Behind the Surge in Institutional Bitcoin Demand: What the Numbers Really Say

Companies don’t typically throw hundreds of millions at volatile assets without a thesis.

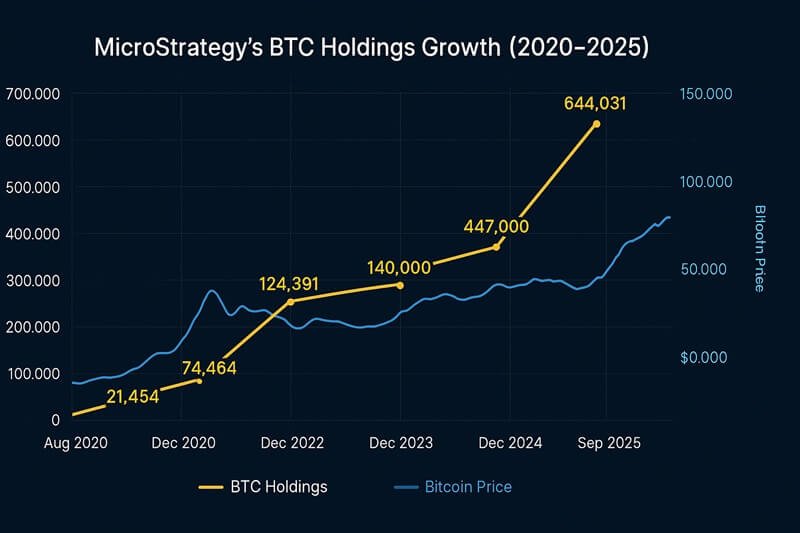

Yet over the past four years, institutional Bitcoin buying has shifted from fringe experiment to boardroom strategy. Strategy holds over 189,150 BTC as of Q4 2023 [1].

Japan’s Metaplanet began converting its treasury reserves to Bitcoin in 2024 [2].

Even traditional corporations like Tesla have allocated portions of their balance sheets (a company’s official record of assets and debts) to cryptocurrency [3].

These aren’t crypto startups or DeFi protocols. They’re publicly traded companies with fiduciary duties (legal obligations to act in shareholders’ best interests), auditors, and shareholders who ask hard questions.

So what do they see that retail investors might be missing?

Key institutional Bitcoin holders worldwide, including MicroStrategy’s 640,031 BTC, Metaplanet’s 30,823 BTC, and government holdings in El Salvador and Bhutan / Source: Bitnewsbot

The Numbers Don’t Lie – Corporate Balance Sheets Are Changing

Institutional Bitcoin buying = companies converting cash reserves into BTC as a long-term hold strategy.

Strategy (former Microstrategy), led by Michael Saylor, started purchasing Bitcoin in August 2020.

The company’s average purchase price sits around $29,817 per coin [1]. During 2022’s bear market – when Bitcoin dropped below $16,000 – MicroStrategy kept buying.

That’s not speculation – that’s conviction backed by a specific macro thesis.

Saylor has been publicly vocal about his reasoning.

In a 2021 interview, he stated:

Metaplanet’s shift was equally dramatic. The Japanese firm announced in April 2024 that it would adopt Bitcoin as a treasury reserve asset [2].

By mid-2024, the company had accumulated significant Bitcoin holdings as part of a deliberate strategy to hedge against yen depreciation [2].

“But these are just a few companies, right?” – Not quite.

Tesla held 9,720 BTC as of its Q3 2023 reporting period [3].

Block (formerly Square) allocated $220 million to Bitcoin starting in 2020 [5].

Even traditional finance players like BlackRock and Fidelity have launched spot Bitcoin ETFs, allowing institutional clients to gain exposure without directly holding the asset [6].

Chinese media and entertainment companies have also entered the space.

Pop Culture Group, a Nasdaq-listed Chinese media firm, announced Bitcoin purchases as part of its treasury strategy in 2024 [7].

The move signaled that institutional Bitcoin buying has expanded beyond Western markets into Asian corporate treasuries.

Countries Are Playing the Same Game

Institutional Bitcoin buying isn’t limited to corporations.

El Salvador made Bitcoin legal tender in September 2021 and has been accumulating BTC in its treasury [8]. As of late 2023, the country held over 2,500 BTC [8].

