2,589 ETH Staked in 24 Hours, Will Ethereum Price Remain Above $4,000?

Ethereum price rebounded above $4,000 on Saturday, Sept 25, after briefly plunging below the critical level on Friday for the first time in 50 days. Despite thin weekend liquidity, Ethereum has managed a 2.2% intraday price rally, supported by visible on-chain flows.

Coinmarketcap data shows ETH rebounded from intraday lows of $3,927 to reach $4,021 by Saturday evening, amid 49% decline in trading volumes to $29 billion. On-chain metrics show an increased activity on Ethereum staking contracts as market volatility intensified on Friday.

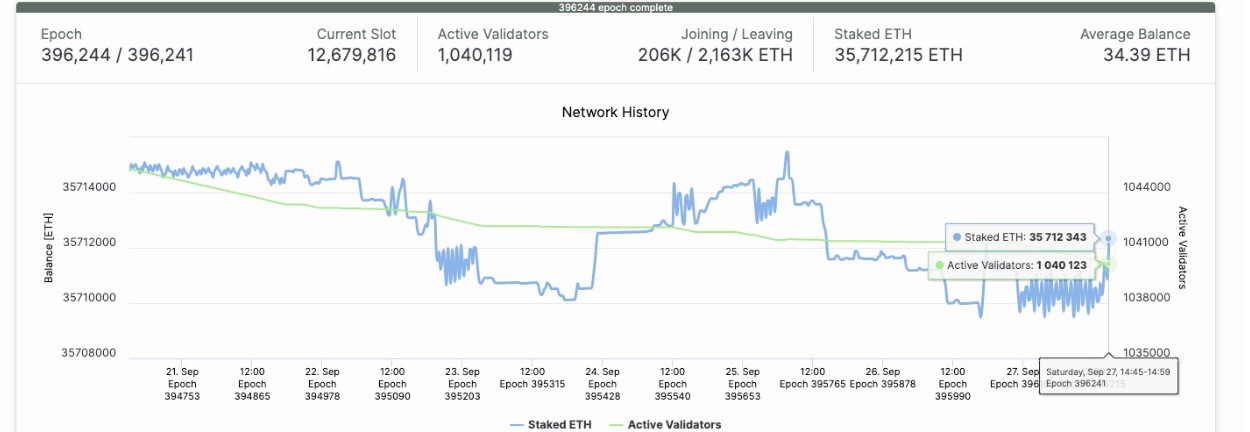

Ethereum staking deposits increased by 2,589 ETH (~$11 million) on Saturday, Sept 27 | Source: Beacoincha.in

Official data from Beaconcha.in indicates that Ethereum staking deposits increased by 2,589 ETH over the last 24 hours, reaching 35,712,343 ETH at the time of this report. Valued at current prices, the latest staking contracts have absorbed nearly $11 million from the Ethereum market supply, nullifying the impact of the rapid liquidations, which saw the BTC price remain in the red, pinned below $110,000 at the time of publication.

T Rex’s $32 Million BitMine ETF Reaffirms Corporate Demand for ETH

Ethereum saw another wave of whale inflows as T Rex launched its 2x BitMine ETF (BMNU), which secured $32 million in inflows on its first trading day.

The derivative provides 2x leveraged exposure to BitMine’s (BMNR) stock price, offering corporate investors secondary exposure to the second-largest cryptocurrency by market capitalization..

Bloomberg’s Chief ETF Analyst, Eric Balchunas, highlighted that BMNU’s $32 million in inflows ranked as the third-largest first-day takings among all US-listed ETFs approved in 2025.

The positive first-day showing reflects strong institutional demand despite weakened market sentiment since ETH price retraced from the all-time high of $4,953 in August 2025.

Ethereum Price Forecast: Can ETH Remain Above $4,000?

Ethereum’s rebound above $4,000 has been supported by staking inflows and ETF demand. While this reflects considerable buy-pressure preventing further declines but technical signals remain mixed.

From a technical perspective, a rising wedge pattern formed earlier in September remains a key bearish overhang on Ethereum’s near-term price outlook.

Ethereum (ETH) Technical Price Analysis | Source: TradingView

The wedge breakdown projects a downside target near $3,200, suggesting Ethereum faces risks of deeper retracement if selling pressure intensifies.

Expanding Bollinger Bands indicate rising volatility, but ETH still trades closest to the lower band around $3,916, confirming downside risks. However, a close above $4,000 could prove decisive for speculative traders aiming for another attempt at the 20-day moving average near $4,373.

The Relative Strength Index (RSI) at 38 indicates oversold conditions, which could incentivize speculative traders looking to enter at a local low.

If ETH consolidates above $4,000 and breaks $4,373 resistance, bulls could face another major supply cluster at $4,500. Conversely, failure to hold $3,916 risks accelerating a drop toward $3,500, with the rising wedge target at $3,200 still in play.

nextThe post 2,589 ETH Staked in 24 Hours, Will Ethereum Price Remain Above $4,000? appeared first on Coinspeaker.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Weekly Highlights | Gold, US Stocks, and Cryptocurrencies All Fall; Walsh and Epstein are the Celebrities of the Week.