Shiba Inu Price Prediction Shows 138% Upside, And Crypto Analysts Believe Pepeto Could Deliver 100x

SPONSORED POST*

Shiba Inu (SHIB) looks ready for a short-term rebound after months of sluggish trading, though analysts believe its ceiling may not match the explosive potential of emerging presales. Pepeto (PEPETO) is increasingly being viewed as the next 100x candidate in the meme coin market, thanks to its strong presale growth and utility-driven roadmap. The debate now is whether SHIB’s rebound or Pepeto’s early trajectory offers the better opportunity.

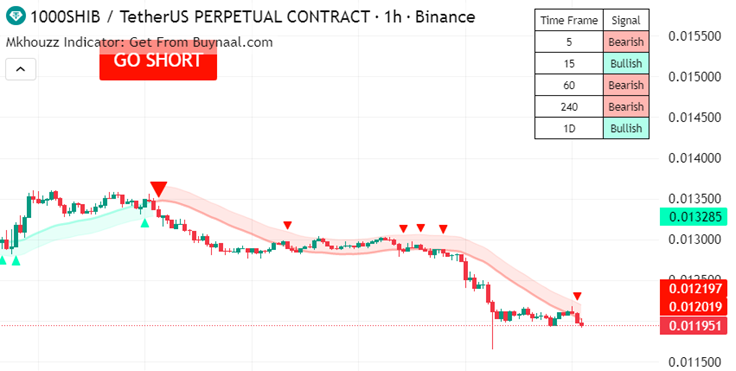

Shiba Inu price points to 138% upside

SHIB has spent the past few months consolidating between $0.00001 and $0.000013, forming what experts call a stable base. This follows a sharp decline from its Q4 2024 highs of $0.000033. Many holders have been frustrated, but momentum may finally be turning.

CoinCodex projects SHIB could climb as much as 138% over the next year, bringing it back near its previous highs. Technical indicators are supportive: RSI has lifted from oversold territory, while whale accumulation suggests quiet buying. If sentiment continues to improve, SHIB could still deliver notable short-term gains.

Shiba Inu ecosystem keeps developing

Beyond price action, Shiba Inu’s ecosystem is expanding gradually. Shibarium, the project’s Layer 2 network, is averaging more than 3 million daily transactions. Developers are working on projects like the Shiba Metaverse and upgrades to ShibaSwap, aiming to push SHIB beyond hype-driven trading.

Still, SHIB’s enormous circulating supply limits the scale of possible rallies. That’s why many traders are comparing it to Pepeto (PEPETO), where the presale price and growth story give far more room for exponential returns. While SHIB may double or triple, Pepeto is being framed as the true 100x meme contender.

Why analysts believe Pepeto could deliver 100x

Pepeto is built entirely on Ethereum, giving it EVM compatibility and seamless integration with existing networks. Its ecosystem already includes PepetoSwap, a zero-fee exchange, and a cross-chain bridge for smooth token transfers. Staking adds another layer of utility, showing Pepeto is built on more than memes.

Presale growth and exchange demo

The presale has already crossed $6.9 million, and demand continues to rise. The demo release of the PepetoSwap exchange gained attention across Twitter, Telegram, and influencer circles, proving the project is moving quickly and building real products.

Staking rewards

Pepeto allows early buyers to stake their tokens at 223% APY, letting them compound holdings during presale stages. Each stage also raises the token price, giving early participants the strongest entry advantage.

Tokenomics and community traction

With a total supply of 420 trillion tokens, the same as Pepe, Pepeto balances meme culture with structured tokenomics. Instead of marketing gimmicks, the team focused on transparency and product delivery, which has built trust with long-term holders. Where SHIB may see 2x–3x gains, Pepeto could be positioned for a 100x breakout as memes meet real utility.

How To Buy Pepeto Now

Connect your MetaMask or Trust Wallet

Head to the official site: pepeto.io

Choose payment with USDT, ETH, BNB, or credit card

Make your purchase at the current presale price

Stake your tokens for high rewards and hold as the project grows

Conclusion

Shiba Inu’s indicators suggest a possible 138% rebound, and its ecosystem is still evolving. But for those looking beyond the usual top 10 names, the real opportunity might lie in early-stage projects like Pepeto.

With a working demo exchange, 223% staking rewards, and over $6.9M already raised in presale, Pepeto is increasingly seen as the next 100x contender. The question now isn’t whether SHIB will rise, but whether Pepeto will leave it behind.

Disclaimer:

The Pepeto presale is live. To participate, use the official website: https://pepeto.io. As the listing approaches, some unauthorized platforms may attempt to use the Pepeto name to mislead investors. Verification of sources is advised.

Get in now – The Pepeto presale won’t wait.

Website : https://pepeto.io

Telegram : https://t.me/pepeto_channel

X : https://x.com/Pepetocoin

This article was paid for. Cryptonomist did not write the article or test the platform.

You May Also Like

Top Altcoins To Buy Before The ETF Season Kicks In

Token Unlock Wave Highlights Supply Overhang for Traders