What Retailers Are Buying – Small-Scale Investors Pour into these 3 High-Potential Altcoins for Possible 25X Gain in 2025

The post What Retailers Are Buying – Small-Scale Investors Pour into these 3 High-Potential Altcoins for Possible 25X Gain in 2025 appeared first on Coinpedia Fintech News

Retail investors are returning to the market. After months of cautious accumulation, small investors are diving into high-upside altcoins once more, looking for 2025’s next breakout cycle.

From real-world fintech integrations to community-driven coins with massive reach, these three tokens are quickly becoming favorites: Digitap ($TAP), BNB (BNB), and Dogecoin (DOGE).

1. How Digitap Emerges Among Top Crypto Projects Before Listing

The first on the list is Digitap, a relatively new FinTech startup blending banking and crypto into a single app where users can hold fiat and digital assets, transfer money instantly, and spend through a Visa-linked card accepted worldwide.

Its privacy-first approach — including a no-KYC option and offshore account protection — has made it especially appealing to small investors looking for real-world use cases rather than pure speculation.

USE THE CODE “DIGITAP15” FOR 15% OFF FIRST-TIME PURCHASES

Investors can currently purchase $TAP through the ongoing presale. The first stage closed successfully, raising over $600,000, and the second round is now live at $0.0159. According to the website, this phase will run for roughly ten days before the price increases to $0.0194.

The steady stage-by-stage increase has retail buyers hurrying to secure allocations before the next scheduled jump.

Digitap’s potential lies in its scale. The platform targets the multi-trillion-dollar cross-border payments and digital banking market — a sector still dominated by slow, high-fee intermediaries like SWIFT.

With staking rewards of up to 124% APR and a deflationary token model that reduces supply over time, $TAP offers real, long-term value rather than just speculation. It’s this mix of utility, growth potential, and real-world use that’s quickly making it one of the best altcoins to invest in for 2025.

2. Analysts See BNB’s Breakout Echoing Its Past Bull Market Runs

Though not a small-cap crypto, BNB is drawing attention from investors of all sizes after reaching a new all-time high and surpassing both XRP and Tether in market capitalization. Trading around $1,307, BNB has gained an impressive 27% over the past week.

Crypto analyst BitcoinHabebe pointed out that the current price structure mirrors BNB’s earlier breakout cycles, suggesting that the token has finally exited a multi-year downtrend. The chart comparison shows how past accumulation phases led to explosive runs once major resistance lines were broken — and this setup looks no different.

If this trend continues, analysts are watching for potential targets around $1,400–$1,500 in the near term.

3. Dogecoin’s Chart Hints at a New Breakout After Long Pause

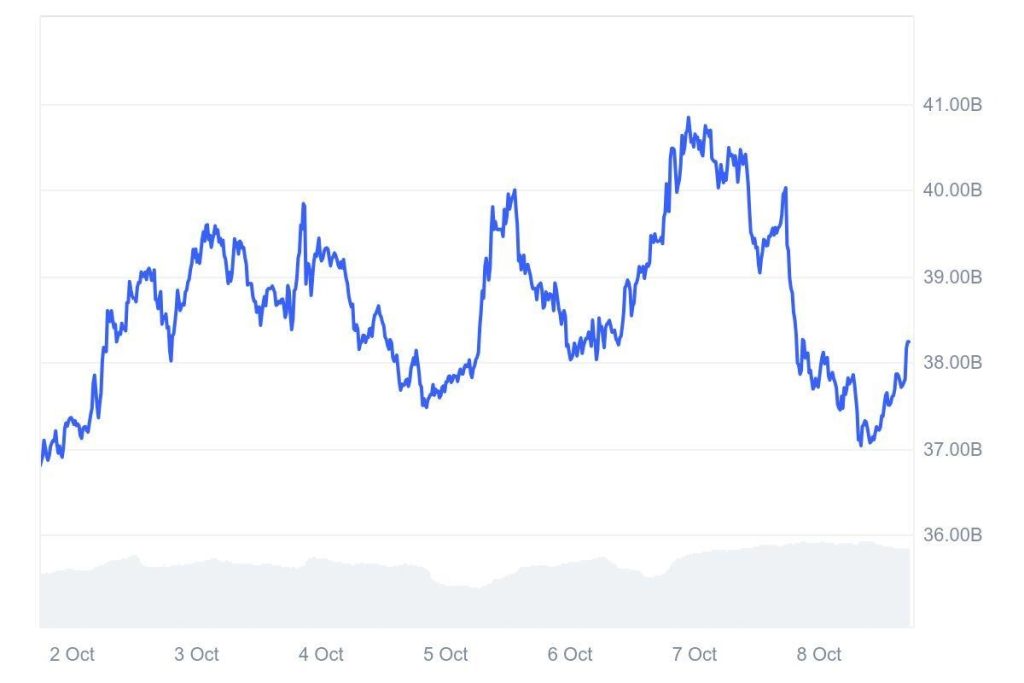

DOGE continues to attract attention from traders watching for the next meme-fueled move — but this time, the setup is more technical than hype-driven. DOGE currently trades at $0.252, up 3.5% this week, with a market cap exceeding $38 billion.

According to analyst CryptoBull, DOGE is forming a macro triangle pattern — a consolidation setup that often precedes major breakouts. The pattern suggests that if DOGE holds its key support around $0.19, a new rally phase could begin, potentially lifting prices toward $0.35–$0.40 over the next few months.

Meanwhile, Dogecoin’s community activity remains unmatched, and events like “Doge Day 2025” and continued development discussions around layer-2 scalability keep the token relevant beyond memes.

Why Digitap ($TAP) Leads This Altcoin Trio

BNB and DOGE each bring proven momentum and massive communities, but Digitap offers something rarer — an early-stage entry into a live financial network with real demand.

Digitap is going after a massive market — global payments and digital banking — sectors that move trillions of dollars every year and remain largely untouched by crypto innovation.

For investors seeking opportunities beyond mature, slower-growth coins or hype-driven memes, Digitap stands out as a true bridge between fintech and DeFi — a platform built for real-world use today and scalable growth tomorrow.

Discover how Digitap is unifying cash and crypto by checking out their project here:

- Presale: https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Tether launches US-regulated stablecoin, banks warn of deposit flight risk