Launch Of Euro-Backed Stablecoin In H2 2026? Nine European Banking Giants Join Forces

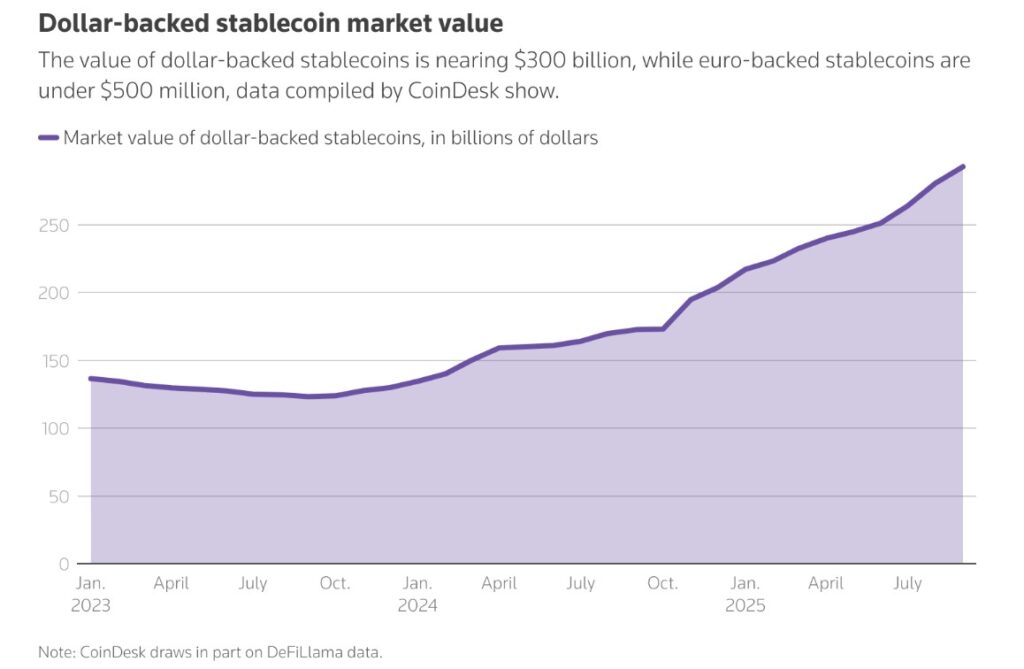

Nine of Europe’s biggest banks—including ING, UniCredit, Danske Bank, SEB, KBC, DekaBank, Banca Sella, and Raiffeisen Bank International—have decided to collaborate on a euro-backed stablecoin. Under the European Union’s (EU) Markets in Crypto-Assets Regulation (MiCA) framework, the collaborating banks will roll out the stablecoin in the second half of 2026. Will this be a game-changer for European crypto payments? Will the euro-backed stablecoin reduce Europe’s reliance on US dollar-denominated stablecoins?

On 25 September 2025, ING released the joint statement confirming that “the initiative will provide a real European alternative to the US-dominated stablecoin market, contributing to Europe’s strategic autonomy in payments.”

According to the banking giants, the stablecoin will provide near-instant, low-cost payments and settlements. Furthermore, it will enable 24/7 access to efficient cross-border payments, programmable payments, and improvements in supply chain management and digital asset settlements, which can vary from securities to cryptocurrencies.

DISCOVER: 20+ Next Crypto to Explode in 2025

“Digital payments are key for new euro-denominated payments and financial market infrastructure”

The member banks made it clear – they are open to new members. Hence, additional banks are expected to join the original nine.

“This digital payment instrument, leveraging blockchain technology, aims to become a trusted European payment standard in the digital ecosystem,” the joint statement said.

The project is interestingly spearheaded by a newly formed company based in Netherlands. It will seek licensing and oversight from the Dutch Central bank, positioning itself as an “e-money institution.”

Floris Lugt, Digital Assets lead at ING and joint public representative of the initiative said, “Digital payments are key for new euro-denominated payments and financial market infrastructure. They offer significant efficiency and transparency, thanks to blockchain technology’s programmability features and 24/7 instant cross-currency settlement.”

“We believe this development requires an industry-wide approach, and it’s imperative that banks adopt the same standards,” he added.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

New European Guidelines Boosted Demand For Euro-backed Stablecoins

A 2024 analysis by Kaiko Research revealed that while Europe has traditionally lagged the US and APAC when it comes to crypto trading, Euro-backed stablecoin’s have consistently grown in volume since the beginning of the year. This concretely suggests that demand for stablecoin is finally picking up in European markets.

Particularly, Circle’s USDC stablecoin is expected to gain substantial market share from its larger rival, Tether’s USDT, found Kaiko. Anastasia Melachrinos, an analyst at Kaiko Research, highlighted that USDC could potentially benefit the most from the new European guidelines.

EXPLORE: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Key Takeaways

- The euro-backed stablecoin is expected to reduce Europe’s reliance on US dollar-denominated stablecoins – which currently dominate the global market.

- The euro stablecoin aims to enable near-instant, low-fee payments and settlements across borders, available 24/7.

The post Launch Of Euro-Backed Stablecoin In H2 2026? Nine European Banking Giants Join Forces appeared first on 99Bitcoins.

You May Also Like

Wealthfront Corporation (WLTH) Shareholders Who Lost Money – Contact Law Offices of Howard G. Smith About Securities Fraud Investigation

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!