Ethereum Foundation’s Privacy Push Brings Monero and Zcash Back Into Focus

The post Ethereum Foundation’s Privacy Push Brings Monero and Zcash Back Into Focus appeared first on Coinpedia Fintech News

The Ethereum Foundation’s latest move—forming the Privacy Cluster under its Privacy & Scaling Explorations (PSE) team—has reignited the conversation around on-chain privacy. This cluster unifies Ethereum’s privacy research and development into three key pillars: Private Reads, Private Writes, and Private Proofs. Together, these aim to make privacy a native property of the Ethereum network rather than an optional add-on.

By focusing on user data protection, metadata minimization, and zero-knowledge infrastructure, Ethereum is taking a significant step toward secure and confidential blockchain interactions. This initiative also signals the Foundation’s recognition that privacy isn’t just a user demand—it’s a technological necessity as Ethereum evolves into a multi-layer, institutional-ready ecosystem.

What the Privacy Cluster Means for the Market

The creation of Ethereum’s Privacy Cluster could reshape how developers, enterprises, and users interact on the network. The roadmap includes implementing stealth addresses, zk-proof-based identity systems, and confidential DeFi tools that allow transactions and governance without exposing sensitive data. For institutions exploring blockchain adoption, such features can enable compliance-friendly privacy, where financial information remains confidential but verifiable when needed.

Retail users, meanwhile, could benefit from simpler, wallet-integrated privacy tools. Beyond technical advances, this shift strengthens Ethereum’s market perception as the leading ecosystem for innovation in zero-knowledge cryptography. By normalizing privacy as a core feature, Ethereum may attract a new wave of developers and investors seeking both transparency and discretion in decentralized finance.

The Impact on Privacy Tokens

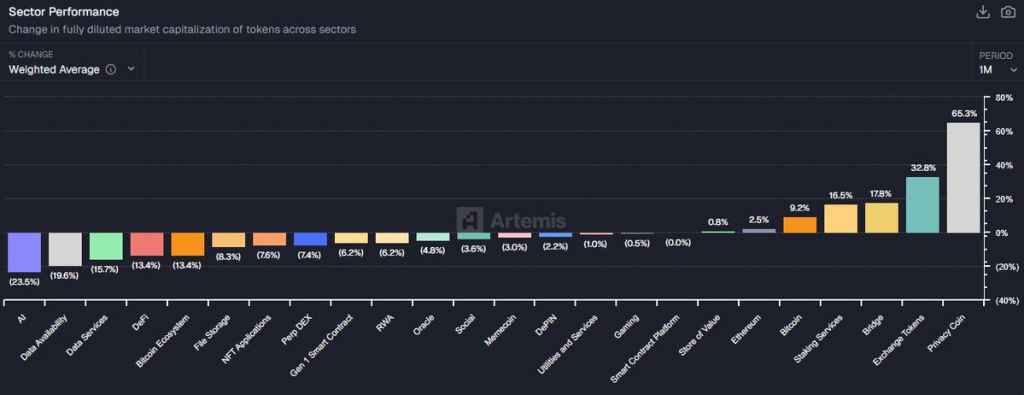

The Privacy sector has emerged as the top-performing category in the crypto market, surging over 65.3% in the past 30 days, according to Artemis data. This rally is largely fueled by the Ethereum Foundation’s announcement of the “Privacy Cluster,” a new initiative aimed at advancing privacy solutions across the Ethereum network. The move signals a growing institutional and developer focus on on-chain data protection, zero-knowledge technology, and user confidentiality.

Source: X

Source: X

While most sectors, including AI and DeFi, have seen double-digit declines, the privacy narrative is attracting fresh liquidity and market attention. Analysts suggest that as Ethereum strengthens its privacy framework, projects enabling secure transactions and decentralized identity could experience significant upside momentum. With privacy becoming a mainstream priority, tokens in this segment may continue to outperform as the next wave of innovation unfolds within the Ethereum ecosystem.

Privacy Tokens That Could Benefit

With Ethereum now prioritizing privacy tooling, several privacy-focused tokens could gain traction. Monero (XMR) and Zcash (ZEC), long-time leaders in confidential transactions, may see renewed investor attention. Meanwhile, Oasis Network (ROSE), Secret Network (SCRT), Aztec, and Railgun—which align closely with Ethereum’s privacy vision—are positioned for developer integration and DeFi use cases. Projects leveraging Polygon’s zkEVM could also emerge as major winners.

Wrapping it Up

Despite the optimism, privacy tokens still face regulatory headwinds and exchange delistings tied to AML/KYC compliance. Ethereum’s privacy initiative, however, hints at a middle ground—privacy with selective disclosure and compliance support—which could legitimize this sector in the long run.

Ethereum’s Privacy Cluster might not spark an immediate rally, but it signals a deeper structural shift. As privacy becomes an embedded norm rather than a niche option, the privacy token narrative could evolve from regulatory risk to technological necessity—redefining how blockchain protects user identity and financial data.

You May Also Like

Navigating The Critical Sideways Bias With Safe-Haven Support

Support at 1.15 under pressure – ING