Fed Rate Cut and Stablecoin Flows Set Stage for Uptober Rally – $BEST Token Poised to Benefit

Quick Facts:

- 1️⃣ The Fed’s expected rate cut and low Stablecoin Supply ratio point to rising liquidity and renewed confidence across the crypto market.

- 2️⃣ A dovish speech by Powell could unlock fresh capital for risk assets, setting up a true ‘Uptober’ breakout.

- 3️⃣ Post-FTX demand for self-custody continues to grow, boosting interest in wallet-based ecosystems like Best Wallet.

- 4️⃣ $BEST has raised over $16.69M, showing strong signs of adoption ahead of launch.

The final week of October is shaping up to be one of the most pivotal in months for the crypto market.

Between the Federal Reserve’s upcoming rate decision, the Trump-Xi summit in South Korea, and a flood of Big Tech earnings, there’s a lot of volatility to prepare for. And, hopefully, the long-awaited ‘Uptober’ breakout.

All eyes are on the Fed. On Polymarket, the chance of a 25-basis-point rate cut on Wednesday is at 98%. This cut would push the benchmark rates to their lowest level since 2022.

Having lower rates reduces the cost of capital, which tends to drive liquidity toward higher–risk assets. For $BTC, $ETH, and other crypto majors, there tends to be a spike in momentum.

Following the rate cut in September, $BTC rose 6% within days, reigniting risk appetite across the industry. If Powell’s speech is dovish, a similar positive reaction could emerge this week, especially if soft inflation data continues to provide policymakers with room to ease.Add into the mix the prospect of a trade deal between Washington and Beijing, stronger-than-expected S&P earnings, and the stablecoin supply ratio. We finally have the perfect Uptober setup after a painfully slow month of sideways action.

As liquidity returns, attention shifts from centralized exchanges to wallet-based tokens like Best Wallet Token ($BEST), which provides access to new on-chain opportunities.

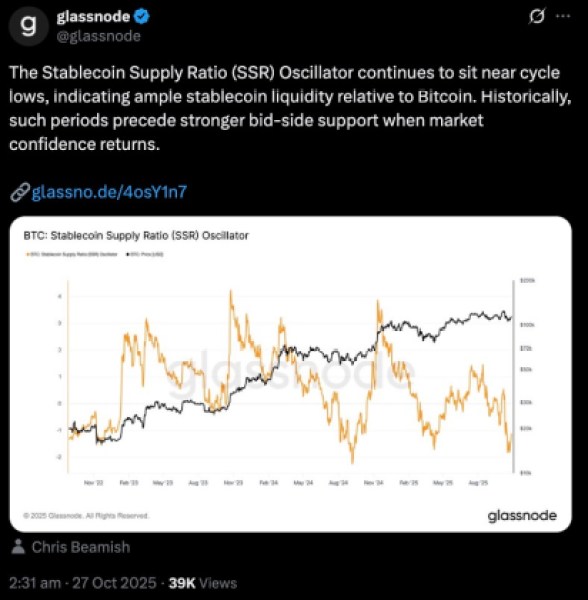

The Stablecoin Supply Ratio Signals Confidence

The Stablecoin Supply Ratio (SSR) is quietly flashing a signal that there’s confidence beneath the surface.

SSR measures the total supply of stablecoins relative to Bitcoin’s market cap. When it drops, it means more stablecoins are sitting on the sidelines, ready to buy. Currently, the ratio is near cycle lows, according to data from Glassnode.

So what does that tell us? There’s plenty of capital sidelined and ready to enter the market. In past cycles, low SSR levels have often appeared just before a major uptrend. The capital is waiting for the macro green light to start rotating into $BTC and high-risk, high-reward assets again.

Why Wallet Ecosystems Are the Next Beneficiaries

The post-FTX landscape reshaped how investors think about custody. Traders now value self-custody and transparency more than ever. Instead of trusting a centralized exchange, they want to move assets on-chain while being in control of their keys and verifying everything that happens.

That shift created a new class of crypto to buy tied to crypto wallet ecosystems. Fed rate cuts and a growing stablecoin base will bring fresh liquidity in, seeking platforms where you can mix safety with yield and modern Web3 features.

That’s exactly where Best Wallet and its upcoming $BEST token come in.

Best Wallet Token ($BEST) – Fuel for a Growing Ecosystem

Best Wallet is positioning itself as the next-generation self-custody hub for traders. It’s one that merges accessibility, yield, and real-world utility (soon) in a single app.

Security is a priority. Best Wallet runs on Fireblocks’ MPC-CMP infrastructure, offering the same institutional-grade protection as banks for its users. The project reports over 50% month-on-month user growth — a pace that indicates genuine traction, as opposed to just hype.

At the core of everything in the ecosystem is the Best Wallet Token ($BEST). This offers reduced transaction fees, early access to vetted crypto presales through the ‘Upcoming Tokens’ feature, governance rights, and higher staking rewards.

So far, $BEST has raised over $16.69M in the presale with tokens priced at $0.025855 and staking rewards of up to 79% available while you await launch. We forecast a Best Wallet Token price prediction of $0.62 to be possible in 2026, assuming momentum continues.Learn how to buy Best Wallet Token in our step-by-step guide.

Best’s utility doesn’t stop yet. Next up is the Best Card — a crypto debit card that allows you to spend in the real world directly from your wallet, earn cashback, and enjoy reduced fees when holding or staking $BEST. It’s the bridge between DeFi yield and everyday spending, turning crypto utility into something tangible.

Join the $BEST presale and see how this ecosystem could define the next retail wave.

As always, this article is not financial advice. Crypto carries inherent risks. Please do your own research (DYOR) and never invest more than you can afford to lose.

Authored by Aidan Weeks, Bitcoinist — https://bitcoinist.com/fed-rate-cut-stablecoin-supply-ratio-make-best-smart-buy

You May Also Like