The key to success behind Ripple’s 100 billion market value: Selling coins for a living, payments, ETFs and political trends

Author: Nancy, PANews

Decentralization is regarded as the core creed of the crypto world, but the story of the old public chain Ripple is full of drama and contrast. Since its inception, Ripple has been controversial for its highly centralized token distribution model and has been criticized for deviating from the spirit of crypto. Even its founder admitted that the company "lives on selling coins." At the same time, this crypto project with a market value of $100 billion has been accused of lackluster technological innovation and mediocre revenue performance. Forbes even mercilessly labeled Ripple a "zombie company."

Despite this, the market and reality tell a different story. Ripple has won the favor of financial institutions, and its market value has often exploded, even enough to compete with traditional giants. Recently, multiple factors such as rising expectations for ETFs, the support of US political forces, the advancement of payment business, and the vigorous layout of stablecoins have once again pushed Ripple into the spotlight.

With payment as the core, Ripple is expanding its business in multiple areas

Ripple continues to promote business expansion this year. As we all know, cross-border payment and remittance is Ripple's core business. This year, it continues to extend its reach around the world. For example, Ripple expands its business in Africa through cooperation with Chipper Cash, Ripple joins hands with Unicâmbio, the oldest currency exchange institution in Portugal, to promote instant payments between Brazil and Portugal, and SBI Shinsei Bank adopts Ripple's DLT for international remittances.

In order to ensure the continued legal and compliant operation of its business, Ripple has vigorously promoted the application of global licenses. As of April 2025, Ripple has obtained more than 55 remittance licenses (MTL) worldwide, covering 33 states in the United States and Dubai. In recent months alone, Ripple has successively won remittance licenses in New York and Texas, and became the first blockchain payment provider to obtain a payment license from the Dubai Financial Services Authority, which allows it to provide regulated cryptocurrency payment services in the UAE.

Not only that, Ripple is further expanding its influence in the payment field through the stablecoin RLUSD. Since its launch in December last year, the market value of RLUSD has climbed to more than 290 million US dollars. This year, Ripple has accelerated the expansion of RLUSD's application scenarios. For example, Ripple cooperated with Chainlink to enhance the practicality of RLUSD in the DeFi field; Ripple reached cooperation with Revolut and Zero Hash to expand the market coverage of RLUSD; recently, RLUSD was launched on the exchange Kraken and was also integrated into its payment solution Ripple Payments for cross-border payment processes for customers such as BKK Forex and iSend. In the future, Ripple plans to open up the use of RLUSD to more payment platforms.

Recently, Ripple announced that it had spent $1.25 billion to acquire the cryptocurrency-friendly prime broker Hidden Road, which is one of the largest acquisitions in the cryptocurrency industry to date. As a prime brokerage and credit network, Hidden Road has more than 300 institutional clients, clearing more than $10 billion through traditional payment channels and processing more than 50 million transactions. After the acquisition is completed, Hidden Road will integrate RLUSD as collateral for its prime brokerage products, while migrating its post-trading activities to the XRPLedger blockchain. This will not only bring more liquidity and application scenarios to RLUSD, but also help Ripple further develop its real-world assets (RWA) track.

In addition, Ripple is also expanding its crypto custody and wallet business. In mid-March this year, Ripple Labs submitted a trademark application for "Ripple Custody". According to the application documents, the trademark covers financial services, including the storage and management of crypto assets to meet financial management needs. This trademark application follows Ripple's launch of custody services in October 2024, which may indicate that the company is seeking to expand its revenue sources beyond payment settlement. The trademark application also mentions "downloadable cryptocurrency, fiat currency, virtual currency and digital currency custody, transmission and storage software", which may mean that Ripple is considering launching an official crypto wallet. If the product is launched, it can create new revenue growth points through transaction fees.

It is worth noting that Ripple CEO Brad Garlinghouse recently revealed that Ripple plans to enter financial fields such as payment, real estate and securities trading in the future.

SEC withdraws lawsuit to win four-year lawsuit, has "close" relationship with Trump

After Trump took office, the regulatory environment of the US crypto industry has clearly turned to a loose one. After several years of twists and turns, Ripple has also ushered in a "major victory". In March this year, Ripple announced that the US SEC officially withdrew its four-year lawsuit against the company. The two parties reached a preliminary settlement agreement. The SEC agreed to refund $75 million of the $125 million fine imposed by the court last year, retaining only $50 million to close the case. In exchange, Ripple will withdraw its cross-appeal.

"The moment has finally arrived, the moment we've been waiting for. The SEC will drop its appeal, a complete victory for Ripple and a victory for the crypto industry from any perspective. The future is bright. Let's build it together," Garlinghouse announced at the time.

