Here’s Why Not Holding Bitcoin by 2034 Would Be Risky

Escalating economic decay and the prospect that Bitcoin would become even more scarce would make not holding the cryptocurrency by 2034 “risky.”

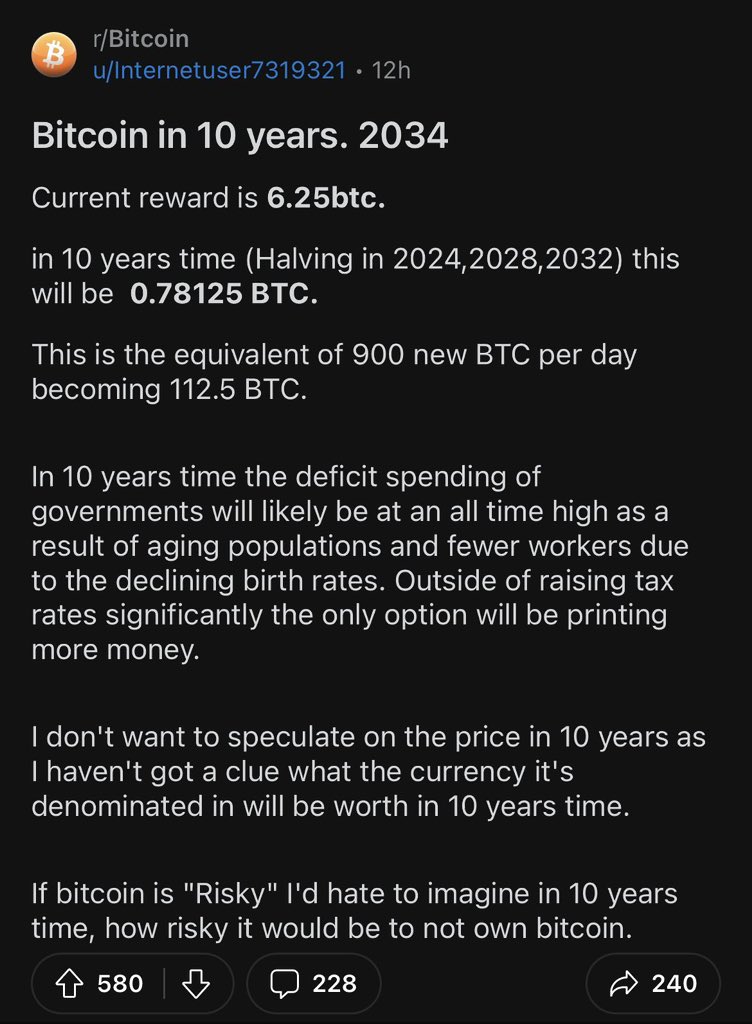

Crypto enthusiasts continue to rediscover some of the most interesting stories on Reddit. The widely followed Bitcoin-focused account “Trending Bitcoin” shared one from an anonymous user on Sunday, which highlighted the risks of not holding Bitcoin.

The 10-Year Bitcoin Projection

The user shared that the block reward for Bitcoin at the time of his post was 6.25 BTC, which culminates in approximately 900 BTC produced per day. While he made the post in 2024, his block reward thesis suggests it was before the April 2024 halving event.

Notably, the latest halving event reduced mining rewards to 3.125 per block, which remains unchanged to date. Interestingly, the user highlighted that this would decrease further in the next nine years to 0.78125 BTC, effective due to the 2028 and 2032 halving events.

The halvings would have trimmed down Bitcoin’s supply extensively from 900 BTC at the time of his post to 112.5 BTC produced daily. With massive institutional demand and a dwindling supply, Bitcoin would become even scarcer, significantly impacting prices.

Not Holding Bitcoin Is Risky

Furthermore, the anonymous user noted that while some suggest that exposure to Bitcoin is risky, those who don’t hold the premier crypto asset are in a more dangerous position. He drew this conclusion from the decadence that would erode the financial system by 2034 and Bitcoin’s place as a safe haven.

Reddit User’s Bitcoin Projection by 2034

Reddit User’s Bitcoin Projection by 2034

For context, the post projected that in 10 years from then, the government’s deficit spending would reach new all-time highs. It claimed this would occur due to an aging population and a smaller workforce amid declining birth rates.

Then, the alternative to increasing taxes would be for the government to print more money, increasing inflation. During such hyperinflationary economic conditions, Bitcoin’s scarcity would ensure it thrives as a store of value.

Meanwhile, the user further raised doubts on fiat currency, noting that he does not know what the currency Bitcoin will be denominated in would be worth by 2034. As a result, he would refrain from making price projections for Bitcoin. This aligns with a comment from Tim Draper that Bitcoin would increase infinitely against fiat currencies like the US dollar.

Bitcoin Gains Popularity as a Safe Haven

Interestingly, the user’s projection is already underway, as Bitcoin has continued to hit new all-time highs against the dollar. Yesterday, it rallied to an unprecedented high of $126,200, boosting the broader crypto market cap to $4.32 trillion.

Many have projected further upsides before the end of the year, as prices continue to gain momentum. Most assertions suggest a range of between $150,000 and $200,000, with a few targeting higher prices.

Moreover, this growth comes despite the government shutdown in the United States due to a budget stalemate. This further strengthens investors’ confidence in Bitcoin as a safe haven, as they trade fiat for the asset in the “debasement trade.”

The post Here’s Why Not Holding Bitcoin by 2034 Would Be Risky first appeared on The Crypto Basic.

You May Also Like

Q4 2025 May Have Marked the End of the Crypto Bear Market: Bitwise

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon