2,230,000,000 XRP in 96 Hours – Here’s What’s Happening

- Whale sell-off of 2.23 billion XRP shakes market stability.

- XRP price drops significantly following massive whale liquidation.

- Market volatility spikes as whales offload billions of XRP tokens.

According to Ali, a significant 2.23 billion XRP tokens have been sold by large investors, commonly known as whales, since Friday. This large-scale sell-off has had a noticeable impact on XRP’s price, leaving investors questioning what’s next for the cryptocurrency.

The dramatic sell-off by whales, large holders of XRP, has raised concerns and sparked conversations about the potential long-term effects on XRP’s price. The decision by these whales to liquidate such a large portion of their holdings has sparked concerns about the future direction of XRP and added considerable volatility to the market.

The rapid movements of these investors, who control substantial amounts of XRP, have played a major role in pushing the price downward. The increased supply resulting from their sell-off has created downward pressure, significantly affecting XRP’s price and leaving investors to react to the sudden shifts in market dynamics.

Also Read: Trending: Dubai’s Ruler Latest Announcement Sparks Excitement for XRP Community

Price Movements and Breakdown

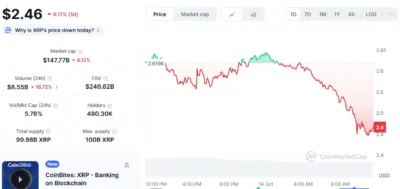

XRP’s price movements have been directly influenced by the recent whale activity. The price started at $2.6, showing signs of stability. However, as the whales began offloading their tokens, the price quickly rose to $2.62. This brief uptick was short-lived, as the sell-off continued, overpowering any buying interest in the market.

The price then began to fall. After peaking, it dropped to $2.46, reflecting a 6.1% decrease. This marked the start of a sharp downward trend as the selling pressure from the whales began to dominate the market.

Source: CoinMarketCap

Further exacerbating the situation, the price continued to decline to $2.4, maintaining the downward momentum. The surge in supply caused by the whale sell-off has clearly overwhelmed the market, driving the price lower. The overall market capitalization of XRP is now $147.77 billion, a significant change from earlier levels.

The Ripple Effect of Whale Activity

The sale of 2.23 billion XRP tokens over the past 96 hours is a clear demonstration of how whale activity can dramatically influence the price of a cryptocurrency. When whales offload such large quantities, the market struggles to absorb the sudden influx of tokens, leading to a sharp decline in price.

This type of market behavior is common when large holders decide to liquidate their positions, and it often results in significant price swings.

For XRP, this event underscores the power that whales hold in determining the short-term direction of the market. As the whales continue to sell off their holdings, the market faces increased pressure, and the price has continued to slide.

With a 16.72% drop in volume over the past 24 hours, the market sentiment appears to be negative, and the effects of the whale sell-off are still being felt.

Whether XRP can recover from this decline depends on how the market responds to the increased supply and if there is enough buying interest to stabilize the price. The ongoing market reaction to this massive sell-off will likely shape XRP’s future price movements.

Also Read: Citi Set to Launch Digital Asset Custody Service in 2026

The post 2,230,000,000 XRP in 96 Hours – Here’s What’s Happening appeared first on 36Crypto.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push