Prior to this, Ripple's expansion in the US market was severely hampered by the protracted "securities dispute" with the US SEC. Garlinghouse once revealed in an exclusive interview with Fox Business that the SEC's lawsuit forced Ripple to turn 95% of its customer base to overseas markets. In response to this dilemma, Ripple actively participated in US political lobbying and invested huge amounts of money in the super political action committee Fairshake during the 2024 US election, becoming one of the most generous large corporate donors in the crypto industry.

Ripple's "close relationship" with Trump also injects imagination into its expansion in the United States. In early January this year, Garlinghouse posted a photo of a dinner with Trump and others at Mar-a-Lago on X, which attracted widespread attention. Soon after, at the beginning of the issuance of Trump's MEME coin TRUMP, Ripple and Galaxy Digital also provided a $160 million emergency loan to the encrypted payment company MoonPay to ensure that its high transaction demand in the early stage of its launch could be met. This support is believed to have played an important role in the rapid growth of the TRUMP token in the early stage.

In mid-February, Trump shared an article about XRP on Truth Social, citing Garlinghouse's statement that since Trump won the election last November, the company's business transactions and personnel recruitment in the United States have increased significantly. This move quickly ignited market sentiment, and XRP trading volume soared. Last month, Trump went a step further and announced that cryptocurrencies such as XRP would be included in the US strategic reserves. This policy announcement triggered a warm response from the market.

XRP ETF global layout accelerates, CEO says it may be launched in the second half of the year

The ETF application boom has also provided Ripple with significant impetus as the regulatory environment for cryptocurrencies in the United States is rapidly evolving.

Since the beginning of this year, there have been frequent developments in ETF products around XRP. For example, asset management company Purpose Investments submitted a preliminary prospectus for the first Ripple ETF to the Canadian securities regulator; in February of this year, Brazil approved the world's first spot XRP ETF, which will be listed and traded on the Brazilian B3 Exchange; in March, Hashdex submitted an amendment to the U.S. Securities and Exchange Commission (SEC), planning to expand its ETF products to include cryptocurrencies such as XRP; not long ago, Teucrium Investment Advisory launched the first leveraged ETF in the United States linked to XRP, aiming to provide a daily double return on XRP tokens.

At the same time, many well-known institutions such as Bitwise, Grayscale, WisdomTree and Franklin Templeton have also submitted applications for spot XRP ETFs, but these applications have not yet been approved by the SEC. However, Nate Geraci, president of The ETF Store, believes that the end of Ripple's lawsuit with the SEC means that the approval of the spot XRP ETF is "obviously just a matter of time." Bloomberg analyst James Seyffart holds a similar view. He predicts that the XRP ETF may be launched in the next few months, and it is likely that ETF products based on XRP futures will be seen first.

Garlinghouse revealed in an interview with Bloomberg TV that the XRP ETF may be launched in the second half of 2025, and there are currently about 11 XRP ETF issuance application documents from different companies awaiting approval from the U.S. Securities and Exchange Commission. "In addition, he also revealed that Ripple Labs' IPO is not impossible.

The price of the currency hit a multi-year high, and the token model caused controversy

