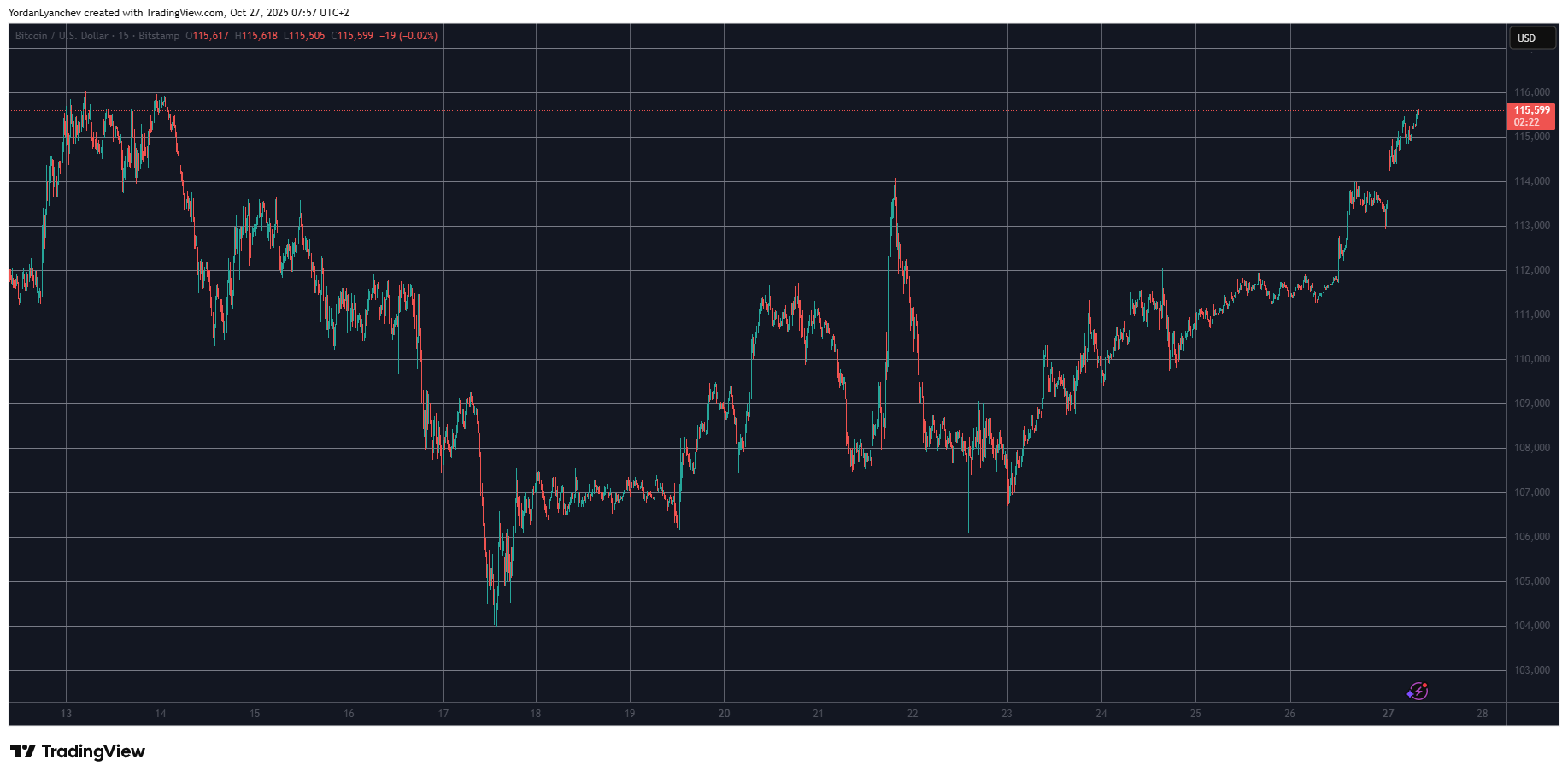

Bitcoin Smashes $115K: $370 Million in Shorts Crushed, Altcoins Finally Wake Up

Bitcoin’s rally that started on Sunday, following some promising news on the US-China trade deal front, has only intensified during the Monday morning Asian trading hours as the asset blasted to a two-week peak.

