Ethereum Trader Who Made $69 Million From Shiba Inu Buys $450,000 Into This Presale At $0.015

The post Ethereum Trader Who Made $69 Million From Shiba Inu Buys $450,000 Into This Presale At $0.015 appeared first on Coinpedia Fintech News

Crypto circles are buzzing again after news broke that an Ethereum trader—famous for turning early Shiba Inu bets into a staggering $69 million windfall—has just bought $450,000 worth of PDP in the Paydax Protocol presale at $0.015.

This isn’t just another whale headline. It’s a strong signal that the same instinct that made fortunes on Shiba Inu is now zeroing in on a presale project with serious fundamentals.

Why This Move By The Ethereum Trader Matters

The Ethereum trader in question isn’t known for chasing hype. His entire legend comes from spotting overlooked tokens before they became household names. In 2020, Shiba Inu was a meme no one cared about. Today, that same play is remembered as one of the most legendary trades in crypto history.

Source: TradingView

Now, his $450,000 allocation into PDP suggests he sees the same asymmetric upside—only this time, anchored by the Paydax Protocol, a project solving one of DeFi’s biggest headaches: unlocking liquidity.

The Paydax Protocol: Liquidity Without Sacrifice

The Paydax Protocol (PDP) was built to address a fundamental problem: most traders can’t access the value of their tokens without selling them. Whether it’s staking, vesting, or presale allocations, assets often sit dormant when they could be redeployed for more yield.

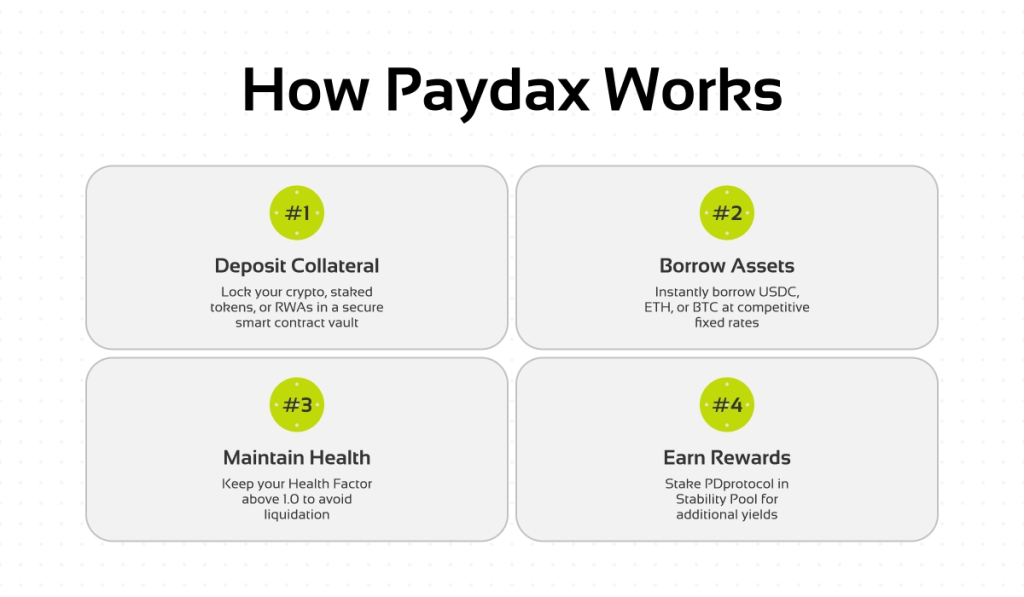

Paydax Protocol fixes that by creating a liquid escrow layer on a secure DeFi backbone. Here’s how it works:

- Collateralization → Users deposit tokens like PDP or other assets.

- Liquidity Access → Stablecoins or liquid tokens are unlocked immediately.

- Ownership Preserved → When vesting ends, you still keep your full allocation.

Source: Paydax Protocol

For an Ethereum trader used to rotating capital aggressively, this is a game-changer. Instead of being forced to choose between holding and trading, the Paydax Protocol enables both options simultaneously.

A Use Case That Resonates

Picture an investor, such as the Ethereum trader, who holds a large bag of Shiba Inu (SHIB) and Ethereum (ETH). Instead of selling tokens to access liquidity and losing their exposure to further yield from either altcoin, they could collateralize those tokens in the Paydax Protocol, unlock stablecoins, and farm yield while their PDP continues to appreciate.

This dual exposure—both upside and liquidity—is exactly what was missing during the Shiba Inu days. Back then, early buyers had to sit tight or sell too early. With Paydax Protocol, the game has changed.

From Shiba Inu to PDP: A Pattern of Early Entry

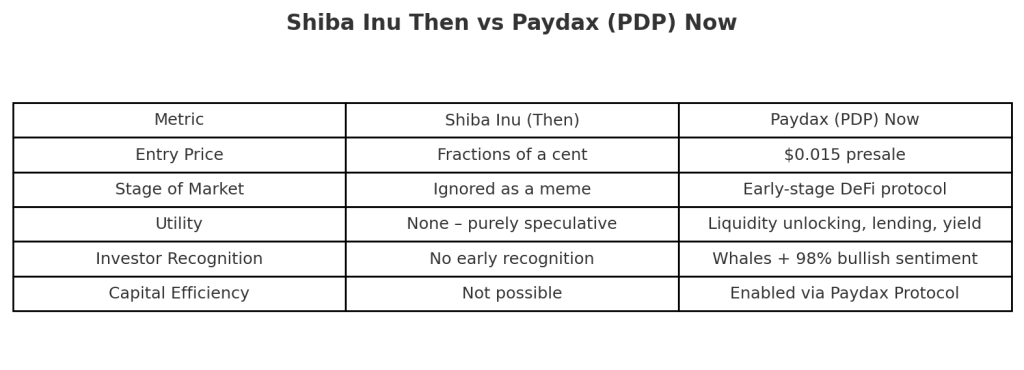

When the Ethereum trader first backed Shiba Inu, it was trading at fractions of a cent, dismissed by most of the market. By the time the rally hit, those early allocations had multiplied into generational wealth.

