Metaplanet Market Value Falls 70%, Now Trading Below Its Bitcoin Reserves – Treasury Bubble Burst?

Metaplanet Inc’s enterprise value has dipped below its Bitcoin reserves, with the Tokyo-listed company’s mNAV (the ratio of its market capitalization and debt to its token holdings) falling to 0.99 on Tuesday, according to Bloomberg.

The firm, as of Oct 14, now holds 30,823 Bitcoin worth approximately $3.4 billion, yet trades for less than the value of its crypto assets.

Notably, this growing financial imbalance facing Metaplanet is happening to the majority of digital asset treasury companies worldwide.

From All-Time Highs to Trading at Discount

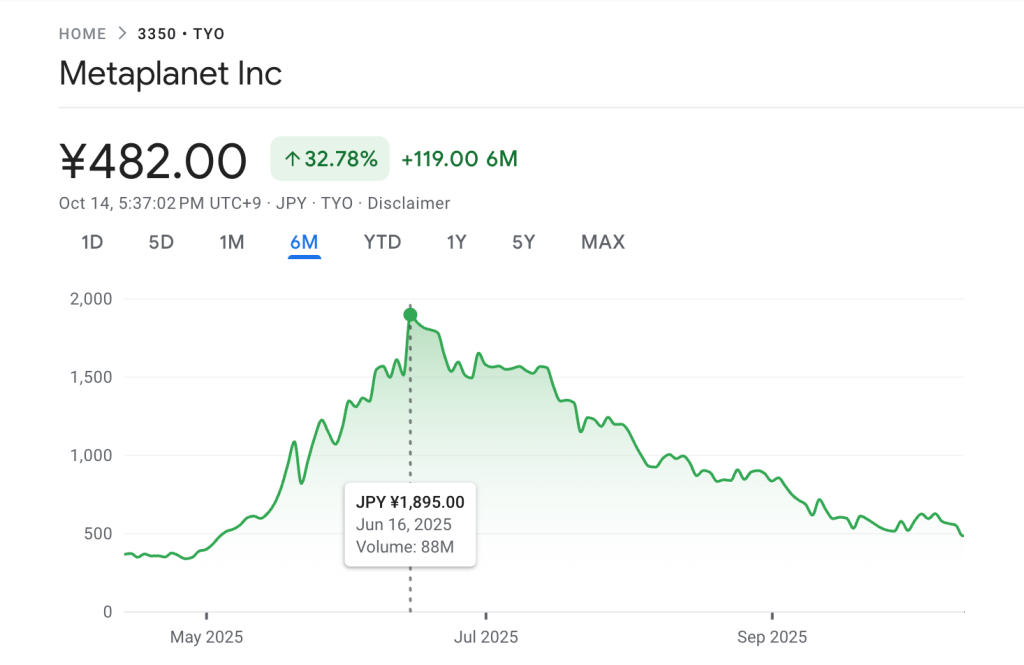

Metaplanet’s shares reached an all-time high in mid-June but have since declined by about 70%, making the company the first major Bitcoin treasury firm to consistently trade below its holdings.

Source: Google Finance

Source: Google Finance

At the time of publication, the share is trading at 482 Yen ($3.21), down 12.36% today.

According to Bloomberg, Mark Chadwick, a Japan equity analyst who publishes research on Smartkarma, described the decline as “a popping of a bubble.”

Chadwick believes that the “general euphoria” surrounding Bitcoin stockpiling has cooled, although “long-term Bitcoin bulls” may view Metaplanet’s discount as a buying opportunity, he noted.

The downturn coincided with broader market turmoil.

Crypto traders faced a record $19 billion in liquidations on October 10 after President Donald Trump announced harsher tariffs on China, triggering severe volatility that sent most major tokens tumbling.

Reacting to the massive liquidation, Bitcoin, for instance, dropped to 6 6-month low, trading very closely to $101K.

Quarter of Bitcoin Treasuries Now Trade at Discount as Bubble Deflates

Metaplanet is far from alone in its struggles.

K33 Research reports that a quarter of all public companies holding Bitcoin now trade at market values below their BTC holdings, with 26 out of 168 Bitcoin-holding firms trading at a discount.

The most dramatic collapse hit NAKA, the merger vehicle of KindlyMD and Nakamoto Holdings, which lost 96% of its market value from its peak and now trades at just 0.7x NAV, down from 75x.

Other firms, including Twenty One, Semler Scientific, and The Smarter Web Company, have similarly fallen below their net asset values.

Industry-wide premiums have also compressed sharply.

The average mNAV across treasury firms dropped from 3.76 in April to 2.8, while daily Bitcoin accumulation by these companies slowed to just 1,428 BTC in September, which is the weakest pace since May.

Several companies have resorted to desperate measures.

ETHZilla, formerly 180 Life Sciences, secured $80 million in debt from Cumberland DRW to fund a $250 million share buyback after its stock fell 76% from August peaks.

Electric vehicle firm Empery Digital expanded its debt facility to $85 million for buybacks, despite holding $476 million in Bitcoin, which exceeds its $378 million market cap.

Analysts have been warning about this burst since the beginning of the year.

Back in June, VanEck warned that companies approaching parity with their Bitcoin holdings risk “erosion” rather than “capital formation.”

The firm’s head of digital assets research, Matthew Sigel, recommended pausing share issuance programs if stocks trade below 0.95 times NAV for 10 or more trading days.

Monthly corporate Bitcoin adoption has declined by 95% since July, according to CryptoQuant data, which shows that only one company adopted Bitcoin in September, compared to 21 in July.

The decline comes as 205 publicly traded companies have announced digital asset treasury strategies with a collective $117 billion funneled into crypto.

Strategy Inc., formerly MicroStrategy and the sector’s bellwether, has seen its mNAV premium crash from 3.89x in November 2024 to 1.44x following the launch of IBIT ETF options earlier this year.

Strategy’s monthly Bitcoin purchases have also plummeted from 134,000 BTC in November 2024 to just 3,700 BTC in August 2025, though the company added 6,000 BTC in the first 10 days of September.

The firm now holds 640,250 BTC at a cost basis of $74,000 per coin, which translates to over $24 billion in unrealized gains.

Back in August, Sentora research also identified critical vulnerabilities in corporate Bitcoin strategies, warning that “idle Bitcoin on a corporate balance sheet is not a scalable strategy in a rising-rate world.”

Most treasury companies engage in negative-carry trades, borrowing fiat currency to acquire non-yielding assets without adequate risk mitigation.

Rising interest rates intensify these pressures, making it increasingly difficult to manage risk.

Just like Sentora, Coinbase Research also warned last month that the sector has transitioned from guaranteed premiums to a “player-versus-player” competitive phase where most participants face potential failure during adverse credit cycles.

Both firms believe that without Bitcoin evolving to generate yield, corporate treasuries remain structurally vulnerable to market downturns and rising rates.

You May Also Like

The Economics of Self-Isolation: A Game-Theoretic Analysis of Contagion in a Free Economy

One Of Frank Sinatra’s Most Famous Albums Is Back In The Spotlight