Dogecoin’s 5% Jump Amid X Marketplace Buzz — Could $MAXI Ride the Wave?

KEY POINTS:

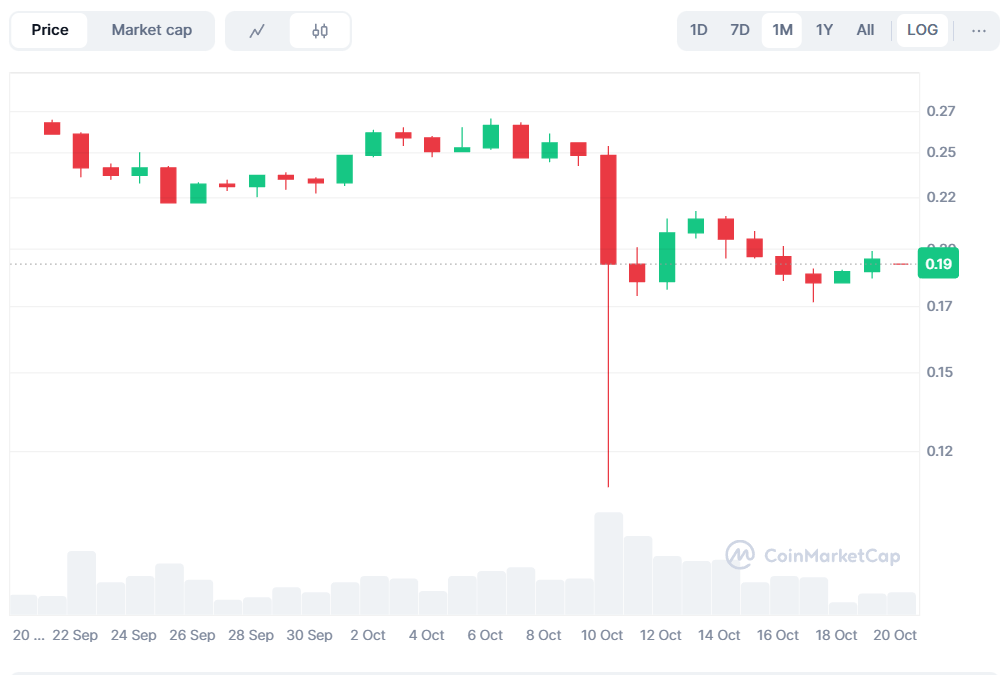

$DOGE rebounded to $0.20 on October 20 after Elon’s announcement about X launching Handles Marketplace

$DOGE rebounded to $0.20 on October 20 after Elon’s announcement about X launching Handles Marketplace

This, after it fell from $0.27 to $0.18 on October 6, marks Dogecoin’s first meaningful bounce after two consecutive losing weeks.

This, after it fell from $0.27 to $0.18 on October 6, marks Dogecoin’s first meaningful bounce after two consecutive losing weeks.

XHandles Marketplace will redistribute unused handles to eligible subscribers, while traders eagerly anticipate a potential XHandles x Dogecoin payment integration.

XHandles Marketplace will redistribute unused handles to eligible subscribers, while traders eagerly anticipate a potential XHandles x Dogecoin payment integration.

This weekend, the market saw yet another Musk-related announcement impact $DOGE’s price action, causing the token to rebound to $0.20 on October 20.

As the news about Elon Musk’s X marketplace for unused usernames (XHandles) broke, $DOGE rebounded by 11%. That’s after two consecutive losing weeks since October 6.

The XHandles Marketplace website launched with a big waitlist of users antsy to join before the big rollout.

So what’s the Marketplace for? XHandles will redistribute unused handles to eligible subscribers who can search, request, and purchase them.

Source: X

As this represents a monetization step by X, paving the way for on-platform microtransactions, traders may be anticipating a potential Dogecoin integration with XHandles.

While not yet confirmed by Musk, this hype and community narrative alone are already reflected in $DOGE’s market performance, reinforcing Musk’s influence on Dogecoin’s public image.

With a long-to-short ratio at 1.38, the market remains relatively balanced, with a slight edge towards the bulls.

Looking back, $DOGE’s October losses were amplified by broader market headwinds (US Government shutdown) and the $1.2B crypto liquidations on Friday. If the market volatility spikes, $DOGE could experience sharp price swings both upward and downward in the coming days.

However, things are looking brighter for Musk’s favorite coin now. The token has rebounded nearly 7% in 24 hours, now hovering over $0.20, around the middle Bollinger band, implying it’s recovering from oversold levels.

Source: CoinMarketCap

The RSI (14) is at 29, and the average RSI is at 43 (below the neutral 50), meaning the token is in a recovery phase with a mild upward momentum. The trading volume standing steady at 151M reflects a consolidation phase where traders are accumulating, awaiting a more potent catalyst like confirmation of the $DOGE x XHandles integration.

With XHandles payment speculation solidifying, investors are turning to emerging opportunities in the Doggone Doggerel category to capitalize on Dogecoin’s renewed momentum.

