Pump.fun’s dominance is challenged by new platforms, the traffic war of MEME coin Glonk begins, and the founder comes out to help

Author: Nancy, PANews

On May 14, the MEME market staged a striking showdown, with the MEME coin named Glonk being launched on both the Pump.fun and Letsbonk.fun Launchpad platforms. Although it is not uncommon for the same IP to issue tokens on different platforms, the special thing about this event is that the founders of the two platforms personally stepped in to promote their respective Glonk versions.

This battle for traffic not only quickly ignited market enthusiasm, but also revealed the increasingly fierce competition among MEME distribution platforms. The entire ecological landscape is undergoing profound changes.

Glonk stirs up the platform war, and the founder personally comes out to help

In the early hours of this morning, a MEME coin $Glonk, which originated from the absurd humor culture of the UK, suddenly triggered a market craze. Its prototype is the fictional character Glonk in the illustrated book series "Flanimals" created by the famous British comedian Ricky Gervais. Glonk is a green reptile, which has won the resonance of many readers with its "sad but funny" contradictory temperament and is jokingly called an emotionally stable loser. Glonk has also been given the subculture labels of "lying flat" and "nihilism", which fits the current young group's mentality of playing badly, making it have a strong potential for meme dissemination.

At the same time, as a heavyweight in the British comedy world with tens of millions of fans, Ricky Gervais' celebrity effect provides $Glonk with a natural basis for attention and dissemination.

Alon, co-founder of Pump.fun, and Tom, founder of Letsbonk.fun

Glonk was first launched on the Letsbonk.fun platform and quickly gained popularity. Pump.fun then launched a competing version, and the competition between the platforms quickly heated up. The founders of both platforms personally posted a message to call for support for Glonk on their own platforms, which pushed the competition to a climax and evolved into a high-heat platform confrontation in the Solana ecosystem. The community also regarded this competition as a "flag of resistance" against Pump.fun, which further stimulated the topicality and community participation of Glonk.

What is even more dramatic is that Raydium, a Solana ecosystem project, has also publicly voiced its support for the Letsbonk.fun platform. You know, Raydium and Pump.fun were once allies, and the latter once contributed nearly half of its trading volume and platform revenue. Raydium itself is also promoting its own token issuance platform LaunchLab. Now the sudden change of sides has undoubtedly made this competition more explosive. Another small episode is that a few days ago, the official X account of Pump.Fun also blocked the founder of Letsbonk.Fun and the developer of Raydium, which has now been lifted.

According to GMGN data, as of press time, the market value of the Letsbonk.fun version of Glonk has exceeded $18 million, but has now fallen back to about $3.7 million, with a 24-hour trading volume of more than $86.3 million, temporarily in the upper hand; while the market value of the Pump.fun version of $Glonk has rapidly fallen from a peak of $15 million to about $1.5 million at present, with a 24-hour trading volume of $55.7 million. The market has already expressed its attitude towards this duel with real money.

It can be said that the competition around Glonk is an amplifier of community sentiment and a re-game for the right to speak.

Pump.fun's dominance is being challenged, and new forces are rising rapidly

The role of the Launchpad platform has evolved from a single token issuance tool to a traffic portal and a battlefield for brand competition. Recently, with the rapid rise of emerging platforms such as Letsbonk.fun, Believe and LaunchLab, market competition has become increasingly fierce. In addition to the weakening of the market share of the leader Pump.fun, the recently popular Boop.fun has also gradually died down, and market discussion has dropped sharply.

