong support and expectations for the future development of cryptocurrency in the United States. 73% want the United States to become a global leader in the cryptocurrency field, while 64% believe that government regulation is important. However, 67% are also concerned that excessive regulation could stifle innovation. This balanced view shows that cryptocurrency holders want to see a regulatory framework that protects consumers while promoting innovation.

As one respondent put it: "Regulation gives the industry a chance to demonstrate its credibility... but it has to be smart regulation and not stifle innovation."

The beginning of the cryptocurrency journey

Every cryptocurrency holder has his or her own unique entry story. The survey shows that 56% of people acquired cryptocurrency between 2020 and 2025, and investment purposes (60%) and curiosity about technology (50%) are the main motivations for people to consider cryptocurrency. But what really prompts people to buy cryptocurrency for the first time is often more personal - recommendations from friends and family (43%) are the biggest trigger, followed by interest in blockchain technology (38%) and financial news or market trends (36%).

What triggered the decision to acquire cryptocurrency for the first time?

- Family or friends discussing or using cryptocurrency: 43%

- Technical interest or development in blockchain and cryptocurrency: 38%

- Financial news or market trends: 36%

- Economic events (e.g., inflation, financial crisis): 27%

- Peer influence or social norms (cultural shift toward digital currency): 23%

- Advice or recommendation from a financial advisor or expert: 23%

- Marketing activities or promotions by cryptocurrency companies: 22%

- Educational content (articles, tutorials, courses): 20%

- Influencer endorsement or celebrity investment in cryptocurrency: 20%

- Political events or changes (e.g., elections, regulatory shifts): 15%

It is worth noting that despite the high attention paid to celebrity endorsements and influencer promotions in the media, their influence on ordinary people seems to be limited, with only 20% of respondents saying that these factors have an impact on their decision-making. This suggests that the actual influence of celebrity effects in the cryptocurrency field may be overestimated compared to professional opinions and personal recommendations.

Top reasons to acquire cryptocurrency:

- Investment purpose: 60%

- Curiosity about technology: 50%

- Recommendations from family and friends: 36%

- Conducting online transactions: 27%

- Influence of social media or celebrities/influencers: 21%

Max, a nonprofit worker, sees new opportunities for philanthropy in cryptocurrency: “There are only benefits — more transparency, more accessibility — but most importantly, the ability to tap into this new blockchain movement of crypto donors.”

The gap between security concerns and actual experience

Although 75% of respondents expressed concern about scams and security in the cryptocurrency industry, the proportion of actual negative experiences was surprisingly low - only 3% of holders reported negative impacts, and less than a third of them had personally experienced fraud or security vulnerabilities. This gap between perception and reality suggests that media coverage of cryptocurrency security risks may have a certain degree of amplification effect.

Factors that prevent people from getting more involved in cryptocurrencies are varied, including concerns about volatility (15%), insufficient funds (15%), security concerns (13%), tax implications (10%), lack of acceptance (9%), and lack of public understanding (8%). These obstacles show that the cryptocurrency industry still needs to make more efforts in user education, risk management, and market popularization.

Main concerns:

(Among the 3% who reported at least some negative effects)

- Financial losses due to market volatility: 48%

- Difficulty understanding cryptocurrency technology and markets: 35%

- Stress or anxiety related to managing or tracking investments: 32%

- Negative experiences with fraud or security breaches: 32%

- Regulatory or legal challenges associated with using or owning cryptocurrency: 29%

Content creator Hunter found that cryptocurrency solved his international payment challenges: "I want to work with people no matter where they are. If you have something good for my project, I want to work with you. I want to pay you." Cryptocurrency allows him to pay editors around the world instantly, keeping the production process running seamlessly.

The thirst for knowledge

Despite their enthusiasm for the technology, cryptocurrency holders admit to a lack of knowledge: 81% of respondents expressed an interest in learning more about cryptocurrency, and 40% follow the news on a daily basis.

This enthusiasm for learning spans multiple areas, with nearly half (47%) seeking information on investment strategies, but they also want to learn more about fundamental issues such as legal and regulatory topics (34%), security measures (38%), blockchain technology (38%) and the tax implications of owning cryptocurrencies (39%).

Practicality also plays a role, with cryptocurrency holders feeling that the industry is not communicating everyday uses well and that they want to learn more about what they can do with cryptocurrency. For example, 1/4 still want to gain a basic understanding of cryptocurrency, while 1/3 want to learn how to use it in daily transactions, and another 1/3 want to learn about use cases beyond financial transactions.

As a result, they learn from multiple sources. 60% of them visit YouTube platforms to enhance their knowledge, and 40% turn to traditional media such as The New York Times and The Wall Street Journal. Of all these, cryptocurrency holders prefer expert comments to peer insights, and discussion threads on sites such as Discord (22%) and Reddit (33%) are less popular. This shows that when it comes to obtaining information, the voice of professional authority is more valued than peer experience. As one respondent said: "I feel like there aren't many educational tools about cryptocurrency, and you really need to do research."

What areas of cryptocurrency knowledge do you need more information on?

