MrBeast Files Trademark for Banking and Crypto App

The filing with the U.S. Patent and Trademark Office reveals plans for a mobile banking app that would offer crypto trading, short-term loans, investment advice, and credit cards. Jimmy Donaldson, MrBeast’s real name, filed the application through his company Beast Holdings LLC.

What Services Would MrBeast Financial Offer?

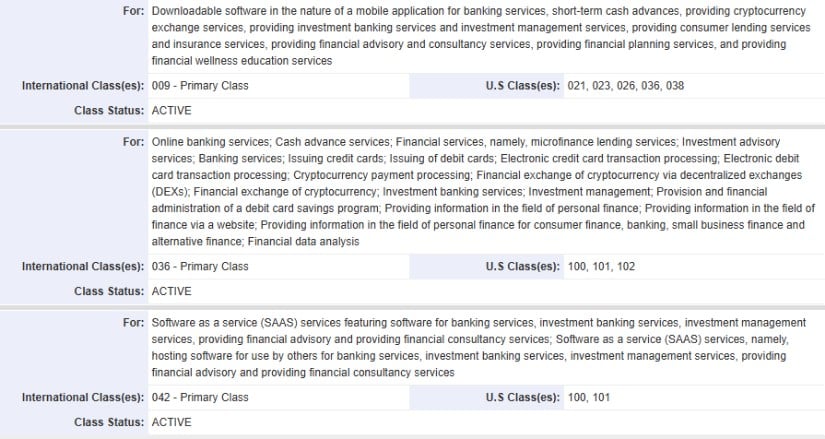

The trademark application lists a wide range of money-related services. Users could get cash advances, trade cryptocurrency, and receive investment banking services. The app would also offer microfinance lending, which means small loans for people who need quick cash.

Other planned features include issuing credit and debit cards, processing crypto payments, and providing financial education. The application even mentions operating decentralized exchanges, which are platforms where people can trade digital currencies directly with each other.

MrBeast Financial would work as a software-as-a-service platform. This means the company would host the technology and users would access it through their phones or computers. The application covers three different trademark categories, showing this isn’t just a small side project.

MrBeast’s Massive Audience Creates Huge Potential

MrBeast currently has over 445 million followers across his social media platforms. This gives him a bigger potential customer base than many traditional banks had when they started. To put this in numbers, that’s more people than the entire population of the United States.

About 39% of MrBeast’s viewers are between 13 and 17 years old, according to Precise TV data. Research shows that 49% of teenagers open their first bank accounts during these years. This timing could give MrBeast Financial a strong advantage with young users who are just starting to manage money.

The trademark won’t get approved right away. Based on typical processing times, the Patent Office will likely review the application in mid-2026. Final approval or rejection could come by late 2026. Even after trademark approval, MrBeast would need separate approvals from financial regulators to actually operate banking and crypto services.

Past Fintech Experience and Partnerships

This isn’t MrBeast’s first move into financial technology. In April 2021, he invested in Current, a mobile banking company. He featured Current in several of his videos and gave away money to fans through the platform.

Source: tsdr.uspto.gov

More recently, MrBeast partnered with MoneyLion for his Prime Video show “Beast Games.” The partnership included a $4.2 million giveaway for viewers who signed up for MoneyLion accounts. However, this partnership faced criticism from consumer protection groups who said MoneyLion’s cash advance services work like payday loans with high fees.

In March 2025, MrBeast’s company Beast Industries showed investors plans for credit cards, personal loans, and crypto services. The pitch deck mentioned working with established fintech companies to handle regulatory requirements.

Serious Crypto Controversies Cast Shadows

MrBeast faces serious questions about his past cryptocurrency activities. In October 2024, blockchain investigators released reports claiming MrBeast made between $10 million and $23 million by promoting crypto tokens and then selling them after prices rose.

The investigation by analysts including SomaXBT and Kasper Vandeloock traced over 50 crypto wallets allegedly connected to MrBeast. They claimed he received tokens from projects, promoted them to his millions of followers, and sold when prices spiked. Many of these tokens later crashed, losing over 90% of their value.

Specific allegations included making $11.5 million from SuperVerse tokens, $4.65 million from ERN coin, and $1.72 million from PMON tokens. MrBeast has not publicly responded to these allegations. He has stated multiple times that any claims about him launching meme coins are scams designed to trick his fans.

These allegations raise important questions about whether someone with this history should run a financial services platform. If similar activities happened in the stock market, regulators like the SEC would likely investigate.

Expert Opinions and Consumer Concerns

Lee McKnight, an Associate Professor at Syracuse University, told Newsweek that MrBeast shows “market savvy” by entering banking and digital assets now. However, McKnight questioned whether people should choose financial services based on social media influencers.

Consumer protection groups worry about mixing MrBeast’s young audience with complex financial products like crypto trading and high-interest loans. The controversy over his MoneyLion partnership shows these concerns aren’t theoretical.

MrBeast Financial could offer advantages too. His massive reach could help people who struggle to access traditional banking services. Gamification features might make learning about money more engaging for young users. The platform could introduce millions of people to cryptocurrency and digital finance tools.

Industry analysts note that MrBeast’s audience size rivals the early customer bases of successful neobanks. If he can turn even a small percentage of his followers into customers, MrBeast Financial could quickly become a major player in fintech.

The Bottom Line

MrBeast’s trademark filing signals real plans to build a financial services empire. With an estimated net worth over $500 million and proven business success with Feastables snacks and MrBeast Burger, he has the resources to make this happen. The filing comes as part of broader expansion plans that include a mobile phone service and a book deal with author James Patterson.

Whether MrBeast Financial actually launches depends on regulatory approval and public trust. The crypto allegations, young target audience, and complexity of financial regulations create major hurdles. But if anyone can turn internet fame into a banking business, it might be the person who built a billion-dollar empire giving away money on YouTube.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

RWA Crypto Projects Gain Momentum with Chainlink, VeChain, and Avalanche Surging in Engagement