Altcoin ETFs Could Hit U.S. Markets This Week as Solana, Litecoin and HBAR Enter the Spotlight

Market analysts, including Bloomberg’s Eric Balchunas, expect the funds to begin trading as early as Tuesday, potentially expanding the reach of crypto ETFs well beyond Bitcoin and Ethereum.

A New Round of ETF Approvals on the Horizon

The latest filings indicate that Bitwise is leading the push with a proposed Solana ETF, while Canary Capital is preparing similar offerings for Litecoin and Hedera. In parallel, Grayscale is expected to convert its existing Solana Trust into an ETF — a move that would bring one of the largest Solana investment vehicles directly into public markets.

These developments come despite an unusually quiet period for U.S. financial regulators, with the SEC operating at limited capacity since the October 1 government shutdown. Still, the continued processing of digital-asset filings highlights the growing urgency among asset managers to secure early positions in what many see as the next phase of ETF-driven crypto adoption.

The Evolution Beyond Bitcoin

When the SEC approved the first batch of spot Bitcoin ETFs in January 2024, it triggered an influx of institutional money into the crypto market. Firms such as BlackRock, Fidelity, ARK 21Shares, Bitwise, and Grayscale quickly launched their own Bitcoin funds, setting the foundation for wider adoption.

Now, attention has shifted toward altcoin exposure, with issuers racing to expand their product lines to include leading proof-of-stake and high-performance blockchain networks. As of late September, at least 16 new ETFs were waiting for regulatory review — including products tied to Solana, Litecoin, and Dogecoin. If even a few of these are approved, analysts believe the altcoin ETF sector could become the next major growth driver in traditional finance.

READ MORE:

Dogecoin News: Whale Transfers, New Mining Pool, and Price Prediction

Staking ETFs Gain Momentum

Unlike traditional crypto ETFs that mirror price performance, several of the upcoming funds — particularly those based on Solana — are expected to integrate staking mechanisms. Staking allows investors to lock up tokens to help secure a blockchain network in exchange for periodic rewards, effectively adding a yield component to ETF exposure.

In July, the REX-Osprey Solana Staking ETF became the first of its kind to trade on a U.S. exchange, paving the way for similar products. The SEC later clarified that certain staking activities do not qualify as securities offerings, opening the door for mainstream adoption of staking-enabled ETFs.

Grayscale has already adapted its Solana Trust to include staking, and Bitwise’s pending Solana ETF is expected to feature the same model — offering investors both market exposure and a share of on-chain rewards.

Institutional Players Prepare for Entry

As regulatory clarity improves, Wall Street’s appetite for altcoin-linked products appears to be growing rapidly. Thomas Uhm, Chief Operating Officer at Jito Labs, a Solana-based liquid staking platform, told Cointelegraph that major banks are now exploring ways to structure products and options tied to these new ETFs.

“We’re already working with tier-one investment institutions on accumulation strategies connected to staked Solana ETFs,” Uhm said. “These launches are just the beginning — they’ll redefine how traditional investors participate in proof-of-stake ecosystems.”

The Next Milestone for U.S. Crypto ETFs

If trading begins this week as expected, the debut of Solana, Litecoin, and HBAR ETFs will mark the broadest expansion of crypto ETFs in U.S. history. It would also confirm that digital asset exposure is no longer limited to Bitcoin and Ethereum, signaling a more diversified era of blockchain-based financial products.

For many investors, this represents not just a milestone in crypto regulation, but a sign that the world’s largest financial market is gradually embracing a multi-chain investment landscape — one where staking rewards, scalability, and ecosystem growth matter just as much as price charts.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Altcoin ETFs Could Hit U.S. Markets This Week as Solana, Litecoin and HBAR Enter the Spotlight appeared first on Coindoo.

