Solana DEX PnP Integrates DeFiLlama for On-Chain Prediction Markets

Predict and Pump (PnP), a Solana-native decentralized exchange (DEX), has integrated DeFiLlama data feeds to enable fully on-chain prediction markets. The announcement was made on Saturday via PnP’s official X account, stating that users can now convert real-time DeFi metrics into tradable prediction contracts.

DeFiLlama provides a wide range of blockchain analytics data, including total value locked (TVL), market capitalization, protocol revenues, and fee volumes across multiple chains. Through this integration, PnP users can create and trade markets directly on live on-chain metrics sourced from DeFiLlama’s data feed.

PnP Disintermediates Prediction Markets with DeFiLlama Integration

Unlike existing centralized prediction platforms, Kalshi and Polymarket, which require permissioned approval for new listings, PnP’s DeFiLlama integration removes intermediaries entirely. It enables an open marketplace where users can speculate on any on-chain metric without custodial oversight or listing restrictions.

The feature will allow anyone to open new markets based on protocol performance, liquidity movements, or token flows. Traders will also earn fees when others participate in the markets they create.

The global prediction markets sector continues to gain traction in October. Earlier in the month, NYSE Parent, Intercontinental Exchange Inc. (ICE), took a $2 billion stake in Polymarket. The deal valued the platform at $9 billion post-money, making 27-year-old founder and CEO Shayne Coplan the youngest self-made billionaire.

On Friday, major derivatives exchange operator CME Group also announced a partnership with FanDuel, aiming at launching a new prediction market platform to rival existing players.

Solana’s official X page amplified the news, sharing PnP’s announcement with its 3.5 million followers.

Solana Price Stalls Below $190 as Derivatives Data Suggests Bull Trap

As institutional Gold markets and US equities closed trading on Friday, major altcoins saw increased inflows, but Solana’s native token (SOL) struggled to sustain momentum. On Saturday, Ethereum (ETH), BNB, and XRP posted roughly 3% gains, while Solana underperformed with the weakest price uptick of 1.3%, among the top 5 ranked layer-1 assets.

Market data from Coinglass shows that SOL underperformance is linked to intense bearish pressure from futures traders.

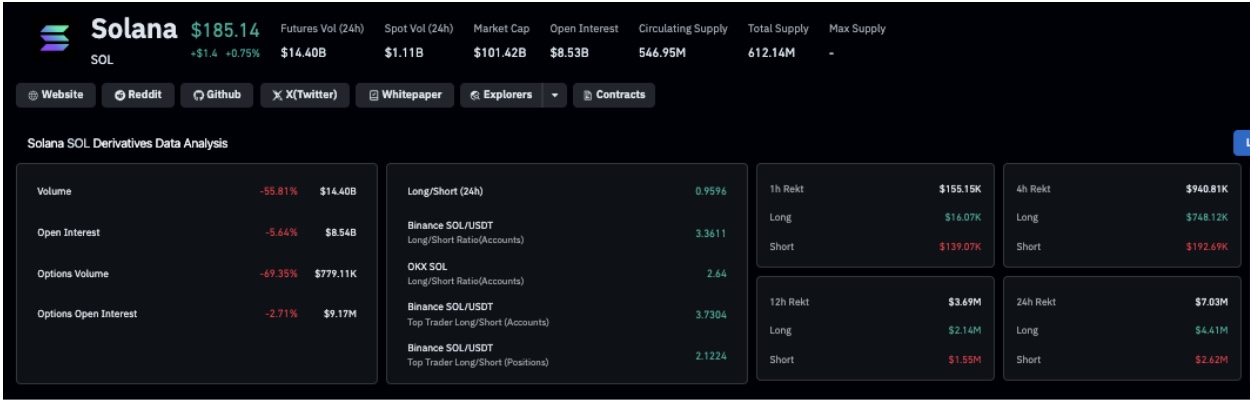

Solana Derivatives Market Analysis | Source: Coinglass

As seen above, SOL futures trading volumes dropped 56.02% to $14.4 billion, while open interest fell 6.37% to $8.51 billion.

The long-to-short ratio also remains negative at 0.96, signaling bearish dominance. Solana traders’ reluctance to back up the 1.3% intraday gains with new futures positions poses a “bull trap,” signal. Failure to hold out for a close above $185 could see SOL price slide towards the next major supply cluster at $18.

Maxi Doge Presale Tops $3.7M as Solana Traders Weigh Options

With Solana price struggling below the $190 mark, traders are rotating into high-upside early-stage projects like Maxi Doge (MAXI). The meme-powered leverage platform offers up to 1000x leverage with zero stop-loss restrictions, attracting traders with a high-risk appetite.

Maxi Doge Presale

The Maxi Doge presale has now surpassed $3.7 million out of its $3.9 million target. MAXI tokens are currently priced at $0.00026 per token, with the next tier set to activate in approximately 48 hours. Prospective investors can visit the official Maxi Doge presale website to earn early-joiner benefits before public listings.

nextThe post Solana DEX PnP Integrates DeFiLlama for On-Chain Prediction Markets appeared first on Coinspeaker.

You May Also Like

The Surprising 2025 Decline In Online Interest Despite Market Turmoil

Cryptos Signal Divergence Ahead of Fed Rate Decision