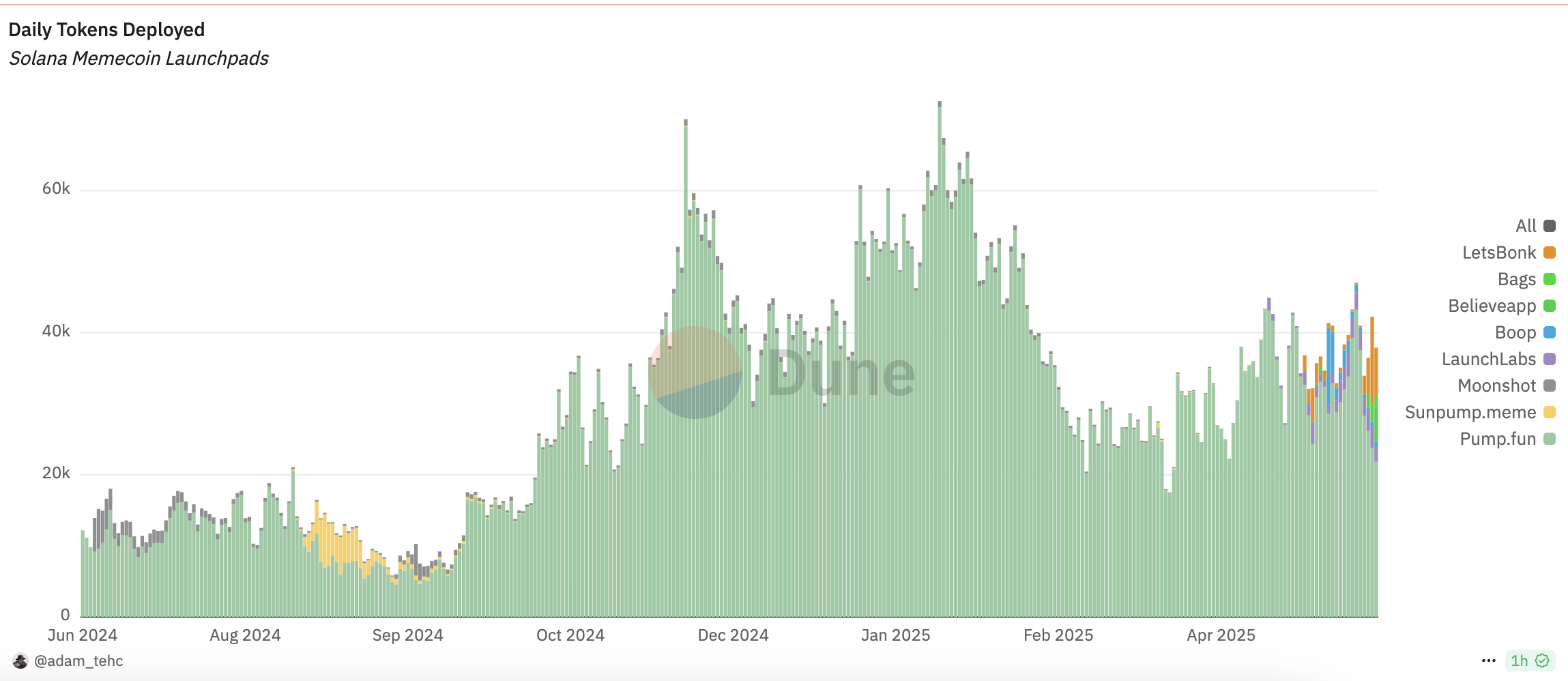

Although Pump.fun still occupies a dominant position, its dominance is gradually weakening. In terms of graduation rate, taking Dune data on May 13 as an example, Pump.fun launched a total of 19,523 tokens on that day, with a graduation rate of only 0.7%; in contrast, LaunchLab launched 8,218 tokens, with a graduation rate of 1.22%; Letsbonk.fun launched 7,287 tokens, with a graduation rate of 1.7%. This shows that users' interest in and recognition of emerging platforms are increasing.

Judging from the market share of daily token deployment, Pump.fun's share has dropped from over 95% maintained for a long time to 57.5% on May 13; while Letsbonk.fun reached 17.9%, Believe was 12.9%, and LaunchLab also reached 5% during the same period, indicating that the market structure is rapidly differentiating.

What is more noteworthy is that many MEME tokens that have become popular recently, such as $LAUNCHCOIN, $GOONC, $DUPE, $Hosico, $USELESS, $IKUN, etc., were mainly born from Letsbonk.fun and Believe. In particular, Believe's ecological tokens have generally risen, and the platform coin LAUNCHCOIN has once exceeded 280 million US dollars. In contrast, Pump.fun's projects in the same period performed mediocrely and lacked new hot spots.

These changes show that the Launchpad market is rapidly diversifying, and competitors are gradually eroding Pump.fun's leading edge. Faced with competitive pressure, Pump.fun recently tried to enhance the platform's attractiveness by introducing a creator revenue sharing mechanism, returning 50% of the transaction fees to token creators. However, this move has caused controversy within the community and is believed to be likely to increase the risk of developers' Rugs, and the remaining 50% of the revenue remains in the hands of the platform, failing to truly benefit users. Competitive platforms are also increasing their incentive mechanisms. For example, Letsbonk.fun announced on May 13 that it would provide a total of 15,000 USDC in rewards to projects that perform well in the next week, further enhancing the platform's attractiveness.

Overall, the Launchpad market is entering a new stage with more diversity and fierce competition. The competition between platforms is no longer limited to who can issue coins, but is more about the overall competition of traffic acquisition, brand building and user experience, which is also the key to becoming a new round of "explosive product manufacturing machine".

You May Also Like

Why the Visa Card Narrative Makes it the Best Crypto to Buy

What Are Small DC Electric Motors? A Complete Guide to Types and Uses