Ethereum (ETH) Price: 22% Pullback to Key Support Sparks Buy-the-Dip Calls

TLDR

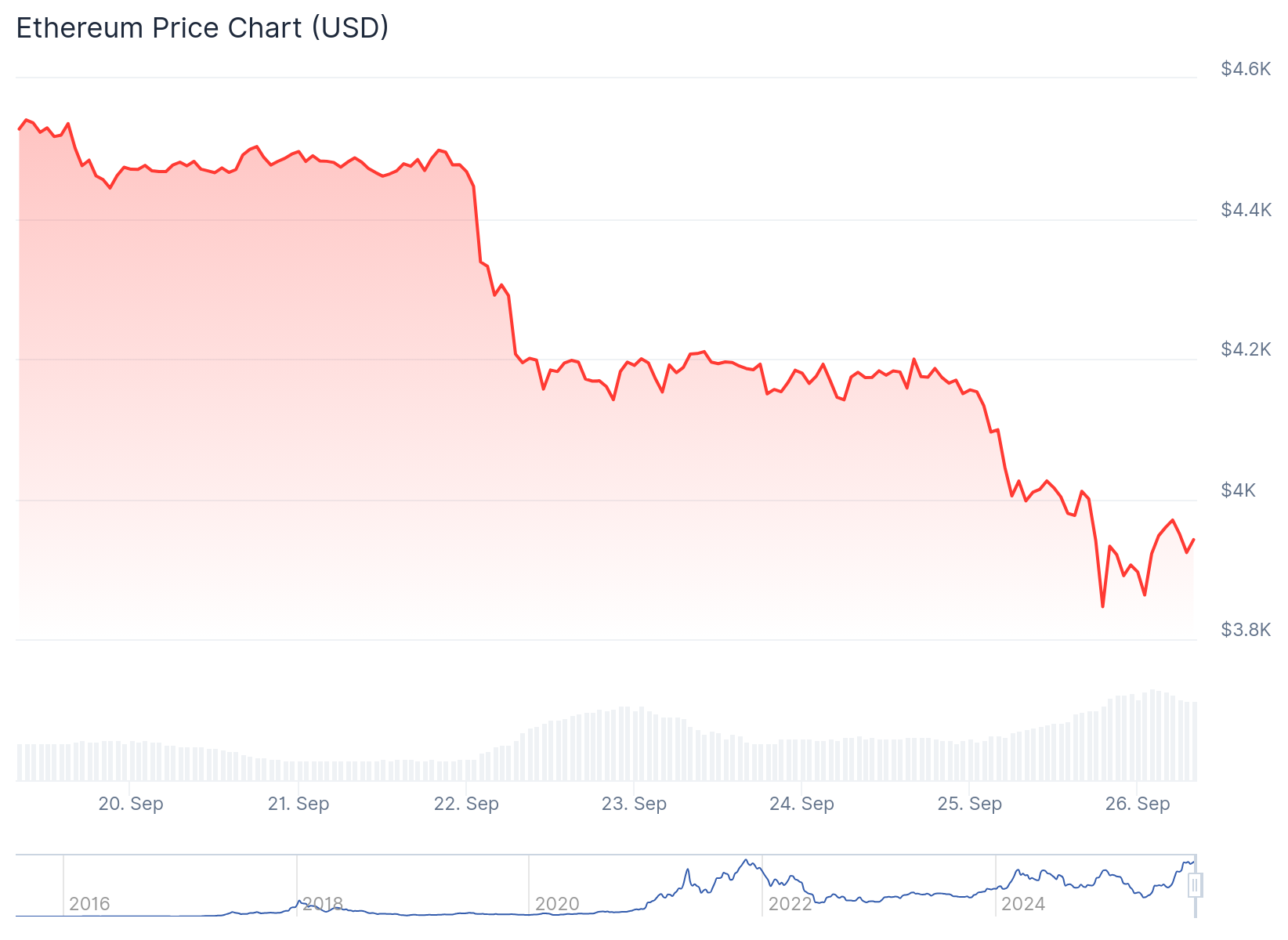

- Ethereum dropped 13% from recent highs above $4,400, now testing support around $3,650-$3,850

- Mid-sized holders (10,000-100,000 ETH) are increasing accumulation while large whales reduce positions

- Crypto market saw $1.1 billion in liquidations with Ethereum leading at $409 million in 24 hours

- Spot Ether ETFs recorded over $250 million in outflows despite launch of first staking ETF

- Analysts see potential buying opportunity as ETH enters final correction phase

Ethereum is experiencing a major shift in market dynamics as mid-sized investors take control while the cryptocurrency tests critical support levels. The second-largest cryptocurrency by market cap has dropped 13% from recent peaks above $4,400.

