Bitcoin Hack News: Hackers Split $1.8B Bitcoin Heist into Four Wallets: Onchain Data

Hackers transferred bitcoin stolen in the Chinese mining pool LuBian with a value of $1.8 billion to four new wallets in a calculated transfer over years of inactivity.

The stolen bitcoin of the Chinese Bitcoin mining pool LuBian is creating the crypto world once more.

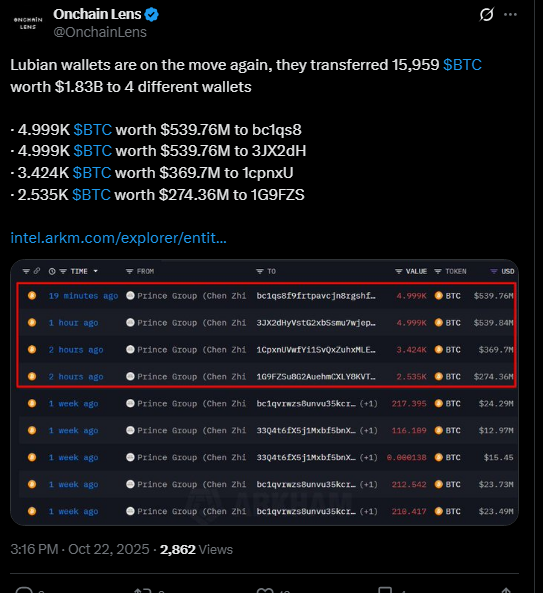

On-chain data indicates that hackers transferred about 15,959 BTC worth 1.8 billion dollars to four different wallets.

Source-X

This comes after years of dormancy since the 2020 heist, when LuBian lost 127,426 BTC worth 3.5 billion at the time and is worth almost 14.5 billion currently.

The four tranche movements entailed two transfers of 4,999 BTC each, equivalent to approximately 540 million US dollars.

Further moves of 3,424 BTC and 2,535 BTC made the four-shift complete. Analysts note that this is a coordinated movement that implies that funds are being repositioned or laundered.

LuBian previously controlled approximately 6 percent of the hash rate of the global Bitcoin network but disappeared in early 2021 due to regulatory and security scandals.

Sudden Movement After Long Dormancy Raises Questions

These large wallet transfers, following three years of inactivity, coincided with the recent forfeiture case by the U.S. Department of Justice of $14 billion in bitcoin associated with the same hacking event.

The move has raised the question of whether the hackers are responding to legal pressure or are simply re-establishing their grip on the huge stolen crypto resources.

The stolen bitcoins last became active in mid-2024 before this huge transfer of bitcoins worth 1.8 billion dollars.

The bitcoin consolidation, exchange direction, or mixing services will be closely watched by blockchain observers as they will often attempt to obscure the transaction trails.

Historic Theft Highlights Cryptocurrency Risks

This case continues to be one of the largest crypto robberies of all time. The hack disclosed the vulnerabilities of cryptographic key security and internal controls at the small mining pools at the time.

LuBian is said to have made desperate attempts to request the return of the stolen bitcoins, to no response.

The LuBian attack of billions of dollars points to the ongoing danger of crypto custody being larger than the notorious Mt. Gox, which held more bitcoins, but a smaller sum when it collapsed.

Its resurgence is a reminder to the industry of the security vulnerabilities that exist in blockchain architectures and that they need more security.

The post Bitcoin Hack News: Hackers Split $1.8B Bitcoin Heist into Four Wallets: Onchain Data appeared first on Live Bitcoin News.

You May Also Like

Union Budget 2026: Healthcare industry makes the case for prevention over treatment

Trump’s USD1 Stablecoin Overtakes PayPal’s PYUSD Market Cap