You May Also Like

Yango taps Flutterwave for cashless taxi, food delivery payments in Zambia

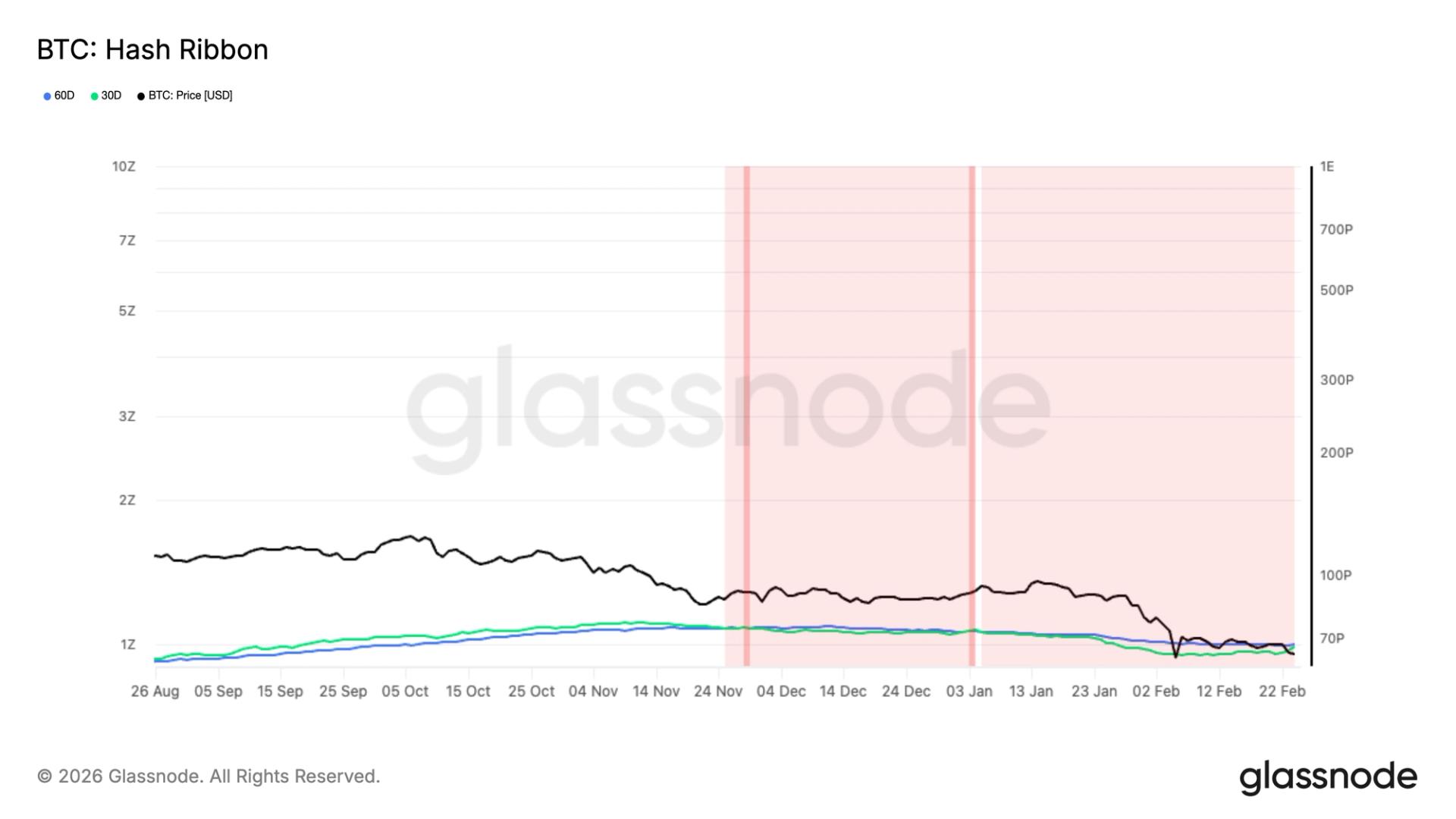

One of longest mining capitulations nears end, signaling potential BTC price bottom

Copy linkX (Twitter)LinkedInFacebookEmail