Ethereum (ETH) Price

Ethereum (ETH) Price

The current price action has triggered massive liquidations across the crypto market. Total liquidations reached $1.06 billion in 24 hours, with 233,337 traders affected. Ethereum led these liquidations with $409 million, while Bitcoin accounted for $272 million.

Source: Coinglass

Source: Coinglass

The largest single liquidation occurred on Hyperliquid, where an ETH-USD order worth $29.12 million was closed. This selling pressure comes ahead of a massive $23 billion crypto options expiry.

Joao Wedson, Founder and CEO of Alphractal, identified a change in ownership patterns. Large whales are reducing their holdings while mid-sized sharks holding between 10,000 and 100,000 ETH are increasing accumulation.

These sharks are driving accumulation and gaining market share. The shift represents funds and private investment firms taking positions as larger institutional holders exit.

Wealth Distribution Changes

The changing ownership structure is reflected in Ethereum’s wealth distribution metrics. The Gini coefficient, which measures inequality, is rising again after months of decline.

This increase signals that ETH ownership is consolidating among wealthier addresses. The concentration is happening particularly among mid-sized entities rather than the largest holders.

Whales, often representing exchanges, large institutional funds, or former miners, continue selling positions. Their exit has created space for sharks to dominate the accumulation process.

Technical Analysis Shows Mixed Signals

Ethereum is currently trading near $3,865 after testing the top Bollinger Band near $5,200. The cryptocurrency remains above key exponential moving averages including the 20 EMA at $3,653.

The 50 EMA sits at $3,162, the 100 EMA at $2,874, and the 200 EMA at $2,483. This positioning indicates Ethereum maintains its macro long-term upward trend despite recent corrections.

Technical indicators show mixed signals for near-term direction. The MACD histogram remains positive but is slowing down, while the Chaikin Oscillator is declining at 57K.

The RSI likely sits between 60-65, suggesting the cryptocurrency moved into overbought territory before the recent pullback. These signals point to consolidation before potential further upward movement.

Crypto analyst Ted Pillows outlined key levels for traders. ETH is holding support near $3,822, which represents its recent low. A break below this level could push prices toward $3,700-$3,750.

Resistance lies between $3,960 and $4,000 according to Pillows’ analysis. The analyst noted that ETH is entering what he calls the “buy zone.”

Michael van de Poppe highlighted the gap between current prices and the 20-day exponential moving average. He noted that the weekly 20-EMA is closing in, suggesting the market may be nearing correction bottom.

Institutional Sentiment Weakens

Spot Ether ETFs have recorded over $250 million in outflows recently. Fidelity’s FETH led these outflows with $158 million, indicating weakening institutional sentiment.

The launch of the first Ether staking ETF has not reversed the negative flow trend. This suggests institutional investors remain cautious about Ethereum exposure at current levels.

Despite institutional outflows, some analysts see opportunity in current price levels. Van de Poppe suggests conditions present a potential buying opportunity for investors.

Source: TradingView

Source: TradingView

Near-term resistance for Ethereum sits between $4,450 and $4,500. Support at $3,650 will be crucial for maintaining short-term price stability.

If the market holds current support levels and buying pressure returns, ETH could test $4,500 and attempt to reach the $5,000-$5,200 zone.

A breakdown below $3,162 would expose prices to further declines toward $2,874 or potentially the $2,500 level.

The post Ethereum (ETH) Price: 22% Pullback to Key Support Sparks Buy-the-Dip Calls appeared first on CoinCentral.

You May Also Like

US Congress Proposes AI Export Oversight Bill

Ubisoft (UBI) Stock: Restructuring Efforts and Game Cancellations Prompt 33% Dip