The parallel today is striking: PDP is still priced at just $0.015 in presale. Unlike Shiba Inu, however, the token isn’t relying on memes or hype alone. Rather, it’s powered by the Paydax Protocol’s lending, yield farming, and collateralization system.

Source: Paydax Protocol

The Numbers Behind the Move

The crypto community loves to get into math. So, here are some numbers for you:

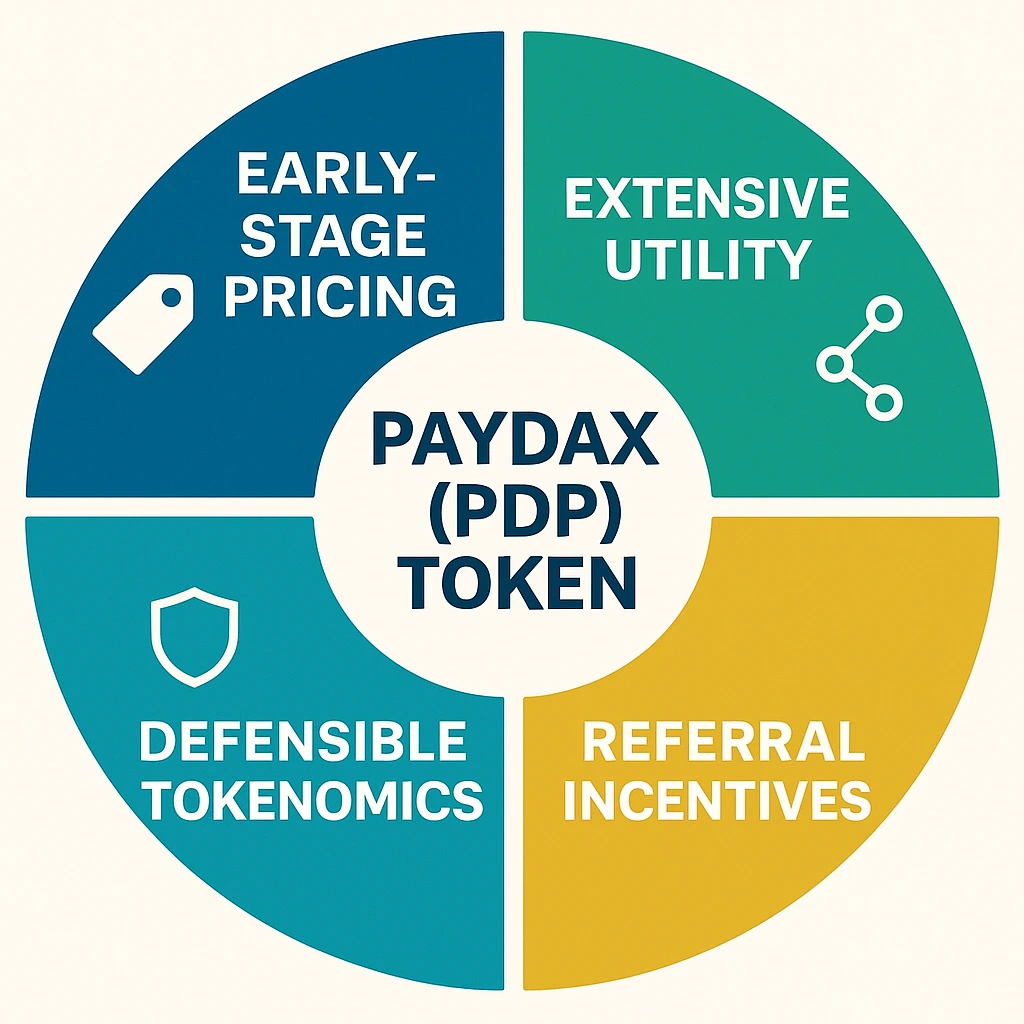

- Presale Price: $0.015 per PDP, next stage lined up at $0.017.

- Trader Allocation: $450,000 → nearly 30 million PDP tokens.

- Potential Upside: Analysts model scenarios where PDP could follow a Shiba Inu-like curve. Even modest adoption could turn a $0.015 entry into $1+ over time.

It’s this asymmetric math—the same math that made Shiba Inu millionaires—that explains why a disciplined Ethereum trader would commit nearly half a million dollars to a presale.

Source: Paydax Protocol

History Rhymes Again

The Ethereum trader who made $69 million from Shiba Inu isn’t betting lightly. His $450,000 into PDP suggests conviction that this transcends meme coin potential; it’s a DeFi cornerstone in the making. If Shiba Inu were about viral timing, Paydax Protocol is about solving real problems while still offering the kind of entry price that can rewrite futures.

For everyday traders, that $0.015 entry could be today’s equivalent of Shiba Inu before its explosive breakout. With the ongoing promo, interested investors can access an 80% bonus on token purchases for a limited time when they use the code PD80BONUS at checkout. Now is no time to wait; now is no time at all. Make like the Ethereum trader and position yourself for Shiba Inu-esque gains with PDP.

Join The Paydax Protocol (PDP) presale and community:

- Website: https://pdprotocol.com/

- Telegram: https://t.me/PaydaxCommunity

- X (Twitter): https://x.com/Paydaxofficial

- Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

You May Also Like

Why ZEC’s Unshielded Supply Surge Is Worrying Traders in 2026

Wormhole launches reserve tying protocol revenue to token