Ethereum Crashes to $3.9K But Promises $10K, While $SNORT Presale Hits $4.8M With Just 4 Days Before It Ends

KEY POINTS: Ethereum crashed below $4K amid $650M crypto-wide liquidations, with $ETH accounting for $115M.

Ethereum crashed below $4K amid $650M crypto-wide liquidations, with $ETH accounting for $115M. Despite the bloodbath, analysts predict a bull flag pattern could push $ETH to $10K.

Despite the bloodbath, analysts predict a bull flag pattern could push $ETH to $10K. Revenge trading and overleveraged positions created perfect storm conditions for market chaos.

Revenge trading and overleveraged positions created perfect storm conditions for market chaos. Snorter Token’s presale offers early entry before the next major crypto rally wave hits.

Snorter Token’s presale offers early entry before the next major crypto rally wave hits.

Ethereum just shed 4% in a day while analysts simultaneously promise it’ll hit five figures. Welcome to crypto in 2025, where price predictions don’t necessarily have to make sense.

Ethereum just crashed below the psychological $4K barrier, settling at $3,953 after what can only be described as a leveraged bloodbath. The carnage covered $650M+ in liquidations across the crypto market in just 24 hours, with $ETH traders contributing a cool $115M to that bonfire.

According to market watchers, the problem isn’t Ethereum’s fundamentals – staking participation is healthy and Layer-2 development is thriving. However, the army of revenge traders is frantically trying to recover its losses by adding more leverage.

Source: X/@Maartuun

Basically, the ‘I can fix this’ energy simply creates more liquidation fuel. Funding rates and liquidation clusters remain elevated, which is analyst-speak for ‘everyone’s still doing the same dumb thing.’

The path forward requires cleaner positioning and a stronger spot demand. Until then, we’re stuck in this bizarre purgatory where down is up and crashes predict rallies.

Snorter Token ($SNORT): A Secure, Multi-Chain, Telegram-Native Trading Bot

If $ETH can crash to $3.9K and still promise $10K, imagine what happens when traders have the opportunity to invest in the fastest, lowest-fee Telegram trading bot before it even launches.

The Snorter Token ($SNORT) bot is positioning itself as the ultimate tool for retail traders. Via Telegram chats, it will transform your DMs into a full-stack trading suite. The bot is currently in development, with the presale funding the infrastructure that’ll make Telegram-native trading as seamless as sending a GIF.

Automated swaps, token launch snipes, stop-losses, and copy-trading will be among this bot’s top features. You’ll also be able to track your portfolio without ever leaving the app. No more juggling 12 tabs while a new meme coin pumps 400% in the time it takes you to connect your wallet.

The $SNORT token powers this entire ecosystem across both Ethereum and Solana networks via multi-chain functionality.

Check out our full review on Snorter Token.

Check out our full review on Snorter Token.

Once live, Snorter Bot will compete directly with existing solutions but with lower fees (0.85% compared to the standard 1.5%+), faster execution, and the kind of meme energy that drives adoption in crypto.

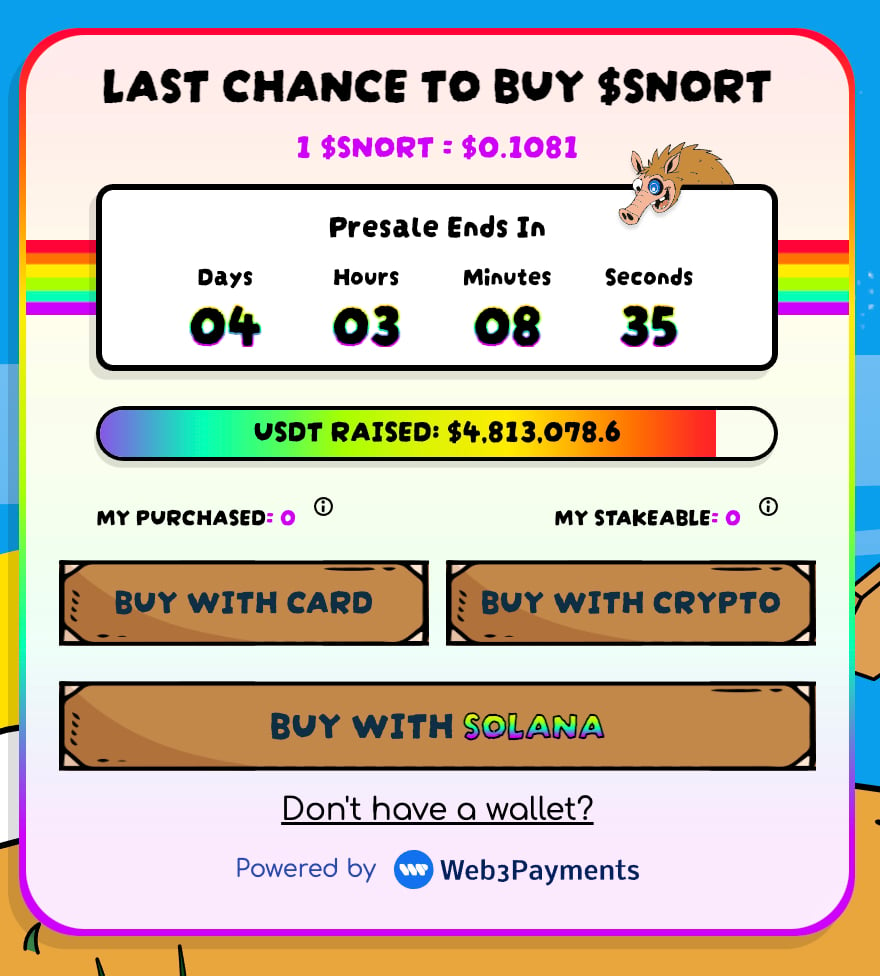

The project has already raised over $4.8M, proving that traders are hungry for tools that actually solve real problems, like missing launches because whales jumped in before you had time to blink.

$SNORT currently costs $0.1081, and you can stake it for 107% APY. Take a look at our step-by-step guide to buying $SNORT to find out everything you need to know.

However, the presale ends in just four days. So this is quite literally your last chance to secure $SNORT at pre-listing prices before the bot launches and trading volume potentially explodes.

However, the presale ends in just four days. So this is quite literally your last chance to secure $SNORT at pre-listing prices before the bot launches and trading volume potentially explodes.

Secure your $SNORT tokens now while you still can.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Sonami Token Presale Launches With 53% Staking Rewards, Powering a Solana Layer-Two Network Vision