Bitcoin (BTC) Dips Below $122K, ZCash (ZEC) Explodes by 35%: Market Watch

The past 24 hours saw Bitcoin attempt to surge past the $124K level but failed and is now attempting to establish a range around $122K.

The altcoins experienced more substantial volatility. Zcash (ZEC) posted a double-digit price increase, whereas Aster (ASTER) leads the losers’ team.

BTC Calms Down

It has been less than three days since the primary cryptocurrency soared to a new all-time high of over $126,000. Since then, however, the bears took charge and prevented another spike to uncharted territory.

At one point yesterday (October 8), the bulls attempted to regain control and pushed the valuation to $124,000. Nonetheless, that surge was short-lived, and BTC headed south to as low as $121,500. In the past several hours, the volatility has been minor, with the asset hovering in the $121,500-$122,000 range.

BTC Price, Source: CoinGecko

BTC Price, Source: CoinGecko

It is worth noting that Bitcoin may experience heightened turbulence later today (October 9) as a result of Jerome Powell’s speech. The Chairman of the Federal Reserve is expected to discuss the US economic outlook, focusing on inflation, growth, and the path of interest rates. Markets will closely monitor the Fed’s signals on whether it plans to cut rates further or pause, as well as how Powell assesses inflation risks and economic resilience.

Any clues that the central bank is more likely to lower the benchmark could increase the interest in risk-on assets and positively impact BTC’s price. The opposite scenario may have an adverse effect, causing a short-term pullback.

Bitcoin’s current market capitalization is approximately $2.42 trillion. Its dominance over the altcoins remains relatively unchanged at around 56.8%.

How are the Alts Doing?

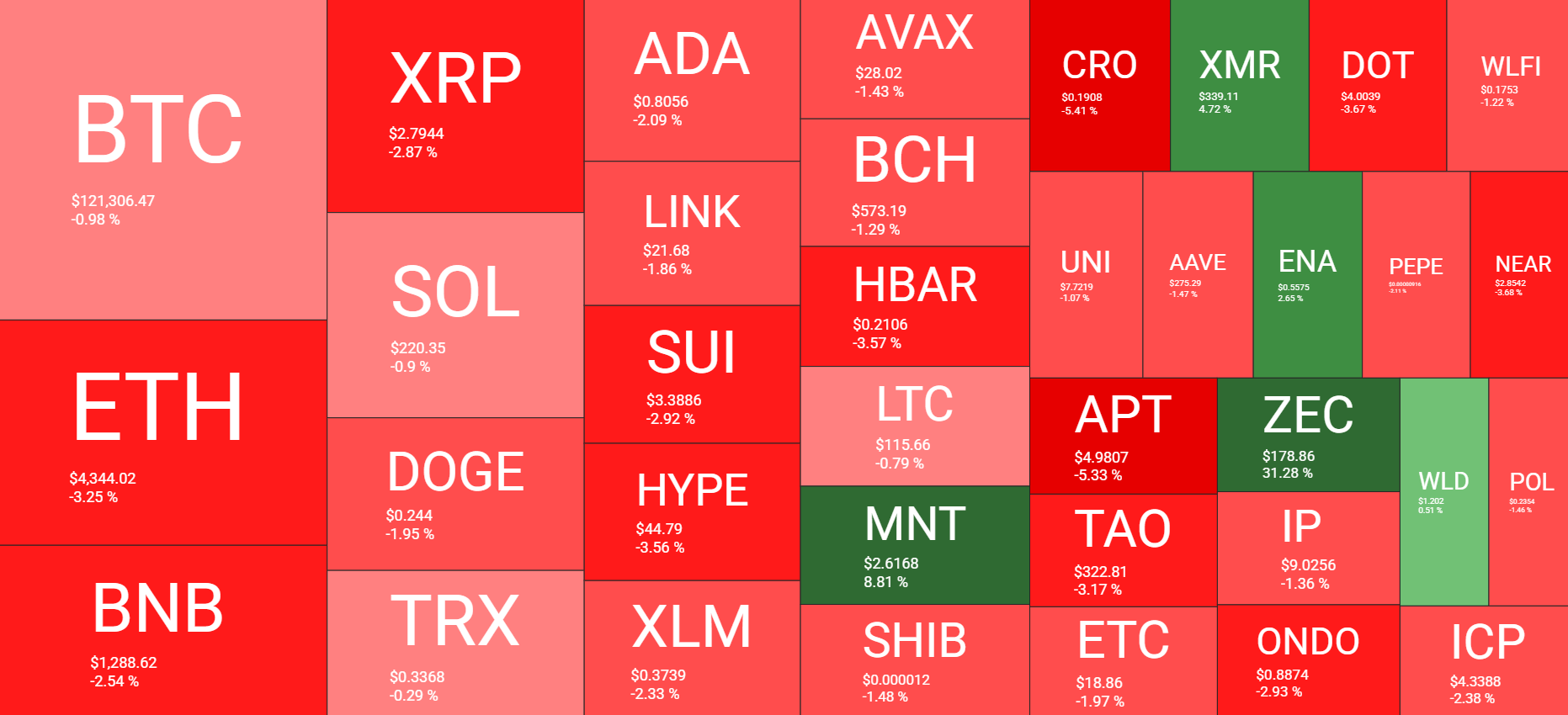

Several well-known altcoins have made the headlines today due to registering significant price increases. Zcash (ZEC) is the best-performing cryptocurrency from the top 100 club with a daily rise of 35%. Mantle (MNT) comes next with a gain of 9%, whereas Monero (XMR) and Ethena (ENA) have pumped by 3-4%.

Aster (ASTER) stands in the opposite corner, with a 12% loss on a 24-hour scale. Pump.fun (PUMP), Cronos (CRO), OKB (OKB), Bonk (BONK), Pi Network (PI), and Hyperliquid (HYPE) have also entered red territory, albeit posting less substantial losses.

The total market capitalization of the crypto sector has decreased by 1.3% to $4.23 trillion.

Cryptocurrency Market Overview, Source: QuantifyCrypto

Cryptocurrency Market Overview, Source: QuantifyCrypto

The post Bitcoin (BTC) Dips Below $122K, ZCash (ZEC) Explodes by 35%: Market Watch appeared first on CryptoPotato.

You May Also Like

Urgent Warning For US Banks To Avoid Payments Market Collapse

Trump’s Decisive Stance: US Will Consult Israel on Ending Iran War But Retains Final Authority