Stripe’s Bridge Leads the Stablecoin Season, and Could Boost Best Wallet Token

What to Know:

- Stripe’s stablecoin arm, Bridge, has applied for a US national trust bank charter under the GENIUS Act, joining Circle, Ripple, Paxos, and Coinbase.

- The GENIUS Act introduces federal oversight for stablecoin issuers, requiring 100% cash or Treasury reserves and monthly public disclosures.

- This could mark the start of ‘Stablecoin Season,’ as regulated issuers bridge the gap between banks and blockchain payments.

- Best Wallet ($BEST) stands to benefit, offering users secure custody, presale access, and up to 80% APY staking rewards.

Stablecoins are going legit, and pretty fast.

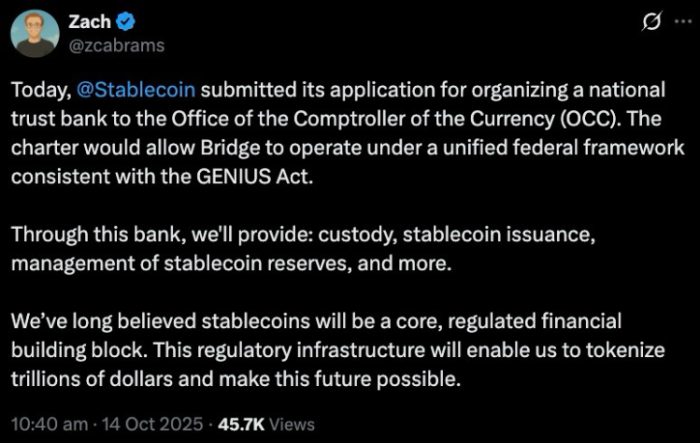

Stripe’s stablecoin arm, Bridge, just filed an application with the US Office of the Comptroller of the Currency (OCC) to form a national trust bank under the newly enacted GENIUS Act.

It’s the latest move in what’s shaping up to be ‘Stablecoin Season’: a full-blown regulatory sprint to bring digital dollars under federal oversight.

If approved, Bridge’s charter would let Stripe issue, redeem, and custody stablecoins directly under the OCC, instead of juggling dozens of state-level money-transmitter licenses.

That means its entire stablecoin business would sit under on federal framework, complete with 100% cash or Treasury-backed reserves and monthly public disclosures, as required by the GENIUS Act.

Bridge now joins Circle ($USDC), Ripple ($RLUSD), Paxos ($USDP), and Coinbase ($COIN) in chasing national trust licenses – a race that marks a historic pivot for the US digital asset market.

Together, these firms are positioning stablecoins as the regulated backbone of global payments, rather than gray-zone fintech experiments.

The timing makes sense. Stablecoins already account for over $315B in circulating value, and Standard Chartered analysts estimate they could pull $1T in deposits away from traditional banks over the next three years.

For users and merchants, that shift would make stablecoins the default settlement rail of the internet. They’re faster, cheaper, and now, finally, compliant.

For Striple, Bridge isn’t just about compliance; it’s also an infrastructure play.

The company recently unveiled Open Issuance, a service that helps apps launch their own stablecoins using Bridge’s back-end. Wallets like Phantom ($CASH), MetaMask ($mUSD), and Hyperliquid ($USDH) already rely on Bridge as their issuance partner.All signs point to a regulated on-chain economy, where digital dollars move under federal supervision and mainstream adoption finally takes hold.

So the real question for investors becomes: if stablecoins are about to become the rails of this new system, which tokens will capture user flow at the edge?

That’s where Best Wallet Token ($BEST) enters the picture, powering one of the fastest-growing Web3 wallets built to bridge the gap between regulated stablecoins and everyday users.

From Stablecoins to Wallet Wars – the New On-Ramp Race

The race for federal trust charters isn’t just about who prints the next digital dollar; it’s about who controls the gateway to it. Stripe, Circle, Ripple, and Coinbase are fighting for issuance and compliance. But at the user level, a different war is breaking out… the battle for wallets.

Under the new GENIUS framework, stablecoins can finally plug into traditional finance with clear oversight from the OCC. That unlocks direct settlement with banks, cross-chain interoperability, and compliant collateral for lending protocols. This is the pipeline for a regulated DeFi economy.And this is where crypto wallets come in. They’re no longer just storage apps. They’ve become super apps.

MetaMask now offers staking, Phantom integrates stablecoin rails, and new players like Best Wallet are going further by blending payments, presales, and rewards inside one secure, Fireblocks-powered interface.

Best Wallet Token ($BEST) – The Token Fueling a Web3 Super App Built for the Stablecoin Era

As stablecoins edge closer to federal recognition, wallet ecosystems are becoming the frontlines of adoption. Best Wallet is positioning itself at that intersection as a non-custodial wallet app that merges security, yield, and discovery into one seamless platform.

Built on Fireblocks’ MPC-CMP framework, the same institutional-grade tech used by major custodians, Best Wallet offers users secure on-chain control without sacrificing usability.

It’s a place to store tokens, buy into new crypto presales, stake assets, and soon, spend crypto cash through the Best Card. That card will deliver cashback and fee discounts to anyone staking the native $BEST token.

And that token is what powers the entire ecosystem. Holding $BEST unlocks reduced transaction fees, higher staking rewards, and early access to new token launches through the in-app ‘Upcoming Tokens’ feature.

Discover how to buy Best Wallet Token in our step-by-step walkthrough.

The project has drawn over 57K followers on X and raised $16.5M so far in the presale. Tokens are priced at $0.025795, and with ambitions to capture 40% of the crypto-wallet market by the end of 2026, you can see why we a Best Wallet Token price prediction of $0.05106175 is not unreasonable.As stablecoins come under the OCC’s watch, wallets integrating compliant rails and institutional security will stand out. Best Wallet is built precisely for that world, connecting regulated stablecoin infrastructure with DeFi native opportunities.

In that sense, the GENIUS Act sets the stage for wallets like Best Wallet to become the banks of the future,

Join the $BEST presale and stake now for up to 80% APY.

This article does not constitute financial advice. Crypto carries inherent risks, so please do your own research (DYOR) and never invest more than you are willing to lose.

Authored by X, NewsBTC — www.newsbtc.com/news/stablecoin-season-stripe-bridge-impact-best-wallet-token

You May Also Like

Stablecoin market hits $312B as banks, card networks embrace onchain dollars

Copy linkX (Twitter)LinkedInFacebookEmail

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!