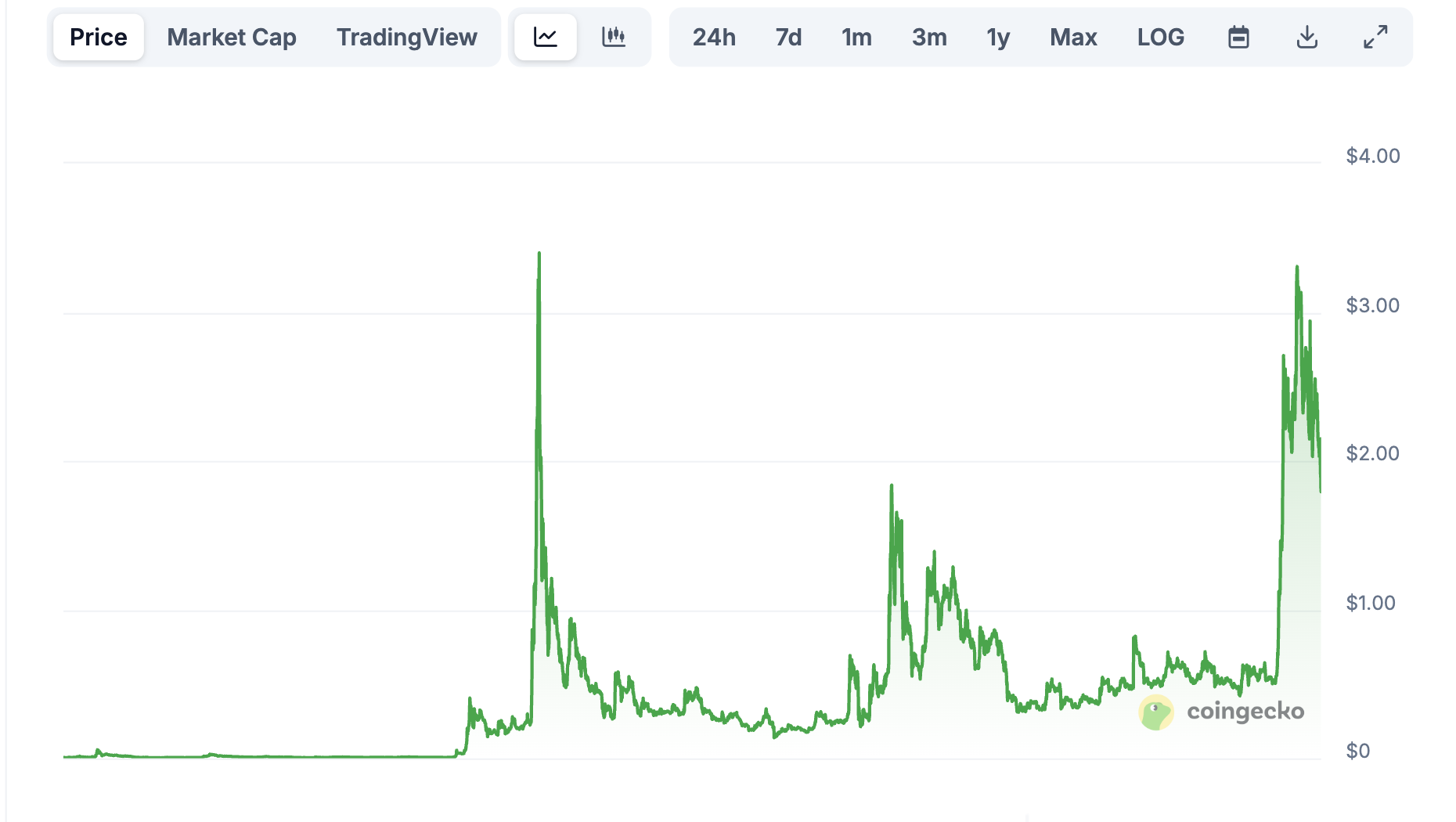

Driven by multiple positive factors, XRP prices have seen a significant boost. According to Coingecko data, since the beginning of this year, XRP has risen by as much as 70.62% to $3.3, setting a new high since January 2018.

Garlinghouse even bluntly stated that with the rise in XRP prices and the growing demand for Ripple's blockchain solutions, the company's original $11 billion valuation has become "seriously outdated."

Standard Chartered Bank said in a report recently that XRP rose sixfold in the six months after Trump's election. This increase is sustainable, partly due to changes in the leadership of the SEC, but also because XRP is uniquely at the core of one of the most promising application areas for digital assets - cross-border and cross-currency payments. At the same time, XRP Ledger (XRPL) is highly consistent with the main use cases of stablecoins such as Tether, which is to support financial transactions completed by traditional financial (TradFi) institutions through blockchain technology. It is predicted that stablecoin transaction volume will increase tenfold in the next four years. Ripple also plans to expand XRPL into the field of tokenization. These positive factors indicate that XRP should be able to keep up with its biggest competitor, Bitcoin. The agency predicts that XRP may rise to $12.5 before President Trump leaves office. But Standard Chartered Bank also supports that XRPL faces two disadvantages: a small number of developers and limited value capture capabilities.

