Broadcom Inc. (AVGO) Stock: Jumps Almost 10% as OpenAI Unveils Massive AI Infrastructure Deal

TLDRs;

- Broadcom stock jumped nearly 10% after OpenAI revealed plans for a 10 GW AI accelerator partnership.

- Deployment starts in 2026, with full rollout by 2029 across OpenAI and partner data centers.

- Supply chain limits at TSMC and Nvidia could challenge OpenAI’s hardware targets.

- OpenAI’s Argentina project and Broadcom deal mark a global expansion of AI infrastructure.

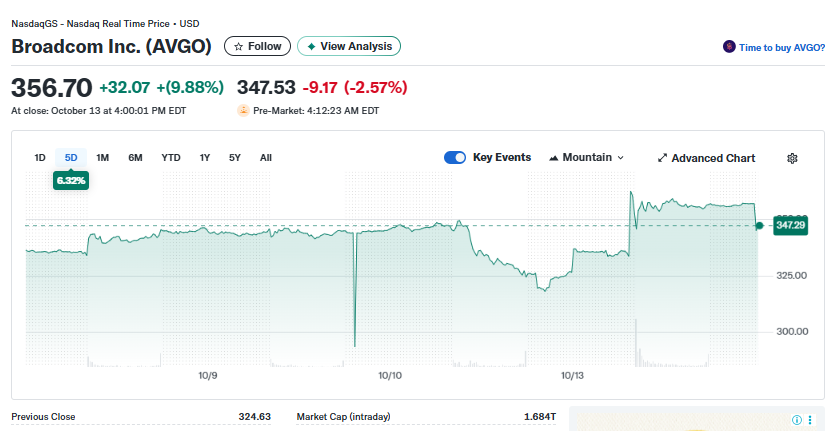

Broadcom Inc. (NASDAQ: AVGO) shares surged 9.88% on Monday after OpenAI revealed a large-scale partnership with the semiconductor giant to co-develop and deploy custom AI accelerator systems totaling 10 gigawatts (GW) of computing power.

The collaboration marks one of the most ambitious infrastructure undertakings in artificial intelligence to date, solidifying Broadcom’s foothold in the fast-expanding AI hardware market.

Under the agreement, OpenAI will design the accelerator architecture, while Broadcom will handle development, manufacturing, and large-scale deployment. The initiative will also utilize Broadcom’s Ethernet and connectivity technologies, which are critical for efficient AI data center networking.

Deployment is scheduled to begin in the second half of 2026, with full completion expected by the end of 2029. The advanced systems will be rolled out across OpenAI’s own data centers and its global partner network, positioning both firms at the center of the next generation of AI computing infrastructure.

Broadcom Inc. (AVGO)

Broadcom Inc. (AVGO)

10-Gigawatt AI Network by 2029

The 10 GW infrastructure plan represents a massive leap in computing scale, comparable to the power output of several nuclear plants combined. The AI racks will provide the backbone for OpenAI’s ever-growing suite of models, including ChatGPT and its enterprise-grade offerings.

Executives from both companies have described the partnership as “essential for building the future of large-scale AI infrastructure,” though financial details remain undisclosed.

This partnership also signals a strategic shift by OpenAI to reduce reliance on Nvidia’s GPU ecosystem, where global supply shortages have limited AI firms’ ability to scale. The collaboration with Broadcom could help OpenAI diversify its hardware base and gain more control over the custom silicon required for model inference at scale.

AI Supply Chain Faces Tight Capacity

Despite the breakthrough announcement, the global semiconductor supply chain faces mounting constraints that could challenge OpenAI’s 10 GW goal. Industry analysts point to a series of bottlenecks in advanced chip packaging technologies such as CoWoS (Chip-on-Wafer-on-Substrate) and High Bandwidth Memory (HBM), areas currently dominated by TSMC, Nvidia, and AMD.

TSMC still holds over 70% of foundry market share, with most of its CoWoS capacity already booked. As OpenAI’s 3 nm chip targets a 2026 release, it will compete for limited production slots at the world’s most advanced foundries.

Meanwhile, OpenAI’s “Stargate collaboration” with Samsung could provide relief by securing DRAM and HBM supply lines, but those remain under pressure as major chipmakers prioritize existing clients. OpenAI is also still purchasing Nvidia GPUs under a separate $100 billion supply agreement, indicating that while training workloads stay on Nvidia hardware, custom Broadcom silicon will likely power inference operations.

OpenAI Expands Global Infrastructure Push

The Broadcom deal is part of a larger AI infrastructure expansion strategy by OpenAI. Last week, the company announced a $25 billion data center project in Argentina, in partnership with Sur Energy. Dubbed Stargate Argentina, the 500 MW facility aims to support OpenAI’s growing compute demand across Latin America.

If completed, it will be among the largest technology and energy infrastructure projects in the region, highlighting OpenAI’s strategy of pairing AI growth with regional energy investments.

With more than 800 million weekly ChatGPT users and a recent $500 billion valuation, OpenAI’s focus on physical compute capacity underscores its bid to dominate the global AI landscape.

The post Broadcom Inc. (AVGO) Stock: Jumps Almost 10% as OpenAI Unveils Massive AI Infrastructure Deal appeared first on CoinCentral.

You May Also Like

Solar and Internet from Space: The Future of Global Connectivity and Energy Supply

Shiba Inu Price Prediction Is Edging Out in the Meme Race, But Pepeto Might Carry the 100x Trophy With $7.8M Raised