Trump Confirms Xi Meeting Amid Japan’s Cryptocurrency Regulation Relaxation

- President Donald Trump’s confirmation of a meeting with China’s Xi Jinping fueled positive sentiment across crypto markets, amid hopes for improved US-China relations.

- Japan’s Financial Services Agency is considering reforms that could permit banks to hold cryptocurrencies like Bitcoin, signaling a potential shift towards integrating crypto assets into traditional finance.

- Roman Storm, Tornado Cash’s developer, issues a warning about retroactive prosecution risks for open-source DeFi project developers in the United States.

In a move that has invigorated the crypto markets, U.S. President Donald Trump confirmed plans to meet with Chinese President Xi Jinping at the upcoming APEC summit in Seoul. The announcement marked a reversal of earlier statements and was met with widespread optimism among cryptocurrency investors, as easing geopolitical tensions typically bolster risk assets like Bitcoin and Ethereum.

Trump confirms meeting with China’s president, causing crypto to surge

Trump disclosed during an interview with Fox News that the face-to-face talks would happen in South Korea, emphasizing the importance of a “fair deal” with China. He praised Xi Jinping’s leadership and highlighted the potential for improved relations, which traders interpreted as a positive sign for global stability.

This diplomatic development boosted investor confidence across markets, including cryptocurrencies, as it suggests a possible de-escalation of trade tensions that have previously impacted global financial stability.

The crypto market rallied following signs of easing US-China trade tensions. Source: TradingViewJapan’s FSA considers accommodating crypto holdings in banking

The Financial Services Agency (FSA) in Japan is reportedly reviewing regulatory changes that could permit commercial banks to purchase and hold cryptocurrencies like Bitcoin for investment purposes. Currently, the framework implemented in 2020 limits banks from holding such assets to mitigate risks associated with volatility.

The proposed revision aims to align the management of crypto assets more closely with traditional financial instruments, such as stocks and bonds. Discussions are expected to take place at an upcoming meeting of the Financial Services Council, an advisory body to Japan’s Prime Minister, signaling a significant move toward integrating digital assets into the mainstream financial ecosystem.

If approved, the reforms would require banks to adopt stringent risk-management protocols, including capital buffers, to safeguard against rapid price swings that could threaten financial stability.

Roman Storm warns open-source developers of retroactive prosecution

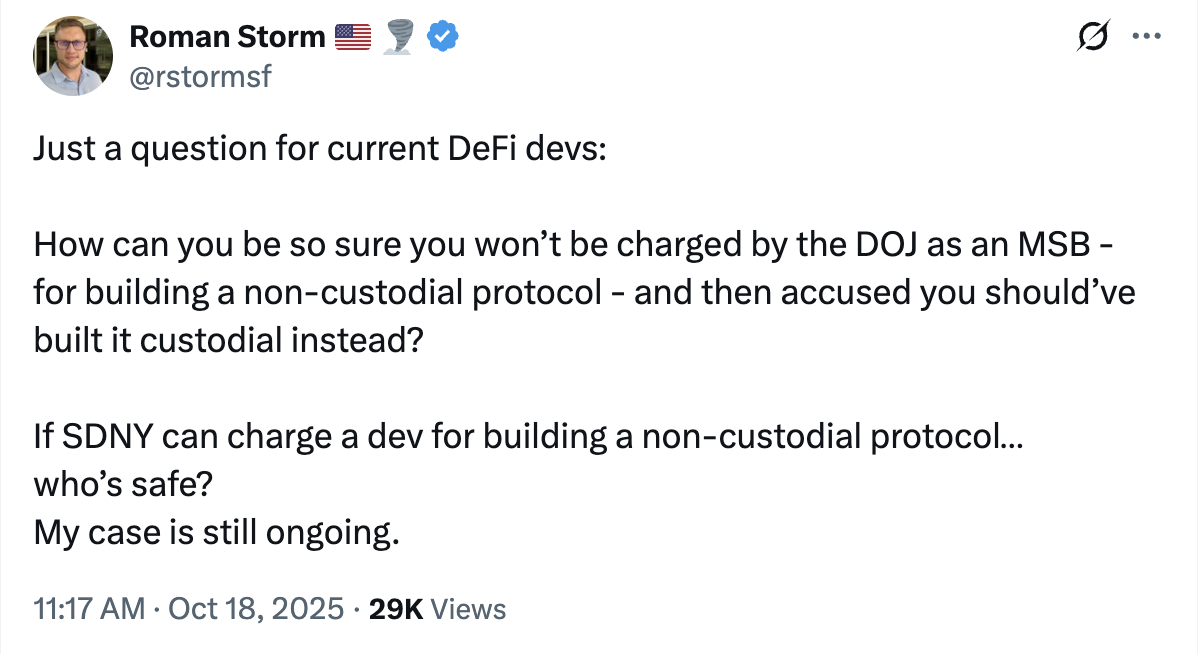

Tornado Cash developer Roman Storm issued a stark warning to open-source software developers working within the decentralized finance (DeFi) sector. In a social media post, Storm expressed concerns that developers could face retroactive legal action from U.S. authorities, particularly the Department of Justice.

He questioned the assumptions of safety for those working on non-custodial protocols, asking, “How can you be so sure you won’t be charged by the DOJ as a money service business for building a non-custodial protocol?” Storm pointed out that, in recent cases, even developers of privacy-centric protocols like Tornado Cash have faced legal scrutiny.

Source: Roman Storm

Source: Roman Storm

This warning underscores the increasingly uncertain legal environment for open-source projects and DeFi developers in the United States, with potential devastating consequences if legal precedents continue to turn against developers working on privacy-focused protocols.

This article was originally published as Trump Confirms Xi Meeting Amid Japan’s Cryptocurrency Regulation Relaxation on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Pi Network Maps 50M Coins Daily as Mainnet Tops 9B

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.