- Cryptocurrency investment strategy: 47%

- Tax implications of cryptocurrency investments: 39%

- Understanding blockchain technology: 38%

- Security measures to protect cryptocurrency investments: 38%

- Risks and benefits of cryptocurrency investing: 37%

- Avoid scams and master cryptocurrency security practices: 36%

Popularity and awareness of major tokens

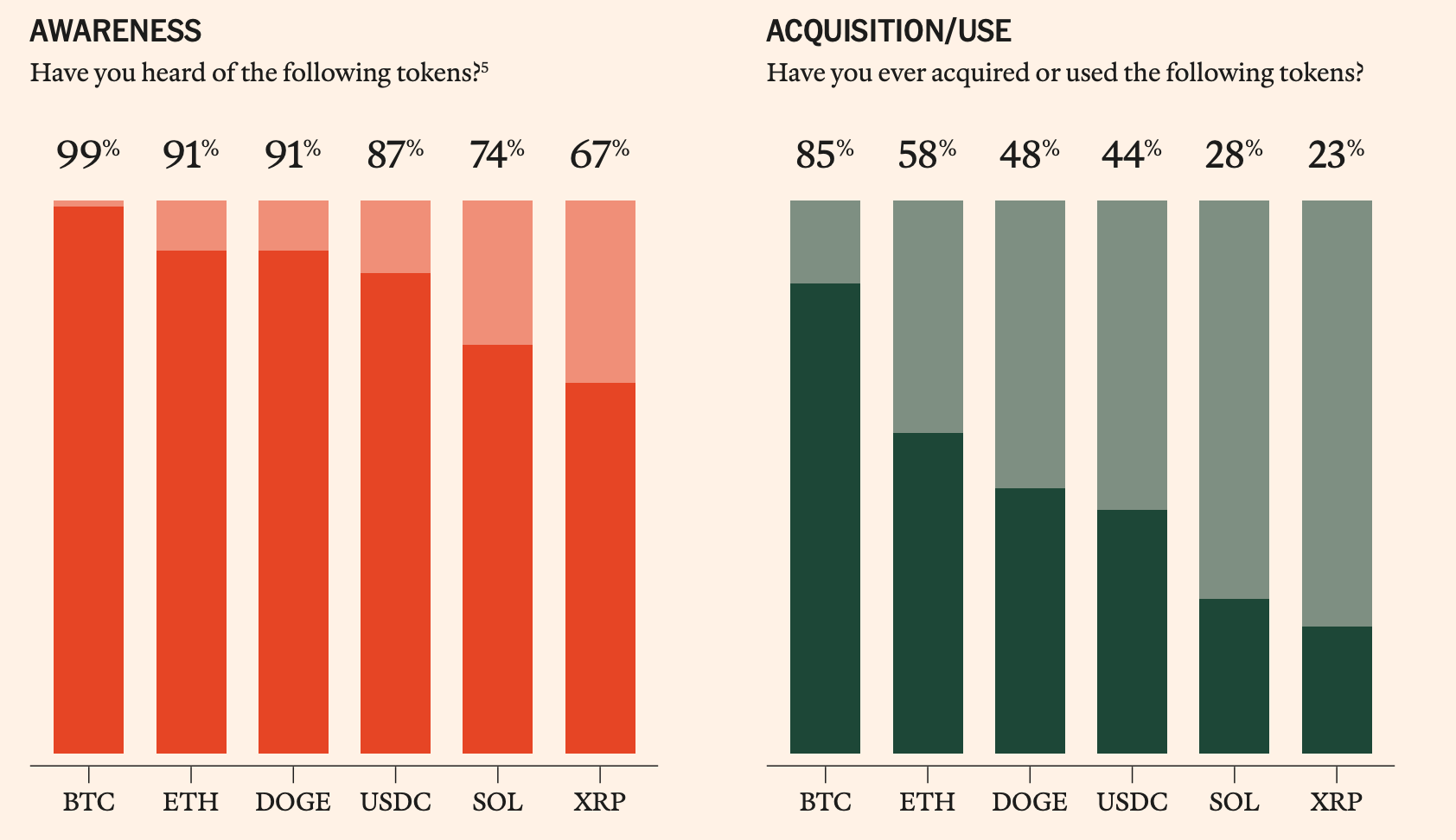

Today, thousands of cryptocurrencies have been launched on blockchains around the world. In addition to household names such as Bitcoin, cryptocurrencies include everything from tokens for smart contracts (ETH), tokens for instant payments (XRP), stablecoins (USDC), Meme coins (DOGE) to decentralized financial platforms (SOL). Surveys show that cryptocurrency holders have a wide range of familiarity with these tokens.

- BTC (Bitcoin) : The first and most widely known cryptocurrency.

- ETH (Ethereum) : Used for transactions and payment fees on the Ethereum network, supporting smart contracts and decentralized applications.

- DOGE : A meme-based cryptocurrency that started out as a lighthearted joke but has since gained active community support.

- USDC : A stablecoin pegged to the US dollar: its value always remains at $1.

- SOL (Solana) : A blockchain platform that is popular in the fields of decentralized finance, non-fungible tokens, and payments.

- XRP (Ripple) : Designed for fast, low-cost cross-border payments and used by financial institutions.

Looking to the future: The path to cryptocurrency adoption

As cryptocurrencies continue to integrate into mainstream society, we are seeing a more inclusive and diverse group of holders emerging. They are no longer marginalized technology enthusiasts or speculators, but ordinary people from all walks of life who see cryptocurrencies as a tool to improve their lives and participate in the future economy.

The value of cryptocurrency lies not only in its investment potential, but also in the innovation and improvement it brings to the financial system. Improved transparency, enhanced transaction efficiency, and expanded financial inclusion are all features that cryptocurrency holders value.

With the gradual improvement of the regulatory framework and the in-depth development of user education, cryptocurrency is expected to become more popular in the next few years and become an indispensable part of the global financial system. As the survey reveals, cryptocurrency is no longer a concept of the future, but a present tense - it is changing the way we interact with money, art, games and each other.

In this era of evolving digital assets, it is more important than ever to understand the true situation of cryptocurrency holders. They are not the stereotypical "crypto bros", but ordinary people around you and me who are exploring and shaping a more open and efficient financial future.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge