BTC Flips $120K Into Support, Can Bulls Push BTC to New All-Time High?

Bitcoin was trading around $120,000 at press time, up slightly in the last 24 hours and 10% over the past week. The current 24-hour trading volume is approximately $64.2 billion. Traders are now watching the $120,000 level to see if it will act as new support, following a daily close above this key area.

Notably, the recent breakout is being compared to a similar move in mid-August, where a daily close above $120,000 led to a bounce toward $124,000 ATH. The price behavior around this level may help confirm the next direction in the short term.

$120K Breakout Mirrors August Move

Analyst Rekt Capital posted that Bitcoin has performed a daily close above the $120,000 mark. In August, a similar close led to a successful retest of the same level as support, followed by a push toward $124,500. The chart shows both events marked with green circles.

Current price action is showing a repeat of that setup. If the level holds, the market may aim for $123,350 and beyond. If it fails to hold, nearby supports are located around $117,288 and $114,249. In another post, Rekt Capital added that Bitcoin is also testing a 2.5-month downtrend line near $119,000.

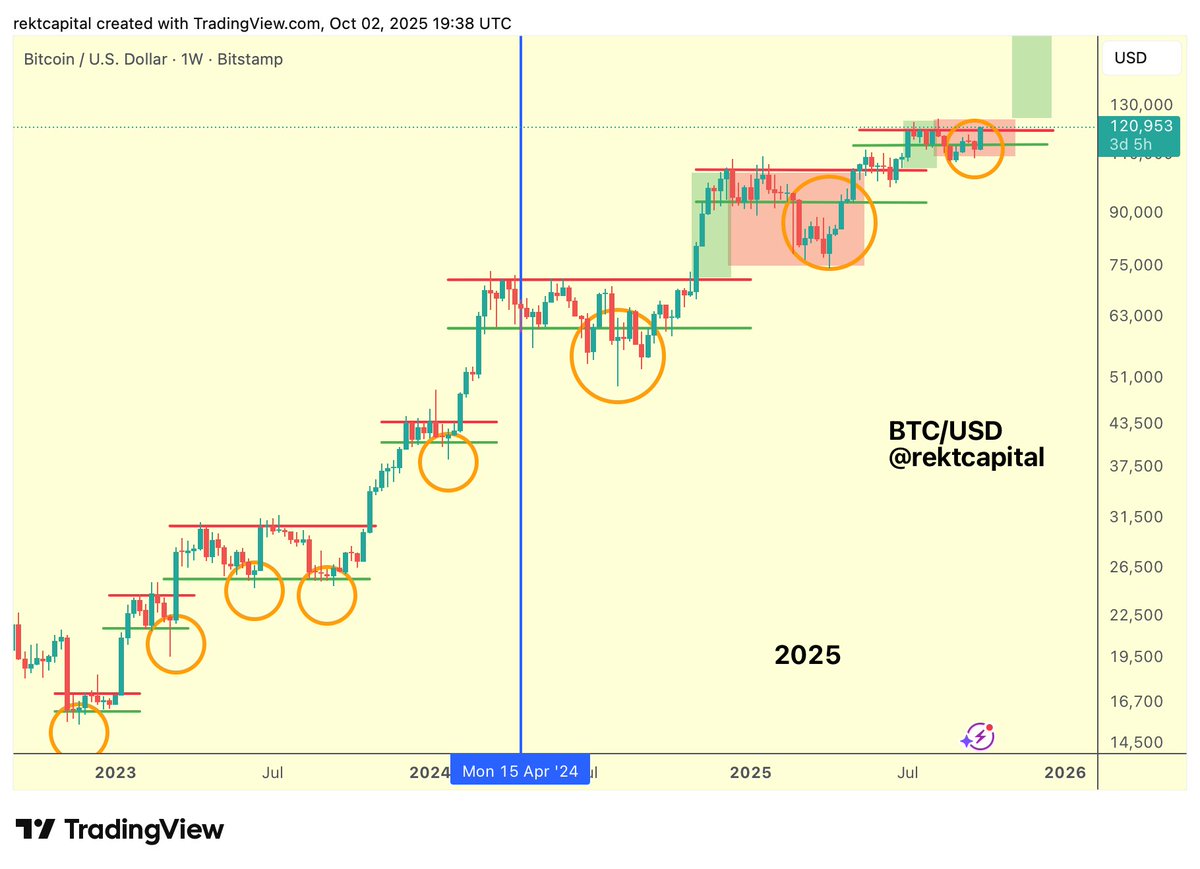

Additionally, on the weekly timeframe, the analyst referred to the possibility of Bitcoin entering “Price Discovery Uptrend 3.” The long-term chart shows a pattern that began in early 2023, where the price breaks out, retests resistance as support, and continues higher.

That structure has repeated at multiple stages. Bitcoin is now positioned at $120,000, and a weekly close above this level may support a continuation into new territory. A green zone on the chart marks the potential area for this movement.

Source: Rekt Capital/X

Source: Rekt Capital/X

Momentum May Slow as RSI Peaks

On the 4-hour chart, analyst Ted Pillows pointed out that the RSI has reached 80.18, the highest level since July. The reading places BTC in overbought conditions on that timeframe.

The RSI reading could suggest a pause or consolidation phase after the recent rally from below $110,000.

Monthly Chart Targets $203K by Year-End

Crypto Seth offered a long-term chart that shows BTC inside a growth channel. He noted the past rallies in the final quarter of the previous cycles: 368% in 2017 and 83% in 2021. Based on that, the analyst is now considering a 70% rise to around $203,530 by the end of 2025.

The chart shows that the price remains well within the bounds of the channel.

The structure remains intact, with no signals of a market top yet.

The post BTC Flips $120K Into Support, Can Bulls Push BTC to New All-Time High? appeared first on CryptoPotato.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout