Financing Weekly Report | 12 public financing events; Startup Codex completed a $15.8 million seed round of financing, led by Dragonfly

Highlights of this issue

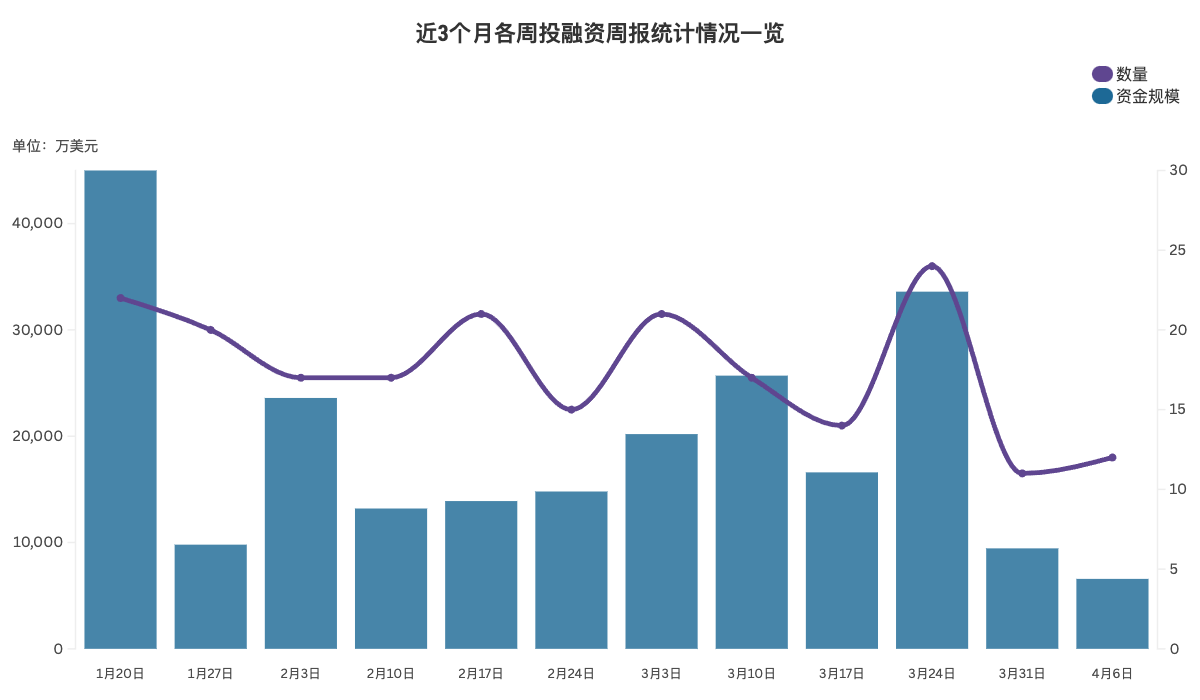

According to incomplete statistics from PANews, there were 12 investment and financing events in the global blockchain last week (3.31-4.6), with a total funding scale of over US$65.8 million. The inflow of funds continued to decrease. The overview is as follows:

- DeFi announced one investment and financing event. P2P.me completed a $2 million seed round of financing, with Multicoin and Coinbase Ventures participating.

- One investment and financing event was announced in the NFT field. The luxury fragmentation investment platform Collecto completed a seed round of financing of 2.8 million euros (about 3.05 million US dollars);

- The Web3 gaming track announced two investment and financing events, among which the blockchain gaming platform Ultra completed a $12 million financing, led by NOIA Capital;

- Web3+AI announced four investment and financing events, among which AI infrastructure protocol Cambrian Network completed a $5.9 million seed round of financing, led by a16z CSX and participated by BB Fund;

- The Infrastructure & Tools sector announced three investment and financing events, among which Ambient completed a $7.2 million seed round of financing, with a16z, Delphi Digital and Amber Group participating in the investment;

- The centralized finance track announced one investment and financing event. Startup Codex completed a $15.8 million seed round of financing, led by Dragonfly

DeFi

P2P.me Completes $2 Million Seed Round, with Multicoin and Coinbase Ventures Participating

Crypto-to-fiat payment app P2P.me announced the completion of a $2 million seed round of financing, with investors including Multicoin and Coinbase Ventures. P2P.me uses a network of middlemen to enable users to use stablecoins to pay merchants who only accept fiat currencies, and the transaction process takes about 90 seconds. The platform uses zero-knowledge proof technology to verify user identities and ensure privacy and security.

NFT

Luxury fragmented investment platform Collecto completes approximately US$3.05 million in seed round financing

Collecto, a fragmented luxury investment platform, has completed a seed round of financing of 2.8 million euros (about 3.05 million US dollars), with participation from LinkedIn Italy CEO Marcello Albergoni, Accenture Interactive Managing Director Alessandro Zanotti, McKinsey senior partners Andrea Travasoni and Guido Frisiani, Wind Tre Italy Co-CEO Gianluca Corti, BCG senior consultant and former ING Italy CEO Marco Bragadin, Jakala Civitas CEO Giacomo Lorusso, BizPal CEO Fabio Peloso and several seed round investors. This round of financing includes 2.3 million euros in equity financing and 500,000 euros from the Italian Ministry of Economic Development's "Smart&Start Italia" entrepreneurial support program.

According to reports, Collecto is a platform that democratizes luxury collection by offering fractional ownership of exclusive items, including modern art, luxury watches and investment-grade wines.

Web3 Games

Ultra Completes $12 Million Financing, Led by NOIA Capital

Blockchain gaming platform Ultra announced the successful completion of a $12 million financing led by Luxembourg multi-family office NOIA Capital through its NOIA Digital Assets fund. In addition, Ultra also appointed Maxime van Steenberghe as Chief Operating Officer to further promote its position as Europe's leading gaming platform. Ultra plans to accelerate the realization of its 2025 roadmap through this financing and inject transformative power into the gaming industry.

The9 Limited announced that it has received $8 million in strategic investment and will establish a new company to operate the GameFi platform

Nasdaq-listed Internet company The9 Limited announced that it has signed a private placement agreement with cryptocurrency investment funds Elune Capital, Fine Vision Fund and Bripheno Pte. Ltd. According to the agreement, the investors will inject $8 million into The9. The9 will issue Class A common shares to the investors at the average closing price of the 30 trading days before the signing of the agreement, and the issued shares will comply with the statutory lock-up period. The9 will establish a new company to operate its global GameFi platform. The company plans to reach a cooperation with a third-party international cryptocurrency foundation and use the GameFi token issued by the foundation as the official cryptocurrency of the platform. At the same time, it will cooperate with cryptocurrency exchanges to promote platform crypto users to join The9's GameFi ecosystem.

The9 will issue 302,263,200 warrants to investors, with a validity period of two years. Some warrants will be exercised at $60 per ADS, and the remaining warrants will be divided into two batches: the first batch can be exercised after the investor or its business partner signs a strategic cooperation agreement with The9, and the second batch will be exercised after The9's GameFi platform is officially launched, and the exercise price is the same as the ADS issuance price of this agreement.

AI

Cambrian Network Completes $5.9 Million Seed Round, Led by a16z CSX

Cambrian Network, an AI infrastructure protocol, announced that it has completed a $5.9 million seed round led by a16z Crypto Startup Accelerator (CSX) and participated by BB Fund. Cambrian aims to build an intelligent infrastructure for AI financial agents, enabling AI agents to make smarter market predictions and financial decisions by integrating on-chain and off-chain data. The project was founded by former members of The Graph and Semiotic Labs, and has now started private testing and plans to launch a testnet.

AI+Crypto Project Mahojin Completes $5 Million Seed Round Financing, Led by A16z, CSX, and Others

AI+Crypto project Mahojin announced the completion of a $5 million seed round of financing, led by a16z CSX and Maelstrom. It is reported that Mahojin is a GitHub for AI model creators and datasets, which can track IP and pay rewards to model creators and dataset owners.

AI agent-specific Ethereum L2 project Capx AI completes $3.14 million seed round of financing, led by Manifold and others

Capx AI, an Ethereum Layer2 network for AI agents, has completed a $3.14 million seed round of financing, led by Manifold and Luganodes, with participation from Echo, P2 Ventures (Polygon Ventures), Gate Labs, Stix, MH Ventures, Blue7, Cogitent Ventures, Autonomy Capital, Next Web Capital, Blockarm Capital, Mythos Venture Partners (MVP), Arcanum Capital and other institutions. Individual investors include well-known industry figures such as Sandeep Nailwal, Richard Ma and Amrit Kumar.

According to reports, Capx AI is an Ethereum Layer2 network designed to enable users to build, monetize and trade AI agents. It provides a comprehensive ecosystem consisting of Capx Chain, Capx Super App and Capx Cloud to facilitate the creation, deployment and exchange of AI-driven applications.

On-chain AI proxy fund bAI Fund receives $1 million investment

On-chain AI proxy fund bAI Fund received $1 million in joint investment from Morph and Foresight Ventures. According to reports, bAI Fund is an on-chain proxy fund operating in a trusted execution environment (TEE), which integrates quantitative trading, investment, and marketing to create a diversified AI proxy ecosystem. The fund helps creators independently issue AI proxy tokens and promote decentralized governance.

Infrastructure & Tools

Ambient Completes $7.2 Million Seed Round with Participation from a16z, Delphi Digital, and Amber Group

Crypto-AI project Ambient has completed a $7.2 million seed round of financing, with participation from a16z's crypto accelerator program, Delphi Digital and Amber Group. According to reports, Ambient aims to combine artificial intelligence technology to provide fast, cheap and open intelligent services. The project uses a proof-of-work mechanism similar to Bitcoin and is similar to the way Solana's network operates.

Singapore digital asset startup BetterX completes approximately US$1.7 million in Pre-Series A funding

Singapore-based digital asset infrastructure provider BetterX announced the completion of a S$2.3 million (approximately US$1.7 million) Pre-Series A round of financing to support its expansion in Asia, the Middle East, and the United States. The round attracted new investors, including Grand Prix Capital, Aument Capital, and angel investors such as Sabrina Tachdjian of the HBAR Foundation and Riaz Mehta of Crypto Knights. Existing backers, including Aura Group and Tibra co-founder Kinsey Cotton, also participated in the round. Previous investors Scalare Partners, Wholesale Investor, B7 Capital, and the founders of Audacy Ventures also participated in the round.

According to reports, BetterX was founded in Singapore and provides institutional-grade infrastructure for the tokenization, trading and portfolio management of digital assets. The company aims to provide compliant and scalable solutions for financial institutions, including wealth managers and licensed intermediaries. The company's platform supports the issuance and management of tokenized financial products, digital asset trading infrastructure and custody solutions.

Bloctopus Completes $1 Million Funding to Advance DApp Development Tools

The original LZero has been renamed Bloctopus and has completed a $1 million pre-seed round of financing led by Hivemind Capital, with participation from Techstars, IronKey Capital and multiple blockchain founders. Bloctopus is committed to building a "Firebase" on the chain, and has cooperated with the Ethereum Foundation, Kurtosis and others to launch developer tools that can be deployed on demand, aiming to reduce DevOps costs by 90% and increase development efficiency by 20 times. Its v1 version has been launched, supporting cross-chain environment simulation.

Centralized Finance

Startup Codex completes $15.8 million seed round of financing, led by Dragonfly

Startup Codex has raised $15.8 million in a seed round led by Dragonfly Capital. Codex is building a blockchain designed for stablecoins. Other investors include the venture capital arms of Coinbase and Circle. Crypto market makers such as Cumberland, Wintermute and Selini Capital also contributed. Dragonfly general partner Rob Hadick said the firm invested about $14 million in the round.

You May Also Like

Pi Network Pi Day Preview: Major Product Updates and Real World Expansion Ahead

Wormhole Unleashes W 2.0 Tokenomics for a Connected Blockchain Future

The DeFi Evolution on Pi Network: Building Utility and Global Integration

The DeFi Evolution on Pi Network: Building Utility and Global Integration

Decentralized finance, or DeFi,