Could Stellar Price Retrace More Before Its Next Big Rally To $3?

The post Could Stellar Price Retrace More Before Its Next Big Rally To $3? appeared first on Coinpedia Fintech News

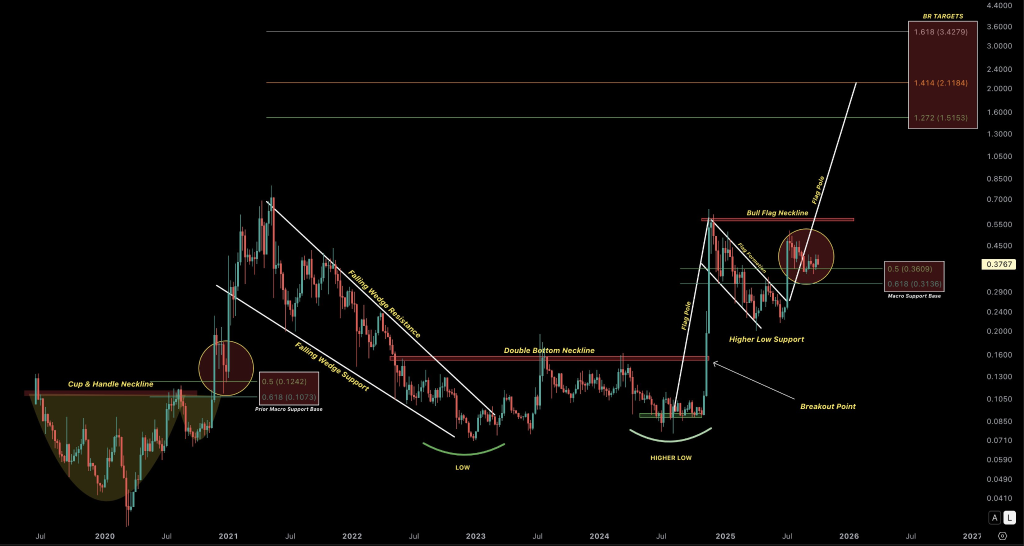

The Stellar price today remains in a tight consolidation phase between $0.38 and $0.40, as the market enters the early days of Q4 with cautious optimism. Currently trading around $0.38 with a $12.17 billion market cap, XLM continues to exhibit resilience following its breakout from a falling wedge pattern in the second half of the year. This consolidation near a key resistance area reflects strong market conviction that the XLM price USD could be preparing for its next upward leg.

Institutional Activity Reinforces Market Confidence

The latest Stellar price chart structure indicates that institutional involvement, especially in the RWA category, might be playing a crucial role in maintaining the asset’s stability at higher levels.

Since the breakout seen in Q3, large-volume buying patterns have surfaced, suggesting sustained accumulation. Many traders view this as a positive sign that big players are taking advantage of temporary pullbacks to strengthen long-term positions in XLM crypto.

Furthermore, the rising trading volumes point toward renewed enthusiasm surrounding Stellar’s cross-border payment network. As more financial entities explore blockchain-based settlement systems, Stellar’s technology remains well-positioned to benefit from institutional adoption trends.

Sustained Accumulation or Pre-Rally Pause?

While the Stellar price forecast appears constructive, the ongoing consolidation could also represent a pre-rally pause a period of accumulation before a breakout.

The tight price band between $0.38 and $0.40 implies that market participants are building positions in anticipation of a larger upward move.

Such phases often lead to sharp directional expansions once resistance levels are breached, which makes this zone a critical watch area for traders.

Potential Retracement Before the Next Leg Up

Market discussions suggest that XLM might briefly retrace toward the $0.31 level before resuming its climb. This potential dip could act as an inducement zone, shaking out weak hands and providing liquidity for stronger buyers to re-enter.

If such a scenario unfolds, analysts believe that XLM could target higher milestones, with long-term projections pointing toward $3, and an extended stretch possibly reaching $8.

While these targets may seem ambitious, they align with the broader sentiment that the Stellar price recovery is more structural than speculative. The combination of technical strength, institutional activity, and growing ecosystem adoption creates a supportive foundation for sustained long-term growth.

You May Also Like

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week

Kalshi debuts ecosystem hub with Solana and Base