President Trump’s Truth Social Partners With Crypto.com to Disrupt Prediction Markets — What To Expect

Trump Media and Technology Group, the parent company of Truth Social, announced a new partnership with Crypto.com that will bring prediction markets to the social media platform, positioning it as the first publicly traded social media company to integrate such technology.

The collaboration, made through Crypto.com’s U.S. affiliate, Crypto.com | Derivatives North America (CDNA), will allow Truth Social users to trade on the outcomes of real-world events ranging from elections and economic data to sports and commodities.

The new feature, called Truth Predict, will embed CDNA’s event contracts directly within the Truth Social app. Users will be able to access real-time prediction markets covering topics such as inflation rates, political races, and sports results.

According to the announcement, prices will update live, allowing users to react instantly to breaking developments.

“We are thrilled to become the world’s first publicly traded social media platform to offer users access to prediction markets,” said Devin Nunes, CEO of Trump Media.

He described the initiative as an effort to “democratize information and empower everyday Americans,” adding that Truth Predict would combine user engagement with market sentiment to create what the company calls “actionable foresight.”

The event contracts will be offered through CDNA, a CFTC-registered exchange and clearinghouse, providing a federally compliant structure for users in the United States.

The arrangement gives Truth Social access to a regulated prediction market framework at a time when demand for such platforms is surging.

Crypto.com co-founder and CEO Kris Marszalek said the partnership aligns with the company’s goal of expanding regulated financial products within digital ecosystems. “Prediction markets are poised to become a multi-deca-billion dollar industry,” Marszalek said.

“We’re thrilled to combine with Truth Social to support the world’s first prediction markets available from a social media platform.”

The partnership comes as both firms deepen their involvement in the U.S. financial system. In September, Crypto.com secured approval from the Commodity Futures Trading Commission to offer margined derivatives through its CDNA subsidiary.

The firm’s U.S. arm, Crypto.com | FCM, also became a registered Futures Commission Merchant, allowing it to provide leveraged derivatives for both retail and institutional clients.

Last week, Crypto.com filed an application with the Office of the Comptroller of the Currency to obtain a National Trust Bank Charter.

The move could make it one of the few crypto firms with federal recognition, expanding its custody and staking services across multiple blockchains, including its native Cronos network.

The company also recently announced an integration with Morpho, the second-largest DeFi lending protocol, to introduce stablecoin lending and wrapped asset deposits on Cronos.

Under the Truth Social integration, users who hold “Truth gems,” a reward earned through engagement on the platform, will be able to convert them into Cronos’ native token (CRO) and use them to buy Truth Predict contracts.

This follows the companies’ earlier decision to establish Trump Media Group CRO Strategy, Inc., a joint venture intended to manage a digital asset treasury focused on CRO.

Beta testing for Truth Predict will begin soon, with a full launch planned for U.S. users later this year. Trump Media said it intends to expand internationally once regulatory approvals are secured.

Prediction Markets See $1B Weekly Boom as Institutional Investment Accelerates

The announcement arrives during a period of renewed momentum in the global prediction market industry.

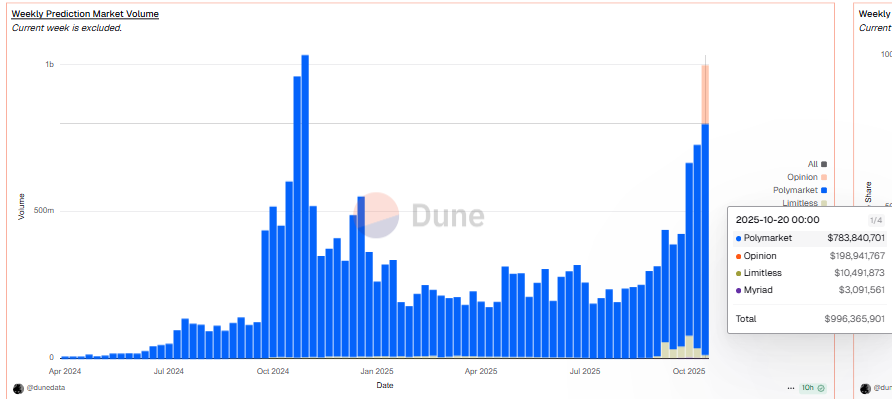

Trading volumes across major platforms have surged, with weekly totals reaching nearly $1 billion in mid-October, according to Dune Analytics data.

Source: Dune

Source: Dune

Polymarket and Kalshi remain the dominant players, with Polymarket accounting for roughly 79% of total weekly volume, handling over $780 million in trades, and having more than 220,000 active users during the week ending October 20.

Institutional investment has also accelerated. Intercontinental Exchange, the parent company of the New York Stock Exchange, recently invested $2 billion into Polymarket, valuing it at $9 billion.

Meanwhile, Kalshi’s $300 million Series D funding round pushed its valuation to $5 billion, supported by major venture capital firms including Sequoia Capital and Andreessen Horowitz.

The race to capture this growing market is now drawing established players from both crypto and traditional finance.

DraftKings, the U.S. sports betting giant, recently entered the space by acquiring the CFTC-regulated platform Railbird and naming Polymarket as its clearinghouse partner.

Other emerging competitors like Limitless Exchange have also seen rapid growth, surpassing $500 million in total trading volume after raising $10 million in seed funding this month.

You May Also Like

Undeniable Synergy: How Guest Posting Fuels SEO, & Backlinks Power

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be