President Nayib Bukele has been explicit about the reasoning: El Salvador uses the U.S. dollar as its official currency, giving the country zero control over monetary policy.

Bitcoin = an opt-out from that dependence [8].

Other nations are watching. The Central African Republic briefly adopted Bitcoin as legal tender in 2022 before reversing course due to regional monetary union pressures [9].

More significantly, politicians in the United States have begun discussing a strategic Bitcoin reserve.

Senator Cynthia Lummis introduced the BITCOIN Act, proposing that the U.S. Treasury establish a Bitcoin reserve program [10].

Even if these proposals don’t pass immediately, the fact that lawmakers are discussing sovereign Bitcoin holdings signals a shift in how governments view the asset.

The 2008 Crisis Never Really Ended

The 2008 financial crisis provides the foundation for understanding institutional Bitcoin buying.

When Lehman Brothers collapsed in September 2008, governments responded with quantitative easing (QE) = central banks creating new money to purchase government bonds and other assets, effectively injecting liquidity into the financial system [11].

The Federal Reserve’s balance sheet ballooned from $870 billion in 2007 to over $4.5 trillion by 2015 [11]. That money didn’t disappear. It inflated asset prices, kept interest rates artificially low, and – according to critics – set up conditions for future instability.

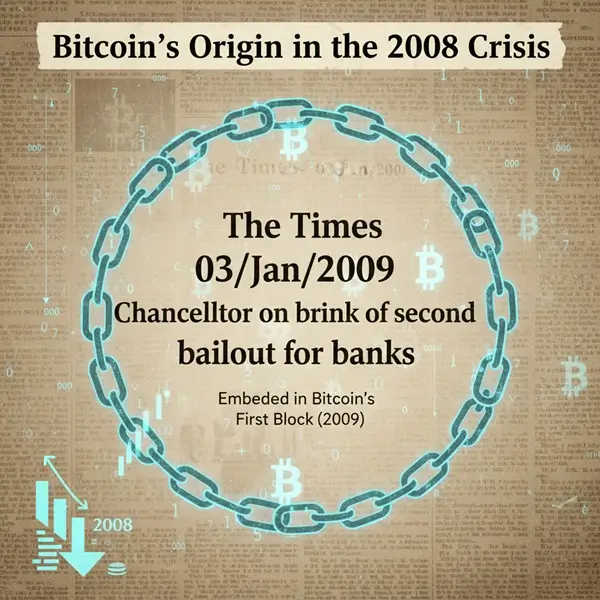

Bitcoin’s whitepaper was published in October 2008, right in the middle of the crisis. Satoshi Nakamoto embedded a message in Bitcoin’s genesis block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” [12].

The timing wasn’t coincidental. Bitcoin was explicitly designed as an alternative to a financial system that required bailouts and money printing.

Fast forward to 2020: COVID-19 triggered another round of QE. The Fed’s balance sheet hit $8.9 trillion by April 2022 [13]. Global debt levels exceeded 350% of GDP [14].

“Is another crisis coming?” – That’s the question institutions are asking.

And their answer – judging by their Bitcoin purchases – appears to be “yes.”

Inflation Hedges and Fiat Devaluation

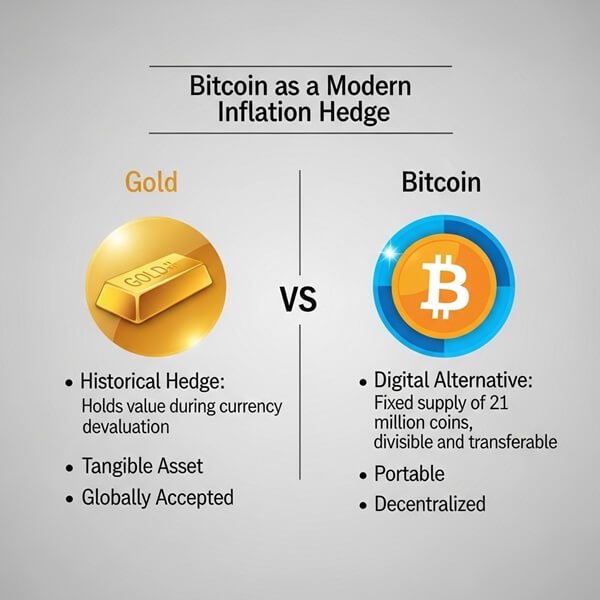

One of the primary drivers of institutional Bitcoin buying is the fear of fiat devaluation (the decline in purchasing power of government-issued currencies).

When central banks print money, the purchasing power of each dollar decreases.

Gold has historically served as a hedge = an asset that holds value when currencies weaken [15].

Bitcoin proponents argue that BTC offers similar properties with added benefits: it’s divisible, easily transferable, and has a fixed supply cap of 21 million coins [16].

Michael Saylor has been damn clear about this thesis. In multiple public statements, he’s positioned Bitcoin as “digital property” and the best-performing asset of the past decade [4].

His company’s strategy revolves around the belief that holding Bitcoin long-term will outperform holding cash, especially in an environment of persistent inflation.

(Ed. note: MicroStrategy’s stock price is now essentially a leveraged bet on Bitcoin—when BTC moves, MSTR moves harder.)

This isn’t about getting rich quick. These companies are treating Bitcoin as a long-term treasury strategy, similar to how corporations might hold gold or foreign currency reserves.

What About the Risks?

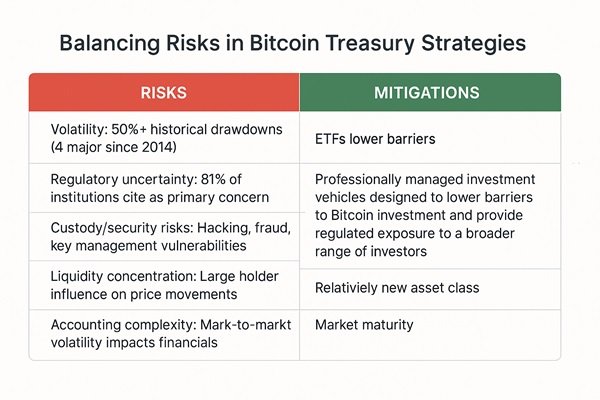

Institutional Bitcoin buying comes with obvious risks. Bitcoin’s volatility is well-documented—the asset has experienced multiple 50%+ drawdowns since its inception [17].

MicroStrategy’s stock price is now heavily correlated with Bitcoin’s performance. When BTC drops, MSTR shares often fall harder [18]. That creates risk for shareholders who might not have signed up for crypto exposure.

Regulatory uncertainty also looms. The U.S. Securities and Exchange Commission (SEC) has been inconsistent in its treatment of crypto assets.

While Bitcoin itself is generally not considered a security, the regulatory environment for custody, trading, and institutional involvement continues to develop [19].

“What if governments ban Bitcoin?” – That’s a question critics raise, though the likelihood decreases as more institutions and governments become stakeholders.

Once publicly traded companies and potentially sovereign wealth funds hold billions in BTC, an outright ban becomes politically and economically complicated.

The approval of spot Bitcoin ETFs by the SEC in January 2024 marked a turning point [6].

BlackRock’s iShares Bitcoin Trust and similar products brought institutional-grade infrastructure to Bitcoin investing, lowering barriers for traditional finance players.

The Strategic Reserve Debate

The concept of a national Bitcoin strategic reserve has gained traction in policy circles.

Senator Lummis’s BITCOIN Act represents the most concrete legislative proposal for U.S. government Bitcoin holdings [10].

While specific accumulation targets remain subject to debate, the proposal reflects a broader conversation about whether Bitcoin belongs in national reserves alongside gold and foreign currencies.

Critics argue that Bitcoin’s volatility makes it unsuitable for government reserves. Proponents counter that volatility decreases as an asset matures, and that Bitcoin’s long-term trend has been upward despite short-term swings [20].

Even if the U.S. doesn’t immediately establish a Bitcoin reserve, other nations may move first. El Salvador has already demonstrated that smaller countries can adopt Bitcoin at the sovereign level [8].

Whether larger economies follow remains an open question, but the discussion itself signals that Bitcoin has moved from fringe asset to legitimate policy consideration.

What This Means for Retail Investors

Retail investors often follow institutional money, and for good reason. Institutions have research teams, risk management departments, and access to information that individual investors don’t.

Does institutional Bitcoin buying mean BTC is guaranteed to go up? No. But it does suggest that major players view Bitcoin as a legitimate asset class worth holding, not a passing fad.

The playbook is visible: convert a portion of treasury reserves to Bitcoin, hold through volatility, and bet that long-term devaluation of fiat currencies makes BTC a superior store of value.

Whether that thesis proves correct depends on factors outside any individual’s control—central bank policy, regulatory developments, macroeconomic trends. But the institutions placing these bets aren’t doing so blindly.

The data shows a pattern: companies started with small allocations, tested the thesis, and many have continued accumulating. MicroStrategy didn’t buy once and stop—they’ve made repeated purchases across multiple market cycles [1].

The Bigger Picture

Institutional Bitcoin buying reflects deeper anxieties about the global financial system. Companies and countries are hedging against outcomes they hope won’t happen but can’t afford to ignore.

The 2008 crisis was papered over, not solved. Debt levels are higher. Interest rates, after a decade near zero, rose sharply in 2022-2023—but the structural issues remain. QE created asset bubbles. Inflation has eroded purchasing power.

Bitcoin offers an alternative, whether you view it as digital gold, a speculative asset, or a hedge against monetary mismanagement. The institutions buying billions in BTC have made their choice.

You don’t have to agree with their thesis. But you should understand it.

The shift from “Bitcoin is for libertarians and tech enthusiasts” to “Bitcoin belongs on corporate balance sheets” happened faster than most predicted. MicroStrategy’s first purchase was in 2020. By 2024, spot Bitcoin ETFs were trading on major exchanges with billions in assets under management [6].

That’s not a slow evolution – that’s a rapid repositioning of how traditional finance views cryptocurrency. The question isn’t whether institutional Bitcoin buying will continue. The question is whether the institutions buying now are early, late, or somewhere in between.

References

[1] MicroStrategy – “MicroStrategy Announces Third Quarter 2023 Financial Results and Bitcoin Holdings” – November 1, 2023

[2] Bitcoin Magazine – “Japanese Firm Metaplanet Adopts Bitcoin Treasury Strategy” – April 8, 2024

[3] Tesla Investor Relations – “Tesla Q3 2023 Update” – October 2023

[4] Michael Saylor Interview – “What Bitcoin Did Podcast with Peter McCormack” – December 2020

[5] Block Inc. – “Square, Inc. Purchases $50 Million in Bitcoin” – October 8, 2020

[6] SEC – “SEC Approves Spot Bitcoin ETF Applications” – January 10, 2024

[7] CoinDesk – “Chinese Media Firm Pop Culture Group Adds Bitcoin to Treasury” – January 31, 2024

[8] Reuters – “El Salvador’s Bitcoin Experiment: President Bukele’s Cryptocurrency Gamble” – November 15, 2023

[9] BBC News – “Central African Republic Drops Bitcoin as Official Currency” – April 24, 2023

[10] Senator Cynthia Lummis – “Lummis Introduces Bill to Establish Strategic Bitcoin Reserve” – July 31, 2024

[11] Federal Reserve – “Federal Reserve Total Assets Historical Data” – Accessed 2023

[12] Bitcoin.org – “Bitcoin Whitepaper by Satoshi Nakamoto” – October 31, 2008

[13] Federal Reserve Bank of St. Louis – “Federal Reserve Assets: Total Assets (WALCL)” – April 2022

[14] Institute of International Finance – “Global Debt Monitor Report” – Q2 2023

[15] World Gold Council – “Gold as a Hedge Against Inflation” – 2023

[16] Bitcoin.org – “Frequently Asked Questions” – Accessed 2024

[17] Coinmetrics – “Bitcoin Volatility and Market Drawdown Analysis” – 2023

[18] Yahoo Finance – “MicroStrategy Inc. (MSTR) Stock Performance vs Bitcoin” – Accessed December 2023

[19] U.S. Securities and Exchange Commission – “Framework for ‘Investment Contract’ Analysis of Digital Assets” – April 3, 2019

[20] Fidelity Digital Assets – “Bitcoin Investment Thesis: An Aspirational Store of Value” – 2022

\

You May Also Like

US Congress Proposes AI Export Oversight Bill

Ubisoft (UBI) Stock: Restructuring Efforts and Game Cancellations Prompt 33% Dip