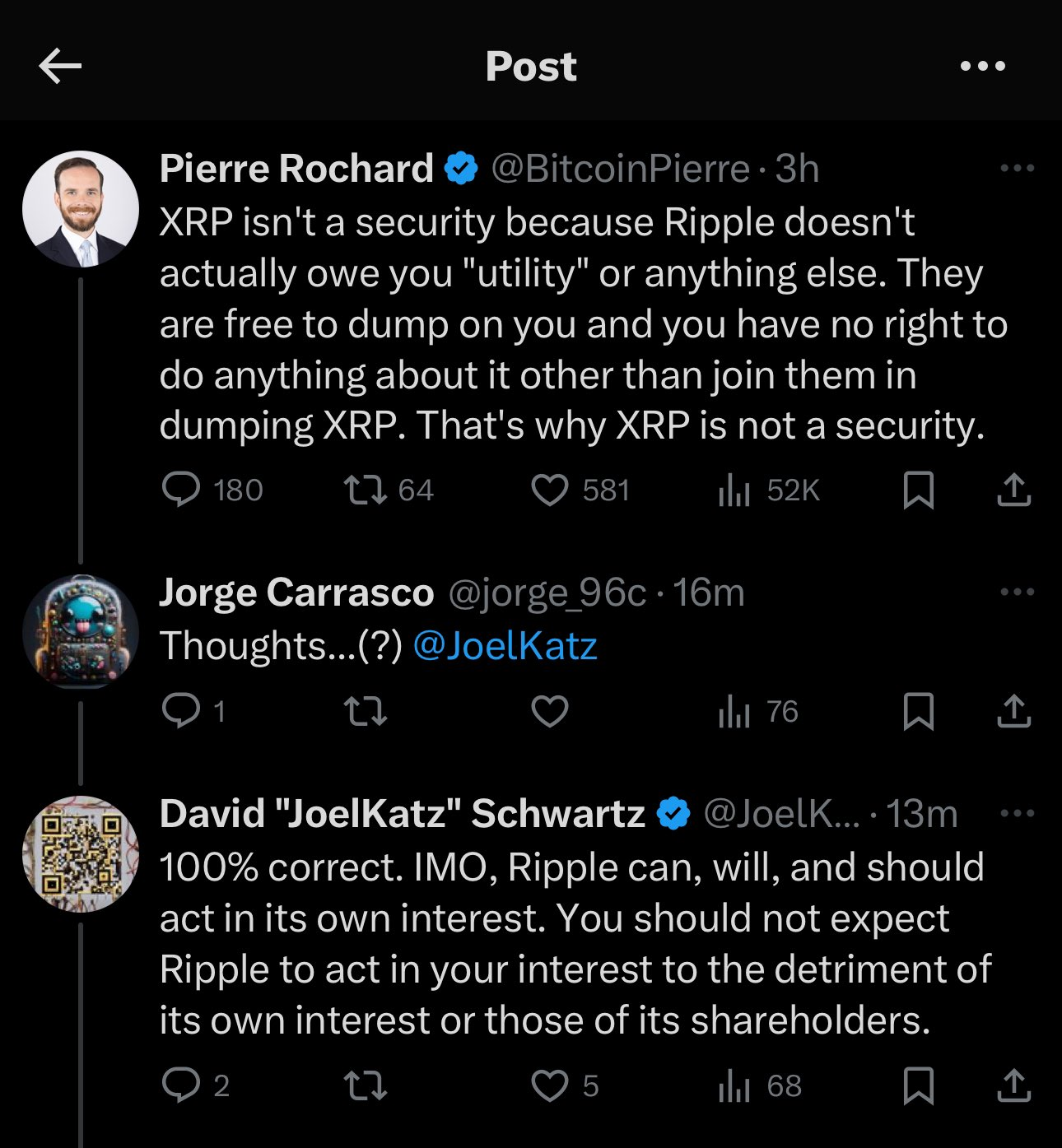

However, Ripple's token model has also caused controversy. For example, Pierre Rochard, vice president of research at Riot Platforms, once warned that investors "are not investing in Ripple, but simply obtaining tokens created out of thin air. XRP is not a security because Ripple does not actually owe you 'utility' or anything else." In response, Ripple Chief Technology Officer David "JoelKatz" Schwartz said, "Ripple can, will and should put its own interests first. Investors should not expect Ripple to profit for investors in a way that harms the interests of the company and its shareholders." This statement implies that Ripple has the right to sell XRP tokens to raise operating funds, which has aroused investor concerns. In fact, Garlinghouse once admitted, "If we don't sell our XRP assets, we won't be profitable or generate positive cash flow."

Public information shows that the total issuance of XRP is 100 billion, of which 20 billion are owned by the three creators Chris Larsen, Jed McCaleb and Arthur Britto, and the remaining 80 billion are allocated to Ripple Labs.

However, in order to ease the market's concerns about the supply of XRP, Ripple has locked 55 billion XRP (55% of the total) in XRP Ledger-based escrow accounts since 2017. These escrow accounts are controlled by smart contracts and automatically unlock 1 billion XRP per month, which will be adjusted to 450 million per month after 2020. However, not all unlocked tokens enter the market each time. Ripple usually only uses part of the unlocked tokens (such as 20%-25% for market sales), and the rest are re-locked in escrow and extended to future months for release.

It is important to note that the founder of Ripple still holds a large amount of XRP. According to crypto detective ZachXBT in March, the XRP address activated by Ripple co-founder Chris Larsen still holds more than 2.7 billion XRP (about $7.18 billion). These addresses associated with Larsen transferred more than $109 million worth of XRP to exchanges in January 2025.

You May Also Like

Stop Buying memecoins from My X Posts

Ex-SEC Chair Behind XRP Lawsuit Defends Bitcoin, John Deaton Demands Answers