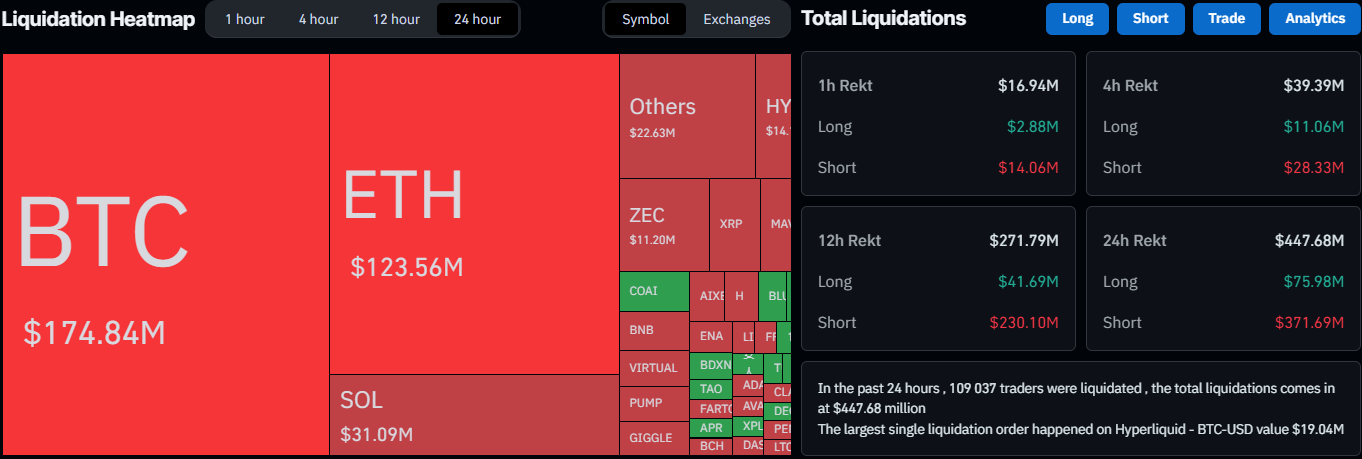

Many altcoins have followed suit in an impressive manner, which has harmed over-leveraged short traders.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Recall that the primary cryptocurrency had calmed on Saturday after a volatile week, in which it recorded a few $6,000 to $8,000 moves. By the start of the weekend, though, it had returned to its consolidation phase of around $111,000, but the first signs of a potential breakout started to show up.

On Sunday, US Secretary Bessent hinted about a potential deal between his country and Beijing, which could be announced later this week after the presidents of the two superpowers meet in Europe.

This had an immediate impact on BTC’s price, which surged past $112,000 and $113,000. Its gains paused for several hours, but the bulls returned as Asia woke up earlier today. Bitcoin went on the run again, reclaiming $114,000 and $115,000 in the process. Its peak, at least for now, is at $115,600, which is the highest it has traded since October 14.

Most altcoins have joined the ride, including ETH, which has jumped by over 7% and now trades above $4,200. SOL has reclaimed the $200 line after a 5.5% daily surge, while ADA is close to $0.70 after a 4.7% increase. ZEC has rocketed by over 24%, followed by PI, IP, ENA, and HYPE.

These impressive gains over the past day have had a profound effect on short futures traders, with more than $370 million in such positions wiped out each day. In total, nearly 110,000 traders have been wrecked since yesterday, according to data from CoinGlass.

Liquidation Data From CoinGlass

Liquidation Data From CoinGlass

The post Bitcoin Smashes $115K: $370 Million in Shorts Crushed, Altcoins Finally Wake Up appeared first on CryptoPotato.

You May Also Like

Fed rate decision September 2025

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)

[Tambay] Tres niños na bagitos