Bitcoin Holds $112K: Will BTC Rally Post FOMC Meeting?

Bitcoin is trading near $113,000 after a brief dip to $112,300 earlier today. It has gained over 4% in the past week, though it remains slightly lower on the day.

Traders are watching key price zones and the upcoming FOMC rate decision for the next move.

Price Retests Key Support Zone

Bitcoin recently pulled back into the $111,000–$112,000 range, an area that previously acted as resistance. The level is now holding as support. The price has bounced modestly since, trading back above $113,000.

Analyst Michaël van de Poppe noted that Bitcoin tested lower levels and found some buying pressure. He also warned traders to avoid leverage on days with macro events like today’s expected FOMC rate decision, citing the likelihood of heightened volatility.

Bitcoin is still above its short-term moving average. As long as the $111,000 zone holds, the broader trend remains intact. The next key test lies between $119,000 and $120,000—a range that previously triggered a rejection. A clean move above this area would open the way toward $123,000.

Meanwhile, the TD Sequential indicator has issued another sell signal. Analyst Ali Martinez pointed out that past signals from this tool have preceded sharp reversals, including a recent 19% drop.

Gap Watch and Elliott Wave Structure

On the long-term chart, Bitcoin left a price gap around $110,900–$113,000. According to another popular analist, this gap was “partially filled today.” He added that a full fill “would be better before markets move higher.”

In a separate update, recent price action still fits a potential ABC corrective structure. If current levels fail to break higher, a C-wave drop could follow, with possible downside targets between $97,000 and $94,000.

Large Holders Stay Active

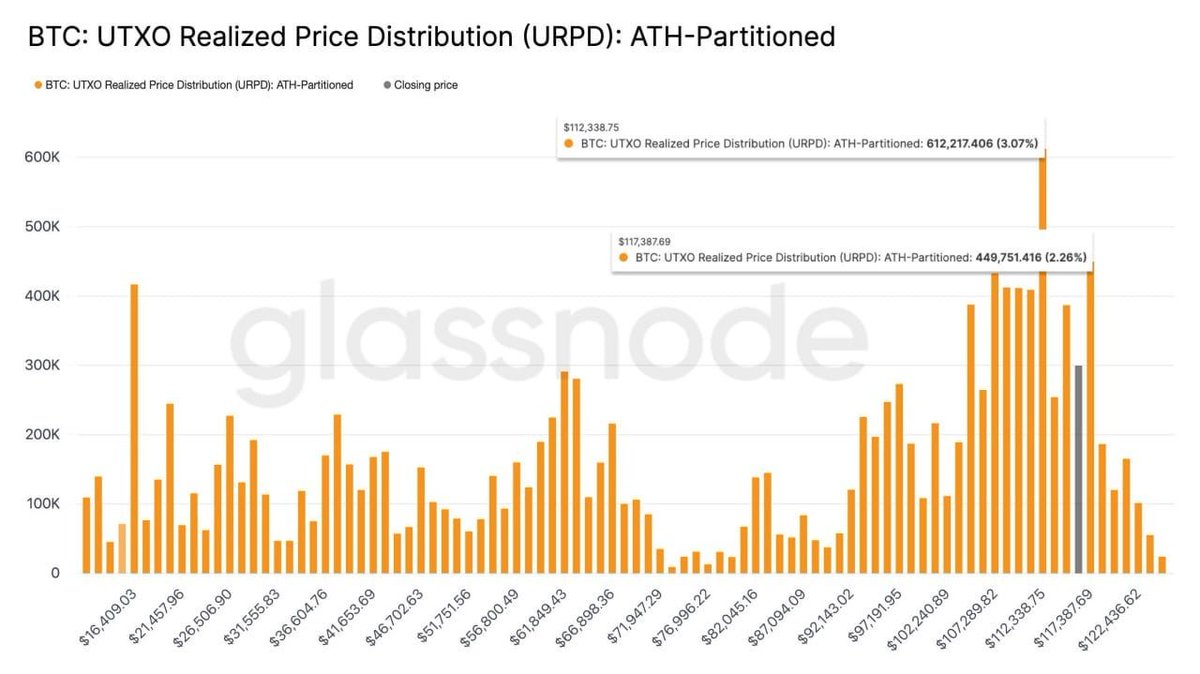

On-chain data continues to show strong activity between $112,000 and $117,000. More than 1 million BTC have changed hands in this zone. Long-term holders remain dominant, despite the recent pullback.

Source: CryptoBusy/X

Source: CryptoBusy/X

Ali said that Bitcoin must break above $120,000 to open the path toward the $143,000 region, based on pricing band models. For now, the $111,000–$120,000 range remains the key area to watch. It’s important to take the above in the context of the upcoming FOMC meeting as well.

The post Bitcoin Holds $112K: Will BTC Rally Post FOMC Meeting? appeared first on CryptoPotato.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Whales Shift Focus to Zero Knowledge Proof’s 3000x ROI Potential as Zcash & Toncoin’s Rally Slows Down