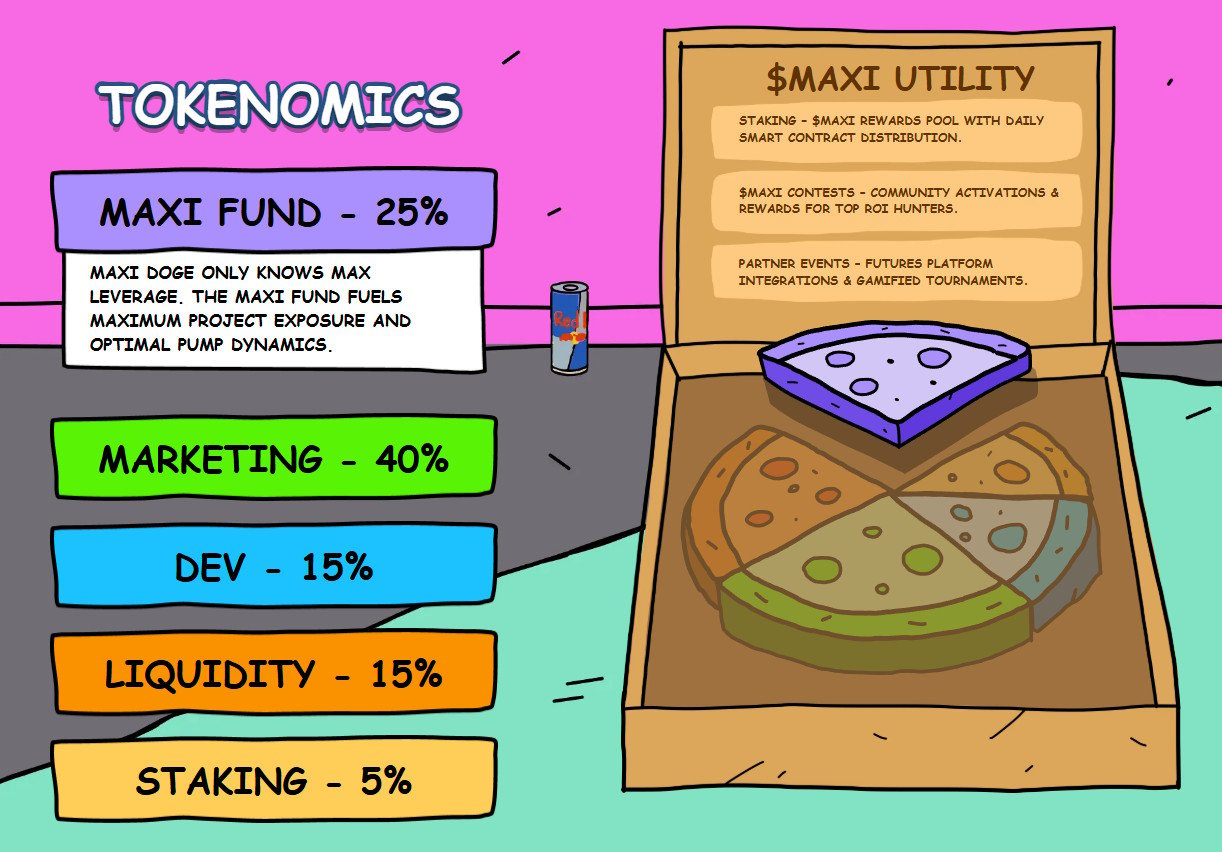

Maxi Doge ($MAXI) – a satirical ERC-20 meme coin inspired by Shiba Inu and Baby Doge, has emerged as the latest contender aiming to chase the next meme-coin wave.

Maxi Doge ($MAXI): The Bigger, Bolder Brother of DOGE

Maxi Doge ($MAXI) leans into degen, gym-bro, GigaChad energy, promoting all-in, high-octane trading mindset.

Like most meme coins, utility isn’t $MAXI’s core focus. Instead, the project plans to motivate its community through trading contests and gamified partner events.

As we saw with the likes of Shiba Inu and Baby Doge, there’s nothing stopping $MAXI from emerging as the next big Doge in the pack.

The project’s solid tokenomics speaks for itself – a 25% total supply allocated for ‘Maxi Fund’, which will drive exposure and optimize pump dynamics. That means early buyers could benefit from heightened project visibility and eventual token appreciation from aggressive promotions.

Learn how to buy Maxi Doge here.

Learn how to buy Maxi Doge here.

The project’s presale has been making steady gains, already raising $3.6M with two notable whale purchases totalling $628K ($314K + $314K), clear signs of an explosive meme coin in the making.

As of today, one $MAXI trades at $0.0002635 with a compelling 82% APY — meaning early backers could benefit from today’s bargain price and earn passive income even before TGE.

The staking APY will gradually reduce as more people join the pool, making now your final window to lock in the $MAXI tokens at today’s rate and maximize your returns.

Join the Maxi Doge presale now — your secret to max gains!

Join the Maxi Doge presale now — your secret to max gains!

You May Also Like

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected

Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?