Experimental Proof: MENT-Flow Achieves Consistency with MENT Solutions for Beam Reconstruction

Table of Links

I. Introduction

II. Maximum Entropy Tomography

- A. Ment

- B. Ment-Flow

III. Numerical Experiments

- A. 2D reconstructions from 1D projections

- B. 6D reconstructions from 1D projections

IV. Conclusion and Extensions

V. Acknowledgments and References

III. NUMERICAL EXPERIMENTS

The following numerical experiments demonstrate that MENT-Flow solutions approach MENT solutions in 2D phase space. Subsequent experiments demonstrate that MENT-Flow can fit complicated 6D phase space distributions to large measurement sets in reasonable time and that entropic regularization keeps the reconstruction close to the prior. To simplify the examples, we focused on linear phase space transformations rather than more realistic accelerator models. We also tended to use ground-truth distributions without linear interplane correlations, highlighting nonlinear features.[4] We chose to maximize the entropy relative to a Gaussian prior.[5] The flow’s base distribution is also a Gaussian, so the entropy penalty pushes the flow toward an identity or scaling transformation.

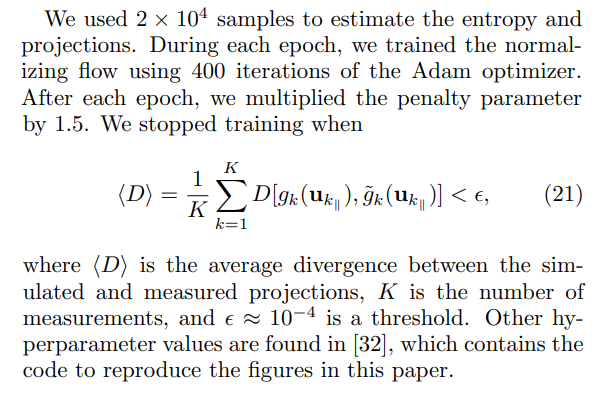

\ Our normalizing flow architecture is described in the previous section. The flow consists of five layers. Each layer is an autoregressive transformation, where the 1D transformation along each dimension is a rationalquadratic spline with 20 knots; the function values and derivatives at the knots are parameterized by a masked neural network with 3 hidden layers of 64 hidden units. Note that increasing the model size should not lead to overfitting since we train via maximum entropy, not maximum likelihood.

\ We compare MENT-Flow to MENT. Our MENT implementation uses linear interpolation to evaluate the Lagrange functions at any location on the projection axes, and we simulate the projections by numerical integration. We also compare to an unregularized neural network (NN) whose only aim is to fit the data. The NN is a standard fully connected feedforward network with 3 hidden layers of 32 hidden units and tanh activation functions.

\

\

:::info Authors:

(1) Austin Hoover, Oak Ridge National Laboratory, Oak Ridge, Tennessee 37830, USA (hooveram@ornl.gov);

(2) Jonathan C. Wong, Institute of Modern Physics, Chinese Academy of Sciences, Lanzhou 730000, China.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

You May Also Like

The USDC Treasury burned $50 million worth of USDC on the Ethereum blockchain.

Crossmint Partners with MoneyGram for USDC Remittances in Colombia