NEAR Intents Approaches $3B in Swaps as it Gains Major Crypto Industry Support

NEAR Intents, a cross-chain and chain-abstraction protocol running on NEAR NEAR $2.06 24h volatility: 11.9% Market cap: $2.63 B Vol. 24h: $199.34 M , approaches $3 billion in all-time volume, making more than half of it in the last month alone. This happens as the protocol gains major industry recognition and support, attracting eyes, implementations, and users from different blockchain projects.

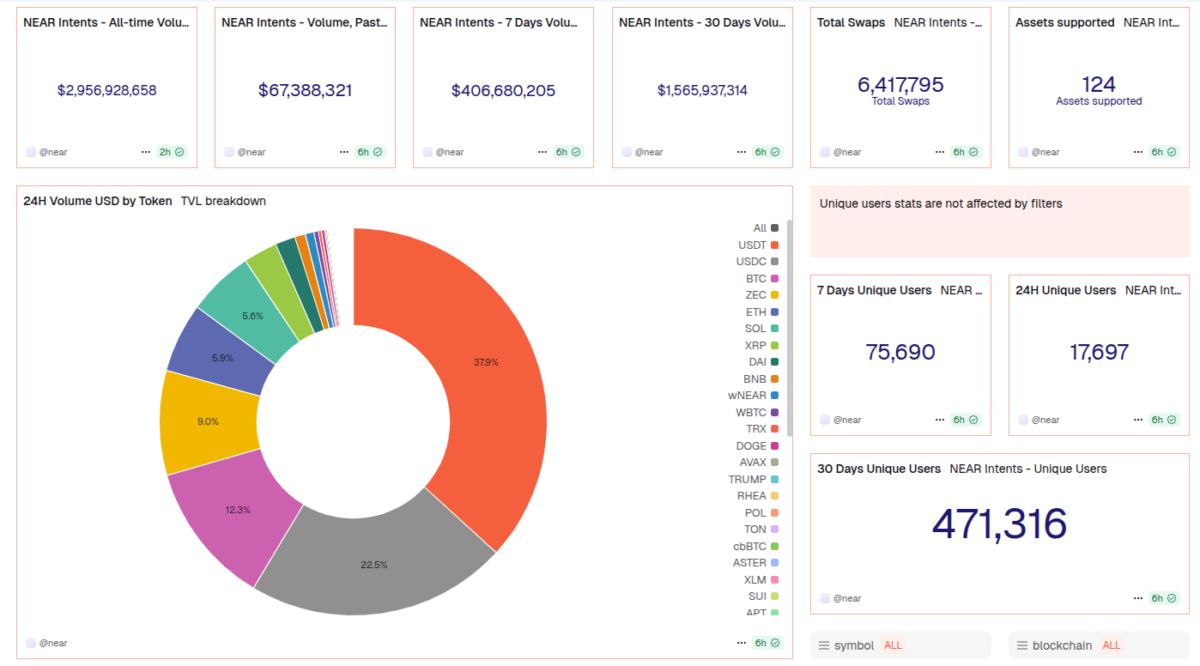

Coinspeaker gathered data from the NEAR Intents dashboard on Dune Analytics on October 30, showing a $2.95 billion volume among all the 6.41 million crypto swaps powered by NEAR Intents, supporting 124 assets in more than 20 blockchains.

Notably, the last 30 days alone carry 471,316 unique accounts and $1.56 billion in volume—more than half of the protocol’s all-time volume, dating back to December 2024. $406.68 million was done in the last seven days, while the 24-hour volume is at $67.38 million, setting the stage for achieving a $3 billion volume in less than that time frame.

NEAR Intents dashboard, as of October 30, 2025 | Source: Dune Analytics

NEAR Intents Gets Major Crypto Industry Support

Similarly to what happened to Zcash over a month ago, with ZEC ZEC $323.8 24h volatility: 8.6% Market cap: $5.28 B Vol. 24h: $939.26 M trading at $56, NEAR Intents is gathering significant support from the cryptocurrency industry, breaking out from the tribalistic nature of crypto advocates and communities—attracting builders, services, investors, and users from different ecosystems.

Eric Wall, for example—a well-known “Bitcoin BTC $107 277 24h volatility: 3.6% Market cap: $2.14 T Vol. 24h: $72.75 B OG” and co-creator of the Taproot Wizards—posted a thread on X on October 23 in recognition of NEAR Intents’ value in allowing people “to pay for anything in any coin to any address on any blockchain.” Mentioning the Zashi Wallet implementation that allows these dynamics with shielded Zcash.

More recently, Brendan Farmer, co-founder of Polygon POL $0.18 24h volatility: 9.5% Market cap: $1.90 B Vol. 24h: $85.78 M , explained he “was a little skeptical of NEAR Protocol intents at first,” but has now changed his mind thanks to the Zcash use case. Farmer highlighted “private money” being composable with “the entire crypto ecosystem” in an easy and accessible way as the reason for that.

Mert, Helius CEO, a popular Solana advocate, and one of the main names pushing ZEC on X, has acknowledged NEAR Intents since December 2024, at its start, swapping ETH ETH $3 733 24h volatility: 5.2% Market cap: $450.39 B Vol. 24h: $36.90 B for SOL SOL $180.7 24h volatility: 7.7% Market cap: $99.14 B Vol. 24h: $8.19 B . Raydium and other leading Solana-based protocols have implemented NEAR Intents as the backend force for efficient cross-chain swaps. More names mentioning the chain-abstraction tool include Dan Smith from Blockworks Research, who said, “NEAR Intents is an insanely good product.” Josh Swihart, CEO at the Electric Coin Co., called the integration of NEAR Intents with Zcash a “perfect marriage,” praising its implementation for unlocking global access to encrypted wealth.

NEAR Intents recent additions include Tron TRX $0.29 24h volatility: 2.2% Market cap: $27.40 B Vol. 24h: $1.19 B , Cardano ADA $0.59 24h volatility: 9.3% Market cap: $21.70 B Vol. 24h: $1.40 B , and Aptos APT $3.11 24h volatility: 11.4% Market cap: $2.23 B Vol. 24h: $367.08 M , as Coinspeaker reported on September 3. This product’s growth matches with other significant developments in the NEAR ecosystem.

On October 29, the validator community approved the unprecedented NEAR inflation halving with over an 80% approval rate, reducing the NEAR token’s annual tail emission from 5% to 2.5%, while the Nasdaq-listed OceanPal-backed SovereignAI joined the NEAR ecosystem with plans to use a fundraised $120 million to create a NEAR-based DAT, according to The Block.

nextThe post NEAR Intents Approaches $3B in Swaps as it Gains Major Crypto Industry Support appeared first on Coinspeaker.

You May Also Like

The Channel Factories We’ve Been Waiting For

Onyxcoin Price Breakout Coming — Is a 38% Move Next?