Ethereum Could Be the Biggest Winner of the Fed’s Upcoming Rate Cuts

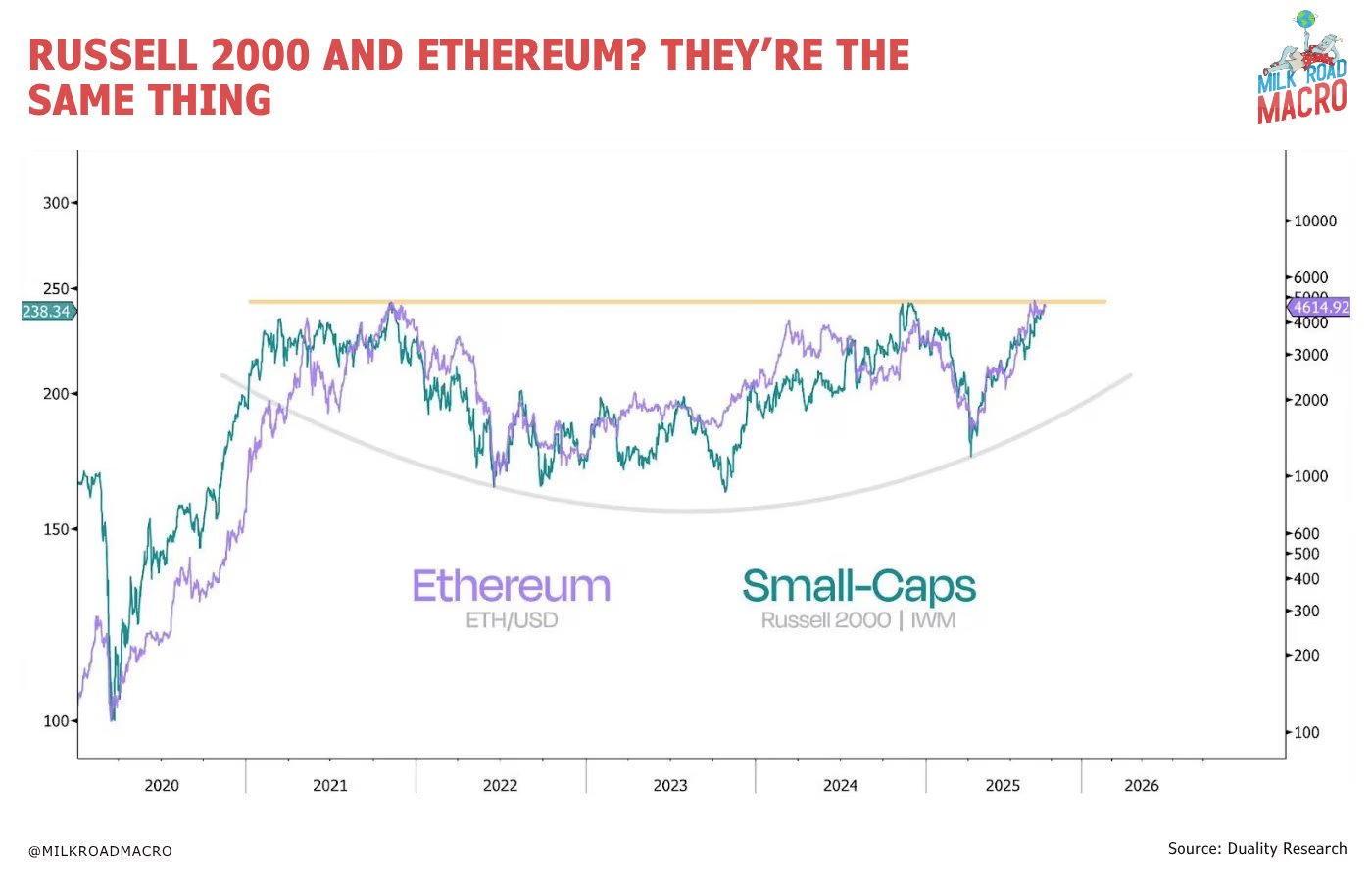

Over the past several months, Ethereum (ETH) has moved almost in sync with the Russell 2000, an index tracking small-cap American companies. The two have displayed a level of correlation rarely seen between crypto and equities. Analysts at Milk Road Macro called the connection “eerily precise,” arguing that both assets could soon respond positively to a more accommodative monetary environment.

Interest Rate Cuts Could Trigger the Next Move

Markets are preparing for what many now see as a near certainty: additional Federal Reserve rate cuts. Data from CME futures indicates traders are pricing in a 96% probability of a 25-basis-point cut in late October and an 82% chance of another in December.

These expectations have stirred optimism across risk assets, particularly for Ethereum, which analysts say has more exposure to yield-driven demand than Bitcoin. Justin d’Anethan, head of partnerships at Arctic Digital, believes that dynamic will be key:

“Ethereum isn’t just a speculative asset – it generates yield. When interest rates drop, that yield becomes even more attractive,” he said.

The Broader Risk-On Shift

Macro trader Michaël van de Poppe thinks Ethereum’s breakout could come sooner than most expect. He points to the ETH/BTC pair, which has shown signs of bottoming after months of consolidation. At the same time, gold’s surge to record levels above $4,000 per ounce has prompted expectations of a pullback – an event that could shift capital from defensive holdings to growth-oriented assets like ETH.

READ MORE:

Solana Price: Experts Warns of Critical Turning Point Ahead

“If the global easing cycle continues, we’ll see a strong rotation into markets with upside potential,” van de Poppe said. “Ethereum fits that category perfectly.”

Technicals Point Toward Higher Targets

Chart watchers have also highlighted a potential cup-and-handle formation in Ethereum’s recent structure – a technical pattern typically signaling continuation of an uptrend after a pause.

Analyst Matt Hughes says Ethereum has been stabilizing above the $4,350–$4,400 area, a region that could serve as the final base before a push toward new highs. He places the next resistance zone near $5,200, while others, like the pseudonymous analyst Poseidon, are eyeing a cycle peak around $8,500.

Despite a modest 6% daily pullback to $4,430, the sentiment among traders remains broadly optimistic. If the Fed follows through with a series of cuts, Ethereum could emerge as one of the biggest beneficiaries of renewed liquidity – and perhaps the next major asset to break free from its historical ceiling.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Ethereum Could Be the Biggest Winner of the Fed’s Upcoming Rate Cuts appeared first on Coindoo.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Academic Publishing and Fairness: A Game-Theoretic Model of Peer-Review Bias